Please note, the information in this article is current only as of the date of publication and guidance is subject to change.

In early 2021, Congress allocated $20 billion to Tribal governments through the American Rescue Plan Act’s (ARPA) Coronavirus State and Local Fiscal Recovery Funds (CSLFRF). The Fiscal Recovery Funds expand aid available through the Coronavirus Relief Fund (CRF), which was established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

On May 17, 2021, the Department of the Treasury released the Interim Final Rule (IFR), which provides guidance on how Tribes can receive and apply Fiscal Recovery Funds aid. Comments on the IFR are due July 16, 2021, and revisions may be made to this guidance upon issuance of a Final Rule.

Below, gain insight into Fiscal Recovery Funds provisions in the IFR that relate to Tribal governments, steps to apply available funds, deadlines, and more.

What Costs Are Eligible for Fiscal Recovery Funds?

Eligible costs are those incurred between March 3, 2021, and December 31, 2024, and the period of performance is through December 31, 2026.

In general, costs for the following four broad categories are authorized under the program:

- To respond to the public health emergency or its negative economic impacts, including assistance to households, small businesses, and not-for-profits, or aid to impacted industries, such as tourism, travel, and hospitality

- To respond to workers performing essential work during the COVID-19 public health emergency by providing premium pay to eligible workers

- For providing government services to the extent of a reduction in revenue due to the COVID-19 public health emergency relative to revenues collected in the most recent full fiscal year prior to the emergency

- To make necessary investments in water, sewer, or broadband infrastructure

How Can Tribal Governments Apply Fiscal Recovery Funds?

Within the eligible use categories outlined in the IFR, Tribal governments have flexibility to determine how best to use payments from the Fiscal Recovery Funds to meet the needs of their communities and populations.

How Can Tribal Governments Use Fiscal Recovery Funds Aid to Respond to the Public Health Emergency or Its Negative Impacts?

Tribal communities were disproportionately impacted by the COVID-19 pandemic. The Fiscal Recovery Funds provide resources to Tribal governments to address some of those economic and health impacts.

As noted above, Tribes may use Fiscal Recovery Funds to respond to the public health emergency or its negative impacts. This category of use for the Fiscal Recovery Funds allows Tribal governments to provide assistance to households and Tribal businesses, but also stresses that Tribal governments must determine if COVID-19 has had a negative economic impact on the beneficiary of these payments.

If so, the Tribe must disclose how the use of funds responds to that negative impact. As clarified by the Coronavirus State and Local Fiscal Recovery Funds Frequently Asked Questions (CSLFRF FAQ) Number 2.17, published June 24, 2021, Tribes don’t necessarily have to demonstrate that each individual or business experienced a negative economic impact to receive assistance, rather they need only demonstrate that the household or business is within the population or group that experienced a negative economic impact. See further details below.

What’s Considered a Negative Economic Impact?

The IFR states that a household or population may be presumed to have experienced economic harm if any of the following are true:

- They experienced unemployment

- They experienced increased food or housing insecurity

- They are a low- or moderate-income household or Tribal member

Relief can include food assistance, rent, mortgage, utility assistance, housing security services, home repairs, job training, cash assistance, and more.

If a Tribal government decides to provide cash payments to members, the amount of cash payments must be reasonably proportional to the negative economic impact they’re intended to address.

How Much Should a Tribe Allocate to Each Individual?

When determining whether the amount of assistance is reasonable, the rule indicates that Tribes may look to the per-person amounts provided by the Federal government during the COVID-19 pandemic, which, under ARPA, were up to $1,400 per individual.

Tribal governments may also provide survivor’s benefits to surviving family members of COVID-19 victims, or cash assistance to widows, widowers, and dependents of eligible COVID-19 victims as an allowable use under the Fiscal Recovery Funds program.

How Should a Tribe Allocate Funds to Tribal Enterprises and Businesses?

