As part of the tax reconciliation act of 2017, US Congress enacted an incentive to spur economic development and job creation in designated distressed communities, or Qualified Opportunity Zones (QOZ).

As part of the tax reconciliation act of 2017, US Congress enacted an incentive to spur economic development and job creation in designated distressed communities, or Qualified Opportunity Zones (QOZ).

While the new incentive received significant interest, lack of Internal Revenue Code (IRC) guidance in the plain statute initially made many investors and funds wary about investing in QOZs. However, two sets of proposed regulations, the first issued in October 2018 and a second in April 2019, provide guidance that can help taxpayers make educated investments in QOZs.

Below is an overview of both sets of proposed regulations and their potential tax benefits for investors.

Background

A QOZ is a designated distressed community where certain investments, for the purpose of economic growth, receive preferential tax treatment. As of November 2018, there are more than 8,500 QOZs in the United States, District of Columbia, Puerto Rico, and the US Virgin Islands. See IRS Notice 2018-48 for an official list of all QOZs.

An investor can make a special type of deferred gain investment in a Qualified Opportunity Fund (QOF) in exchange for equity interest. A QOF is an investment vehicle set up as either a corporation or partnership that purchases eligible property.

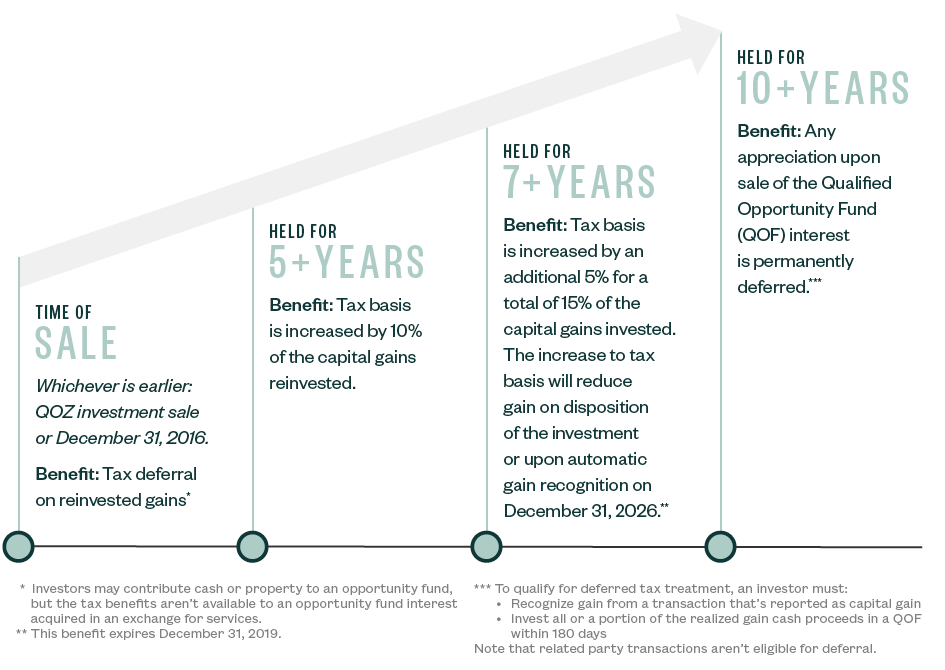

To qualify for deferred tax treatment, an investor must recognize gain from a transaction that’s reported as capital gain. Related party transactions aren’t eligible for deferral. The taxpayer must then invest all or a portion of the realized gain cash proceeds in a QOF within 180 days.

Tax Benefits

Opportunities for Investors

An investor in a QOF generally receives a deferral of gain until the earlier of a sale of the QOF investment or December 31, 2026. Upon investment in the QOF, the investor will look to gain one or more of the following benefits:

- Deferral of tax on reinvested gains until the earlier of sale of the QOF investment or December 31, 2026.

- Where the investment is held for at least five years, the tax basis is increased by 10% of the capital gains reinvested.

- Where the investment is held for at least seven years, the basis is increased by an additional 5% for a total of 15% of the capital gains invested. The increase to tax basis will reduce gain on disposition of the investment or upon automatic gain recognition on December 31, 2026.

- Where the investment is held for at least 10 years, any appreciation upon sale of the QOF interest is permanently deferred.

