Large multinational enterprises (MNEs)—more specifically, those with more than 750 million euro (approximately $856 million as of August 25, 2015) in annual revenue—will soon be required to comply with new country-by-country (CbC) reporting requirements.

Large multinational enterprises (MNEs)—more specifically, those with more than 750 million euro (approximately $856 million as of August 25, 2015) in annual revenue—will soon be required to comply with new country-by-country (CbC) reporting requirements.

Effective January 1, 2016, the new requirements will allow tax administrations around the world to do a high-level risk assessment of a company’s transfer pricing policies and transactions. Do you know how your company will be perceived by those tax administrations? If you don’t, now’s the time to find out.

The new reporting requirements are an outcome of the base erosion and profit shifting (BEPS) project, which is being conducted by the G20 countries and the Organisation for Economic Co-operation and Development. The standardized CbC report will contain information relating to the global allocation of each MNE group’s income and taxes paid alongside other indicators of the location of value creation and economic activity within the MNE group. The goal: to provide tax administrators with sufficient, relevant, and reliable information with which to conduct their risk assessments.

For the business community, it’s important to know what CbC reporting is—and what it isn’t. Countries participating in the BEPS project have agreed that the CbC report may not be used as a substitute for a detailed transfer pricing analysis that includes full functional and comparability analyses. It follows that CbC reports won’t, on their own, constitute conclusive evidence that transfer prices are or aren’t appropriate.

So while CbC reporting may seem like a time-consuming audit roadmap, it’s not as ominous as it sounds. Still, it’s important to understand how your information will be presented on the CbC report and what it will indicate to tax administrations, since it could put you at risk of an audit.

Let’s look at what the BEPS project aims to accomplish, what it entails for MNEs, and what you can do to prepare now for the forthcoming reporting requirements.

Background On BEPS

At a domestic level, each country taxes corporate income independently. Because there is no worldwide tax authority, business activities that cross international borders are faced with the interaction of two or more tax systems. In some of those situations, profit may be taxed by more than one jurisdiction; in other situations, profit may not be taxed at all.

The term base erosion and profit shifting refers to tax planning strategies by which MNEs artificially shift profit from operating affiliates subject to tax in high-tax jurisdictions to affiliates with little (if any) economic substance that are subject to tax in low- or no-tax locations. Such strategies take advantage of gaps and mismatches in the tax rules of the relevant jurisdictions and can significantly reduce an MNE’s global corporate income taxes.

Tax administrations have long acknowledged the potential for double taxation on MNEs and have taken steps through treaties, etc., to provide relief to affected organizations. Tax administrations are now looking at this issue from the other side, watching out for themselves and their revenue by working together to close the gaps that BEPS strategies exploit.

The BEPS project consists of a 15-step action plan based on the following three core principles:

- Coherence. Domestic tax systems are coherent; that is, a tax-deductible payment by one person results in taxable income to the recipient. The BEPS project works toward international coherence in corporate income taxation, complementing the standards that prevent double taxation with a new set of standards designed to avoid double nontaxation.

- Substance. BEPS strategies often utilize shell companies that reside in tax havens and earn a significant portion of an MNE group’s taxable income despite having little or no economic substance—office space, tangible assets, employees, etc. The BEPS project aims to prevent treaty abuse, prevent the artificial avoidance of permanent establishment status, and assure that transfer pricing outcomes are in line with value creation.

- Transparency. Because preventing BEPS requires greater transparency at many levels, the BEPS project calls for improved data collection and analysis regarding the impact of BEPS strategies, taxpayers’ disclosure about their tax planning strategies, and less burdensome (yet more targeted) transfer pricing documentation.

Required Documentation

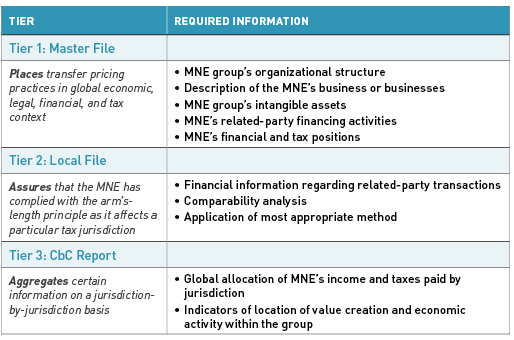

As part of its focus on transparency, the BEPS project gives a three-tiered approach to transfer pricing documentation.

The content of the master file, local file, and CbC report reflects an effort to balance the information needs of the tax administrations, concerns about confidentiality and inappropriate use of the information, and the compliance costs and burdens imposed on the MNEs.

Information will be automatically exchanged between the ultimate parent entity’s jurisdiction of residence and the other jurisdictions in which the MNE group operates, either through new or existing competent authority agreements, double-tax conventions, or tax information exchange agreements. The participating countries have agreed to certain safeguards to keep the information in the CbC report confidential (that is, not released to the public) and ensure it’s put to proper use by tax administrations.

The countries participating in the project have also agreed to review the transfer pricing documentation requirements by year-end 2020. In this process, they’ll assess whether modifications to the content of the master file, local file, or CbC report should be made to require additional or different data. It’s likely the requirements will be expanded to pertain to smaller entities as well and may include more data over time.