The IFR allows Tribal governments to provide assistance to small businesses to help them:

- Adopt safer operating procedures

- Weather closure periods

- Mitigate financial hardship resulting from the COVID-19 public health emergency

The Interim Final Rule also notes that the tourism, travel, and hospitality industries, which would include Tribal casinos, were especially impacted by COVID-19. Tribes are allowed to provide funds to those industries.

Allowable Uses for Aid to Tribal Businesses

- Improving ventilation

- Acquiring physical barriers or partitions

- Creating signage to facilitate social distancing

- Providing masks or personal protective equipment

- Consulting with infection prevention professionals to develop safe reopening plans

- Planned expansion or upgraded tourism, travel, and hospitality facilities that were delayed due to the pandemic

How May Tribal Governments Apply Fiscal Recovery Funds Aid?

Tribal governments may use Fiscal Recovery Funds money to rehire Tribal government staff up to the government’s pre-pandemic staffing level. Eligible uses include:

- Payroll

- Covered benefits

- Other costs associated with rehiring public-sector staff

Rehired staff don’t have to be responding to the economic impacts of the pandemic for the expenses to be allowable charges to the Fiscal Recovery Funds program.

Indirect Costs

The CSLFRF FAQ Number 10.2 states that administrative costs are allowable if directly charged to the program.

The Coronavirus State and Local Fiscal Recovery Funds Compliance and Reporting Guidance issued by the Department of the Treasury June 24, 2021, Part 1. D.2.a, states that pursuant to the CSLFRF Award Terms and Conditions, recipients are permitted to charge both direct and indirect costs to their CSLFRF award as administrative costs.

Tribes may use their negotiated indirect cost rate, alternatively if the Tribe doesn’t have a negotiated indirect cost rate, they may use the de minimus rate of 10% of the modified total direct costs pursuant to 2 CFR 200.414(f).

Indirect costs are expenses that benefit the Tribe’s grant administration as a whole. For example, a Tribe’s centralized payroll and HR departments. While employees within these teams aren’t directly working on a grant, they indirectly benefit the grant by hiring employees and processing payroll.

Additional Uses for Tribes and Certain Qualified Census Tracts

The guidance allows additional flexibility for Tribes to address economic disparities that existed prior to COVID-19 that were amplified during the pandemic. It also seeks to address disparities through:

- Building stronger communities through investments in housing and neighborhoods

- Rectifying educational disparities

- Promoting healthy childhood environments

- Addressing other existing inequities

It’s important to note that the guidance and limitations provided in this section only apply to expenses incurred under this category of the guidance. Tribes may be more broadly allowed to attribute expenses for government services, which we address below.

How Can Tribal Governments Calculate Lost Revenue?

Tribal governments may use Fiscal Recovery Funds money to replace lost public sector revenue. The Interim Final Rule provides guidance on calculating the general revenue lost due to the pandemic and using Fiscal Recovery Funds to provide government services to the extent of that lost revenue under the following method.

To calculate lost revenue, Tribes must compare their actual general revenues in the last full fiscal year before January 27, 2020, to their anticipated 2020 revenues had the pandemic not occurred. For most Tribes, the full fiscal year before January 27, 2020, would be fiscal year-end 2019.

December 31 Calculation Date

Tribal governments with fiscal year-ends other than December 31 should note that the Treasury has indicated the calculation dates are December 31 of each year from 2020 to 2023.

Those entities will need to determine their actual last 12-months revenue for January 1 through December 31 of each year, regardless of the Tribe’s fiscal year-end.

With this in mind, the calculation would occur as of the following four calculation dates:

- December 31, 2020

- December 31, 2021

- December 31, 2022

- December 31, 2023

For example, to calculate 2021 lost revenue, a Tribal government would apply the December 31, 2020, calculation date.