QOZ Opportunities

Example

On December 1, 2018, a taxpayer invests capital gains of $1,000 in a QOF and then sells the investment for $2,000 on December 31, 2030. The taxpayer held the investment for at least seven years, so the taxpayer recognizes $850 in capital gains—$1,000 original gain less 15%, or $150—on December 31, 2026. When the taxpayer sells the investment on December 31, 2030, the $1,000 of appreciation occurring during the term of the investment is permanently excluded from income tax.

The Qualified Opportunity Fund

Any taxpayer—such as an individual, trust, C corporation, or partnership—that recognizes capital gains is eligible to elect a deferral under the opportunity zone rules. To qualify, a taxpayer must invest in a QOF that meets certain requirements.

Requirements

- Certification. The corporation or partnership must be a certified QOF. This is a self-certification process during which the QOF files a Form 8996, currently a proposed form, with its tax return.

- The 90% test. At least 90% of the assets of the QOF must consist of QOZ property.

If the QOF meets the above requirements, the taxpayer can select deferral tax treatment by choosing the deferral election on Form 8949.

To be classified as a QOF, directly and indirectly held trades or businesses must meet a series of specific criteria.

Directly Held

For purposes of the 90% test, it’s important to distinguish between a QOF’s direct ownership in QOZ property and a QOF’s ownership in QOZ property through QOZ stock or partnership interests.

If a QOF directly operates a trade or business and doesn’t hold any equity in QOZ stock or partnership interests, at least 90% of the QOF's assets must be QOZ business property. QOZ business property is tangible property held by a QOF, purchased after December 31, 2017.

The original use of the property must begin with the QOF, or the QOF must substantially improve an existing property. Property is considered substantially improved if the improvements double the tax basis of the originally acquired property within a 30-month period. The tax basis only includes depreciable assets and doesn’t include land. During the QOF's holding period for the property, substantially all of the property must be used in the QOZ.

Indirectly Held

A QOF’s ownership in QOZ property can be indirectly held through an investment in QOZ stock or QOZ partnership interest—QOF second-tier entity. In this case, the QOF can satisfy the 90% test if the QOF second-tier entity qualifies as a QOZ business. A QOF second-tier entity can be either a partnership or a corporation.

The QOZ second-tier entity must be acquired by the QOF after December 31, 2017. The QOF second-tier entity must also be a QOZ business when its equity interests are issued, and it must remain a QOZ business during substantially all of the QOF's holding period.

To be considered a QOZ business, the current rule stipulates a QOF second-tier entity must meet the following requirements:

- Substantially all of the tangible property must be QOZ business property. As previously mentioned, QOZ business property is tangible property purchased after December 31, 2017, that’s substantially improved within a 30-month period.

- Less than 5% of the average unadjusted basis in property can be attributable to nonqualified financial property.

- At least 50% of the total gross income of the entity must be from the active conduct of a QOZ business.

- A substantial portion of the intangible property must be used in the active conduct of the QOZ business.

Additionally, the QOZ business must not be a private or commercial golf club, country club, massage parlor, hot tub or suntan facility, racetrack, gambling facility, or any store where principal business is sale of alcoholic beverages for off-premise consumption.

Proposed Regulations and Other Guidance

Here’s a closer look at the proposed regulations and an analysis of what it could mean for taxpayers investing in QOZs.

Debt Financed Distributions and Other Distributions

A QOF can generally make debt financed distributions. However, if debt financed distributions are made within two years of an investor’s contribution, certain rules may apply that disqualify the investor’s QOF interest. Caution should be exercised when anticipating any debt financed distributions.

Other distributions should be closely scrutinized as well. An investor’s original tax basis in a qualified QOF investment is deemed to be zero. A distribution that’s not supported by tax basis, for example from an allocation of taxable income, could trigger gain recognition to the extent of such distribution.

Profits Interest and Carried Interest

The second round of regulations clarifies that an interest issued for services won’t qualify for the benefits of the QOZ. This includes a profits interest or carried interest a partner may receive in a QOF.

Cash or Other Property Contributions

While the statutory text requires investments in QOFs be made in cash, the second set of proposed regulations clarifies that an investor can make a qualified investment in a QOF with property other than cash.

However, an investment in a QOF with property other than cash would need to be analyzed to see if the investment would otherwise qualify as good QOZ business property. For example, a tax-free transfer to a partnership or other property wouldn’t meet the acquired-by-purchase requirements.