CbC Report Guidance and Deadlines

In general, MNE groups will be required to file a CbC report for each fiscal year beginning on or after the effective date (January 1, 2016). The filing generally should be made by the MNE group’s ultimate parent company in its jurisdiction of residence within one year of the end of the relevant fiscal year. This means that the first CbC reports—which pertain to the 2016 fiscal year—are required to be filed by December 31, 2017. The IRS has indicated it intends to implement CbC reporting by expanding income tax return disclosures.

MNE groups with prior-year revenue below the filing threshold—less than 750 million euro—are exempt from filing a CbC report. If an MNE’s revenue rises above the threshold, it’ll be required to file a CbC report the following year. For example: If an MNE with a December 31 year-end has consolidated worldwide revenue of 600 million euro (approximately $685 million as of August 25, 2015) in fiscal year 2015 and 900 million euro (about $1.03 billion as of August 25, 2015) in fiscal year 2016, that MNE group wouldn’t have to file a 2016 CbC report. But it would have to file a 2017 CbC report, which would be due by December 31, 2018.

How Is Information Presented in the Report?

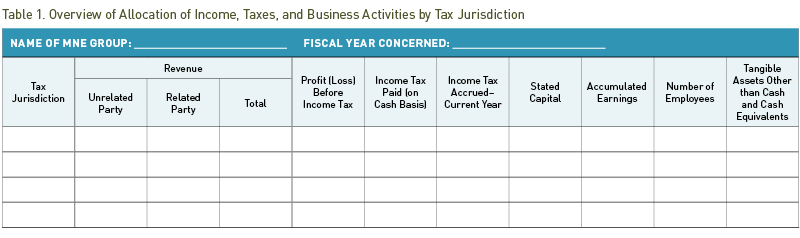

The agreed-upon content for the CbC report is shown below:

Table 1 of the CbC report requires aggregate tax jurisdiction-wide information relating to the global allocation of the revenue, pretax profit, taxes paid and accrued, and certain indicators of the location of economic activity among the tax jurisdictions in which the MNE group operates.

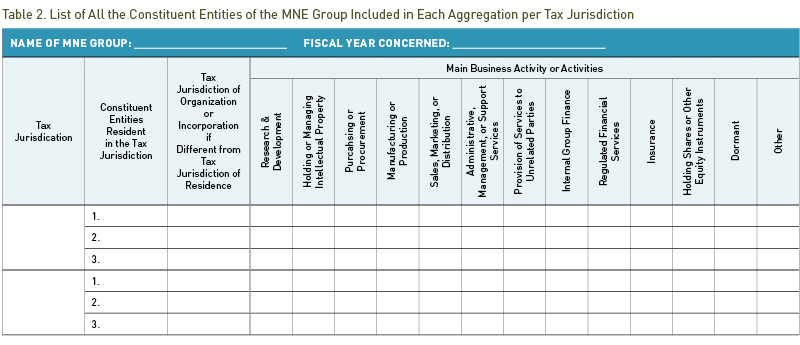

Table 2 of the CbC report requires a listing—by tax jurisdiction of residence—of all the constituent entities of the MNE group for which financial information is reported, the tax jurisdiction of incorporation (if different from residence), and the nature of the main business activities carried out by each constituent entity.

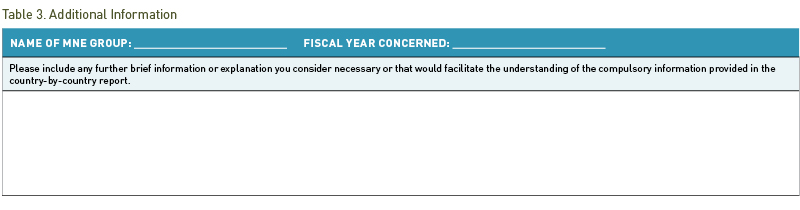

Table 3 of the CbC report provides an opportunity to furnish additional information that would help the tax administrations interpret the information provided in Table 1 and Table 2.

Takeaways

If your MNE group will exceed the 750 million euro revenue threshold in its fiscal year beginning on or after January 1, 2015 (fiscal 2015), you’ll need to file the CbC report for the fiscal year beginning on or after January 1, 2016. Although that form won’t be due until one year after the end of fiscal 2016 (or no earlier than December 31, 2017), we recommend that you start thinking now about how to gather and present the data—and what the CbC report will tell the tax administrations about your transfer pricing policies and tax strategies.

Using the CbC report template now (with 2014 or 2015 information) to conduct your own high-level risk assessment of your MNE’s transfer pricing will give an indication of whether you should refine your transfer pricing policies or restructure your transaction flows or operational structure. It will also highlight areas (countries, transactions, etc.) to focus on when preparing annual transfer pricing documentation.

Even if your company won’t exceed the 750 million euro threshold in 2015 (or for years to come), we still recommend that you start filling out the CbC report and perform your own high-level transfer pricing risk assessment. After all, the emphasis on economic substance isn’t going away, and you’ll want to be prepared in the event your company is selected for a transfer pricing audit in one or more countries.

We're Here to Help

We can help you examine and document your multinational operations to determine how they may be impacted by the new BEPS reporting requirements and how they may be perceived by tax administrators. We can make recommendations for actions you can take this year to control what’s reflected in your 2016 data. For more information on transfer pricing or other topics related to international operations, contact your Moss Adams professional.