4 Steps to Calculate Lost Revenue

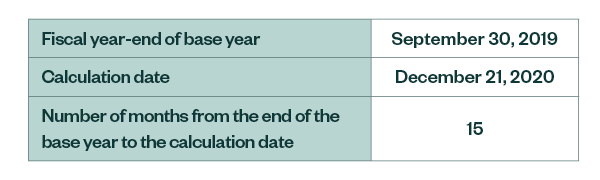

Let’s say a Tribe has a fiscal year-end of September 30. To determine lost revenue for 2020, the Tribal government would apply the following four-step process.

Step 1: Identify Base-Year Revenues

First, identify all revenues collected in the most recent full fiscal year before the pandemic, also called the base year.

Step 2: Estimate Your Counterfactual Revenue

Estimate the counterfactual revenue, which is equal to the base-year revenue, multiplied by the following formula: [(1 + growth adjustment) ^( n/12)].

In this formula, the following is true:

- n is the number of months elapsed since the end of the base year to the calculation date

- Growth adjustment is the greater of 4.1% and the recipient’s average annual revenue growth in the three full fiscal years prior to the COVID-19 public health emergency

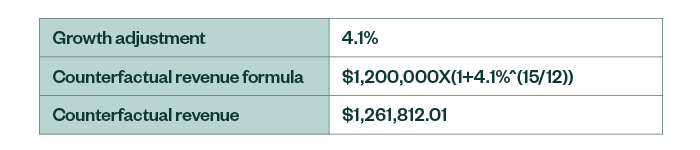

This example uses the 4.1% growth factor, and the amount of time that has passed, or n, is 15 months.

After determining these amounts, fill out the formula to calculate the counterfactual revenue:

Step 3: Identify Actual Revenue

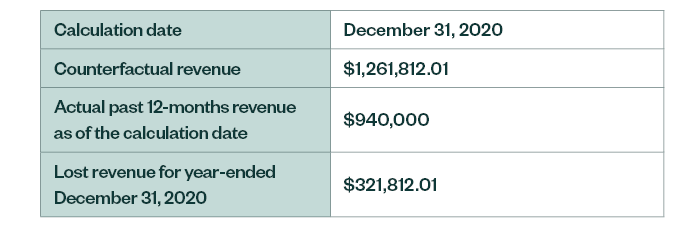

Actual revenue is revenue collected over the past 12 months as of the December 31, 2020, calculation date. In this example, that amount is $940,000.

Step 4: Determine Lost Revenue

Lost revenue is equal to counterfactual revenue less actual revenue. If actual revenue exceeds counterfactual revenue, the lost revenue is set to zero for that calculation date.

In this example, the Tribe could apply up to $321,812.01 of the Fiscal Recovery Funds it spends for government services.

If the last 12 months of general revenues, as of the calculation date, was more than the counterfactual revenue, the lost revenue would be zero for that calculation date.

How Can Tribes Apply Lost Revenue?

The program funds can be used to pay for providing government services up to the amount of calculated lost revenue each year. Government services can include:

- Maintenance or pay-go funded, as defined in the IFR, building of infrastructure, including roads

- Updates to cybersecurity infrastructure, including hardware and software

- Health services

- Environmental remediation

- School or educational services

- Public safety services, including police, fire, and other services

The CSLFRF FAQs indicate that Tribes who provide government services can broadly apply Fiscal Recovery Funds aid expended up to the amount of calculated lost revenues. However, because the section of the IFR that discusses the calculation of lost revenues and use of those funds primarily focuses on government services, it likely won’t allow Tribes to provide additional funding to their businesses.

Tribes may provide funding to their businesses as a response to the public health emergency or its negative impacts as discussed earlier in this article.

Debt Obligations

The Interim Final Rule specifically notes that government services don’t include principal or interest payments on any outstanding debt obligation. This includes fees or issuance costs associated with new debt, rainy day funds, or financial reserves.

Per-Capita Payments

Many Tribes provide distributions, such as per capita payments to their members. Currently, the CSLFRF FAQs and IFR don’t provide specific guidance on whether those payments are considered a provision of government services.

What Is and Isn’t Considered General Revenue?

The IFR provides guidance on what’s included in the definition of general revenue.