For contributions of property, the amount of eligible investment is limited to the lesser of the fair market value of the property contributed or the property’s adjusted tax basis. This may result in a bifurcated fund in which the built-in gain property is contributed with a portion of the fund qualifying for QOF benefits and the remainder is tracked separately as a nonqualifying investment. For purposes of determining the holding period of the qualified investment received for a contribution of property other than cash, the holding period of the QOF interest starts as of the date of the contribution.

Original Use Clarification

The second set of proposed regulations also clarifies the original use requirement for tangible property in a QOZ. According to the regulations, original use commences on the date any person first places the property in service in the QOZ for purposes of depreciation or amortization. Where property has been unused or vacant for an uninterrupted period of at least five years, original use in the QOZ begins on the date when any person first uses or places the property in service in the QOZ.

In addition, used tangible property meets the original use requirement if the property hasn’t been previously used or placed in service in the QOZ. If the tangible property was previously used or placed in service in the QOZ before acquired by purchase, it must be substantially improved.

Use of Intangibles

The rules require that a substantial portion of intangible property be used in the active conduct of a trade or business in the QOZ. The second set of proposed regulations defines a substantial portion as at least 40% of the total intangible asset.

The 90% Test

As noted earlier, the 90% test requires at least 90% of a QOF’s assets consist of eligible QOZ property. Eligible QOZ property includes directly-held QOZ business property, QOZ stock, and QOZ partnership interests.

The first set of regulations provides guidance on how to compute the 90% test for the first year of a QOF’s existence. A QOF can identify the taxable year in which it elects to become a QOF as well as the first month in that year to be treated as such. This is important for determining the beginning of the 90% asset testing dates. Initially, the only investments made in a QOF after the election would be considered qualified investments.

The second set of proposed regulations, however, allows a QOF to apply the 90% test without taking into account any contributions received in the preceding six months. This effectively allows the QOF to exclude large contributions received relatively close to a testing date. The contributions must be held in cash, cash equivalents, or debt instruments with terms of 18 months or less.

Additionally, the second set of regulations allows the QOF to choose a method of valuation for purposes of the 90% test. The QOF may elect to choose a valuation method on an annual basis. The QOF can generally elect to use either its applicable financial statement valuation or the alternative method based on unadjusted cost basis. Certain restrictions may apply where the taxpayer leases assets.

Leased Property

According to the second set of proposed regulations, leased tangible property will be treated as QOZ business property for purposes of the 90% test under the new proposed regulations if the lease meets the following requirements:

- The leased tangible property must be acquired under a lease entered into after December 31, 2017.

- Substantially all of the use of the leased tangible property must be in a QOZ during substantially all of the period for which the business leases the property.

- The lease must be at a market rate.

The leased property doesn’t need to satisfy the original use requirement or be substantially improved. Additional restrictions are placed on leases from related parties. In these cases, the leases must be at market rates, the lessor can’t receive prepayments on the lease for a period that exceeds 12 months, and the lessee must acquire other tangible property that has a value equal to or more than the leased property within a 30-month period.

Substantial Improvements and Treatment of Land

Issued contemporaneously with the first set of proposed regulations, Revenue Ruling 2018-29 states that if QOZ property is acquired, substantial improvements need only be made to tangible property. The land value is excluded.

The second set of proposed regulations further clarifies that unimproved or raw land within a QOZ that’s acquired by purchase isn’t required to be substantially improved. It’s important to note that the land will need to be used in the trade or business of the QOF.

The Substantially All Test for QOF Second-Tier Entities

For purposes of the substantially all test for QOF second-tier entities, the first set of proposed regulations defines substantially all as 70%. In other words, for a second-tier entity, 70% of the tangible property must be QOZ business property. This is significantly lower than the 90% test for direct investments in QOZ business property by QOFs.

Rules for QOZ Operational Businesses

The statutory language for operational business within the QOZ require a business entity derive at least 50% of its total gross income during a taxable year from the active conduct of a qualified business in a QOZ. However, the first set of guidance lacks clarity as to what constitutes an activity inside and outside of the QOZ. The second set of proposed regulations provides three safe harbors for determining whether this standard has been satisfied. This addition should provide a path forward for business to qualify for the QOZ benefits.

