The Inflation Reduction Act of 2022 includes almost $400 billion in federal tax credits and other incentives aimed at reducing carbon emissions and accelerating the United States’ energy transition away from fossil fuels.

While renewable energy developers are perhaps the largest and most direct beneficiaries of the act’s tax credits and incentives, the act presents significant opportunity for rural electric cooperatives, municipal utilities, Tribal organizations, and other tax-exempt entities that can benefit from the refundable tax credit or direct pay provisions of the new Section 6417 of the Internal Revenue Code (IRC).

Learn more about the available renewable energy-related credits as well as considerations tax-exempt entities may need to assess should they opt to pursue direct pay provisions.

What Is Direct Pay and How Can It Benefit an Organization?

If an applicable entity makes a direct pay election, the amount of the tax credit is treated as a deemed payment of tax, which for a not-for-profit entity without taxable income, results in a cash refund payable by the government.

The refund will be paid after the tax return for the applicable year is filed.

For solar and wind technology, as well as energy storage, this direct cash payment is only available to applicable entities, which include rural electric cooperatives, municipal utilities, and other tax-exempt entities—such as local and Tribal governments, and Alaskan Native Corporations.

What Credits Are Refundable to Tax-Exempt Entities Under Section 6417?

With respect to renewable power generation, there are two main types of tax credits made refundable to cooperatives, municipal utilities, and other tax-exempt entities by Section 6417—the investment tax credit (ITC) and the production tax credit (PTC).

Investment Tax Credit (ITC)

The ITC is based on investment, specifically the cost incurred on eligible property, like solar panels, wind turbines, hydropower facilities, and biomass facilities. It’s earned on the facility’s placed-in-service date.

The ITC is subject to a five-year recapture period, where some or all of the credit is clawed back if the facility is sold, taken out of service, or rendered inoperative, like from a casualty loss.

The facility can generally be owned and operated by different parties without impacting the credit and doesn’t require that power be sold to unrelated parties.

Production Tax Credit (PTC)

For electrical facilities—namely, wind, solar, hydro, and biomass—the PTC is based on generation. The PTC is earned annually, over a 10-year period starting with the placed-in-service date as electricity is generated and sold.

There’s no recapture provision for the PTC. The facility claiming it must be owned and operated by the same party. The PTC requires that the end-user of the electricity be unrelated to the generator.

In addition to the ITC and PTC, the Inflation Reduction Act makes a number of other tax credits eligible for direct pay, including the credits for:

- Alternative fuel vehicle refueling property

- Carbon oxide sequestration

- Clean hydrogen production

- Advanced manufacturing production

- Clean fuel production

What Changes Did the Inflation Reduction Act Make to ITCs and PTCs?

The Inflation Reduction Act made three significant changes to the credit amounts under both the ITC and PTC.

Phasedown Removal

It removed a phasedown in the credit that would have reduced the ITC to a third of its value and the PTC to 60% of its value, allowing for the potential of the full credit value through at least 2033.

This full credit value is 30% of eligible costs for ITC and $27.50 per megawatt hour (MWh) of generation for PTC, with the PTC amount adjusted for inflation.

Wage and Apprenticeship Requirements

For facilities of at least one megawatt that start construction after January 28, 2023, it made this full credit value subject to certain prevailing wage and apprenticeship requirements.

If these requirements aren’t met, the credit value is reduced by approximately 80%.

Bonus Credits

Bonus credits are available for projects located in energy communities or that meet specific domestic content requirements. Some projects may qualify for additional bonus credits if located in low-income areas. Bonus credits equal to 10% of basis for the ITC and 10% of the PTC amount are available for projects placed in service after December 31, 2022.

These bonus credits are stackable. The total amount of ITC for a solar project could equal 50% or more, for example. These bonus credits are also eligible for direct pay.

Does It Matter When Construction Starts?

Construction start-dates are important for both PTCs and ITCs. If construction starts within 59 days after the recently released initial wage and apprenticeship guidance was issued (Notice 2022-61), meaning, no later than January 28, 2023, the facility won’t be subject to the wage and apprenticeship rules—although cooperatives, municipal utilities, and other tax-exempt entities may voluntarily comply.