Revenues from Tribal enterprises are considered general revenues because they’re available to fund government services. This is true whether or not the Tribe has historically used these revenues for government services. Tribal governments should include revenues from their Tribal enterprises when calculating general revenues.

The IFR specifically excludes the following from general revenues:

- Refunds

- Other correcting transactions

- Proceeds from debt

- Sales of investments

- Agency or private trust transactions

- Revenue generated by utilities and insurance trusts

- Intergovernmental grants and contracts

Tribes may not be able to rely on revenues reported in their financial statements when calculating general revenues for the lost revenue calculation. This is because refunds should be removed and aren’t normally reported separately in the financial statements.

Can Tribal Governments Use Fiscal Recovery Funds Aid to Pay for Infrastructure Projects?

Yes. Tribes can apply Fiscal Recovery Funds aid to invest in water, sewer, and broadband infrastructure.

Water and Sewer Infrastructure

Investments in water and sewer infrastructure can include a wide array of projects, including replacing lead service lines for drinking water and managing and treating stormwater.

The IFR states that Tribes have substantial flexibility to identify water and sewer infrastructure investments are the highest priority for their communities.

Broadband Infrastructures

Tribes that choose to build or improve their broadband infrastructures should offer reliable 100 megabits per second (Mpbs) download and between 20–100 Mpbs upload speeds.

If these provisions aren’t feasible, broadband systems should be scalable to those speeds in the future. Fiscal Recovery Funds aid can also be used to support household internet access and digital literacy.

Other Infrastructure Investments

Tribes that want to invest in other types of infrastructure, for example roads, may do so as part of the general provision of government services using the lost revenue calculation as long as those projects aren’t debt funded.

Projects are also allowed if they respond to specific pandemic-related public health needs or negative economic impacts.

How Will Fiscal Recovery Funds Be Administered?

The Treasury has stated that most of the provisions of the Uniform Guidance 2 CFR Part 200 apply to the Fiscal Recovery Funds program, including allowable cost principles. This is a significant difference from the CRF program.

While final compliance requirements haven’t yet been published, the Assistance Listing (Catalog of Federal Domestic Assistance or CFDA) Number 21.027 was published on May 28, 2021 on SAM.gov.

Tribes should follow the provisions in the award terms for the assistance listing as it’s updated, and follow their established policies and procedures.

What Are the Fiscal Recovery Funds Spending and Reporting Requirements and Deadlines?

Fiscal Recovery Funds can cover costs incurred beginning March 3, 2021. Costs must be incurred by December 31, 2024, and spent by December 31, 2026.

Costs incurred prior to March 3, 2021, even those responding to the COVID-19 pandemic or addressing a negative economic impact of the pandemic, aren’t allowable under the Fiscal Recovery Funds program.

Reporting Requirements

Reporting requirements are detailed in the Interim Final Rule and summarized in CSLFRF FAQ Number 9.2. Tribes will be required to submit the following reports demonstrating how they’ve applied Fiscal Recovery Funds:

- Interim report. This will cover activity from the date of the award through July 31, 2021. This report is due August 31, 2021.

- Initial quarterly project and expenditure reports. Tribes must submit this report to Treasury by October 31, 2021. The initial quarterly project and expenditure report will cover two calendar quarters from the date of award to September 30, 2021.

- Subsequent quarterly reports. These are due through the end of the award period on December 31, 2026. These reports will each cover one calendar quarter and must be submitted to Treasury within 30 days of the end of each calendar quarter.

We’re Here to Help

Guidance around the ARPA and Fiscal Recovery Funds is still developing, so it’s important to monitor their potential benefits and implications as additional guidance becomes available.

To learn more about changes to the guidance and how your tribe can use funds awarded under the Fiscal Recovery Funds program, contact your Moss Adams professional. You can also learn about additional ARPA aid available to Tribes in our article, Grants for Tribes: $32.5 Billion Available Through the American Rescue Plan Act.