The second set of proposed regulations provides three safe harbors for meeting the 50% gross income test. The business need only meet one of the following safe harbors:

- At least 50% of business services performed are performed within the QOZ. This is based on the hours of employees, independent contractors, and employees of independent contractors.

- At least 50% of services performed for the business are performed in the QOZ by its employees, independent contractors, and employees of independent contractors. This is based on amounts paid for the services performed.

- The tangible property of the business that’s in a QOZ, and the management or operational functions performed for the business in the QOZ, are each necessary to generate 50% of the trade or business’ gross income.

Safe Harbor for QOF Second-Tier Entities

For purposes of the 5% financial assets test for QOF second-tier entities, the first set of proposed regulations provides a safe harbor for QOF second-tier entities to allow these entities to hold cash in excess of the 5% limitation for up to 31 months if the cash is used as working capital.

To qualify for this exception, QOF second-tier entities must meet the following criteria:

- Have a written plan of capital deployment

- Present a schedule that demonstrates deployment within 31 months

- Deploy the capital within the demonstrated timeframe

The second round of proposed regulations allows for extension of the 31-month period only in instances in which the delay is caused by governmental action.

Reinvestment Guidelines

A taxpayer may sell all of an interest in a QOF and reinvest the proceeds within 180 days in another QOF and defer the gain. The holding period for determining the QOZ benefits restarts when the reinvestment is made. Special rules allow a deferring partner to decide if the 180-day period for capital asset dispositions in partnerships begins at the date of disposition or on the last day of the partnership’s tax year.

Capital Gains

While not technically stated in the statute, the first proposed set of regulations clarifies that the QOZ rules apply to capital gains only. This includes short-term capital gains, Section 1231 gains, and presumably unrecaptured Section 1250 gains.

The second set of proposed guidelines includes additional clarification on Section 1231 gains, indicating that only net Section 1231 gains are available for the benefit. The regulations also provide that the 180-day period, with respect to Section 1231 gains, starts on the last day of the taxpayer’s tax year.

Asset Sales After the 10-Year Period

While rules for selling interest in a QOF after the 10-year holding period were initially relatively clear, the second set of proposed regulations provides an election to exclude capital gain from asset sales by a QOF partnership or S corporation. The taxpayer may make an election to exclude from gross income some or all of the capital gain arising from the sale and reported on Schedule K-1 of the QOF partnership or QOF S corporation.

It’s important to note this election only applies to capital gains, and accordingly it appears that any depreciation recapture treated as ordinary income will still be taxable.

Asset Sales Before the 10-Year Period

Where a QOF sells property before the 10-year period, the second set of proposed regulations provides that proceeds received by the QOF from the sale or exchange of QOZ business property need to be reinvested within 12 months for purposes of the 90% test. To qualify, the proceeds must be held in cash, cash equivalents, or debt instruments with terms of 18 months or less. It’s important to note that these sales may be otherwise fully taxable.

Inclusion Events

The second set of proposed regulations provides a substantial list of transactions that are considered inclusion events as well as those that don’t meet criteria. An inclusion event is a transaction that requires the taxpayer recognize otherwise deferred capital gain earlier than December 31, 2026. Generally, an inclusion event is a transaction in which an investor effectively cashes out of a QOF.

Partner Versus Partnership Deferral Timing

According to the first set of proposed regulations, a partnership may elect capital gain deferral. If the partnership doesn’t elect deferral, the proposed regulations allow a partner to do so, and the partner's 180-day period begins on the last day of the partnership's taxable year.

Purchase of Interest in a QOF

The second set of rules clarifies that if a taxpayer purchases an interest in QOF from an owner of the QOF as opposed to a direct investment in the QOF, the purchaser can elect to defer capital gains used to purchase the QOF interest.

Future Developments

The IRS and Treasury have commented that they may not issue a third set of proposed regulations. Future guidance may be forthcoming in the form of finalizing the previously issued proposed regulations and other forms and publications. In addition, the IRS has indicated that they could roll out enhanced anti-abuse guidance.

We’re Here to Help

There have been numerous inquiries on opportunity zones as investor interest in deferring capital gains increases. Enhanced awareness of QOZs and exploring planning opportunities for capital gains can help investors fully benefit from the opportunities at hand.

The proposed regulations provide guidance that can help taxpayers start making educated investments in opportunity zones. To learn more about opportunity zones and these proposed regulations, contact your Moss Adams professional or visit our dedicated tax reform web page.