If construction starts prior to January 1, 2024, direct pay credits won’t be subject to the 10% reduction for failing to meet the domestic content requirements.

While the Inflation Reduction Act doesn’t define how a facility starts construction for this purpose, Notice 2022-61 indicates the IRS may follow existing guidance defining this term for other provisions.

This guidance provides that incurring 5% of project costs, or contracting and incurring some cost for a custom generation step-up transformer, may qualify as starting construction.

Further guidance on wage and apprenticeship and domestic content requirements is much anticipated.

How Can Tax-Exempt Entities Participate in Direct Pay?

While many key issues still await guidance from the IRS, cooperatives, municipal utilities, and other tax-exempt entities could consider how to participate in renewables under the new direct pay regime.

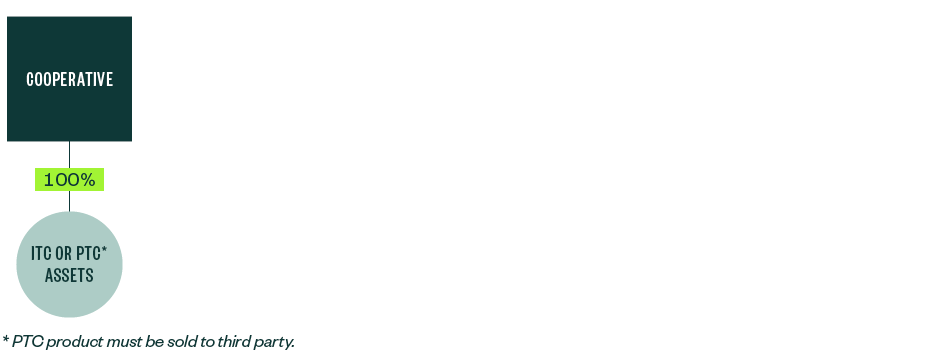

The simplest way, also inferred by the statutory text, is direct ownership of the facility by the cooperative, municipal utility, or other tax-exempt entity.

Direct Ownership Direct Pay Structure

In this structure, the cooperative, municipal utility, or other tax-exempt entity would make the direct pay election on its tax return for the relevant year—placed in service year for ITC, year of generation for PTC—and receive a cash refund in the amount of the credit, assuming the cooperative, municipal utility, or other tax-exempt entity has no taxable income.

The credit would first offset any tax due before resulting in a direct payment for cooperatives, municipal utility, or other tax-exempt entities with taxable income.

While it would have to be confirmed by IRS regulations, it may also be possible for any of the aforementioned to lease an ITC facility and claim direct pay credits.

Other Possible Direct Pay Structures

While additional guidance is needed, other structures could be applicable, such as those described below.

Lease of ITC Asset

Under law predating the Inflation Reduction Act, this structure would rely on the ITC-asset owner’s ability to elect to pass through the ITC to the lessee. For this structure to work, the forthcoming regulations would need to confirm that the ITC passed through to the lessee in this way to be eligible for direct pay.

JV Ownership

Another structure that would need to be confirmed by regulations is a joint venture (JV) structure, where the facility is jointly owned by a cooperative, municipal utility, or other tax-exempt and a taxable entity that isn’t eligible for direct pay:

In this instance, parties would split the operating cash. The cooperative, municipal utility, or other tax-exempt would be allocated the direct pay credits from the JV, while the taxable entity would be allocated the tax depreciation.

This could be used to offset tax or monetize in some other way—for example, by adding a tax equity partner. Regulations would need to confirm that the JV can separately allocate the direct pay credits from other tax depreciation and other tax items of the JV.

While IRS guidance is needed in a number of areas, the legislative text of the IRA shows that Congress intended these entities to be a significant part of the country’s transition to clean energy, and through the enactment of the direct pay provisions, has made sure that they will be.

We’re Here to Help

For further guidance on how your organization can claim these credits, contact your Moss Adams professional.

Learn More