Guarantee of Return

A guarantee of return is a common way to mitigate risk with state tax credit transactions where you aren’t required to be a partner for federal and state income tax purposes. Whereas when purchasing federal credits, a guarantee of return likely wouldn’t allow an investor to qualify as a true partner, which is required for an investor to qualify for tax credits for federal income tax purposes.

The Historic Boardwalk Hall, LLC v. Commissioner case, which was denied cert by the Supreme Court case in 2013, helped define what being a true partner means and prompted the IRS to establish safe harbors guidance for how to structure tax credit investments.

As a result of this decision, most tax credit investments are largely structured the same to comply with safe harbors; to qualify for tax credits, an investor must be a true partner that’s at risk and have a portion of their returns come from something other than the tax credit.

The only structure that can offer a true guarantee is an NMTC, which is outlined above. This is only allowed in certain situations, such as if a financial institution is resyndicating an NMTC, is a nonmember manager of the NMTC fund, and can guarantee the credits or returns.

These are highly complex transactions, but they’re achievable if they’re carefully planned.

Tax Credit Recapture

When investing in federal tax credits, the investor must be a respected partner and bear some risk from business operations.

As such, short of certain NMTC investments, there can be no guarantee from risk of recapture.

Forbearance Agreements

In practice, especially in HTC or real estate transactions, forbearance agreements can and do exist wherein the lenders agree to forgo or limit foreclosure rights on the properties during the five-year recapture period.

These agreements are as close to a guarantee as federal tax credit investments can provide.

There are also other forms of guarantee around construction and other items that can help limit the risk of receiving tax credits.

Tax Opinion on the Validity of Credits and Structure

Once you’re in a tax credit structure, your return is made up of multiple parts:

- Income and losses of the project

- Depreciation of the property

- Tax credits

- Preferred returns

- Recognition of capital gains or losses upon exit

This division can complicate your filing process and lead to reporting errors.

Regardless of whether you invest through a syndicator or directly with a project, it’s key to always receive a tax opinion on the validity of the credits and structure; certain types of investments might not pass the scrutiny of an IRS exam.

For example, taxpayers should carefully consider whether to invest in syndicated conservation easements and structures involving a syndicated charitable deduction or net operating loss.

Listed Transaction

Some transactions are deemed abusive by the IRS and must be reported to the IRS as a listed transaction.

None of the tax credit opportunities discussed above are considered listed transactions with the IRS—they’re all viable tax credit investment opportunities if they’re structured properly.

That said, it’s important to analyze all available opportunities and consult an external tax advisor if you’re unsure about next steps. As is often the case, if it seems too good to be true, it probably is.

How Do One- and Five-Year Returns Differ?

Not all credits are created equal. Some have statutory delivery periods over time, and others deliver the credits and other tax attributes all in the year the project is placed into service.

Examples in which a credit would be delivered in one year versus over five years follow. Because the returns differ for each credit type, your investment strategy might alter based on your tax liability, cash position, and other investment opportunities.

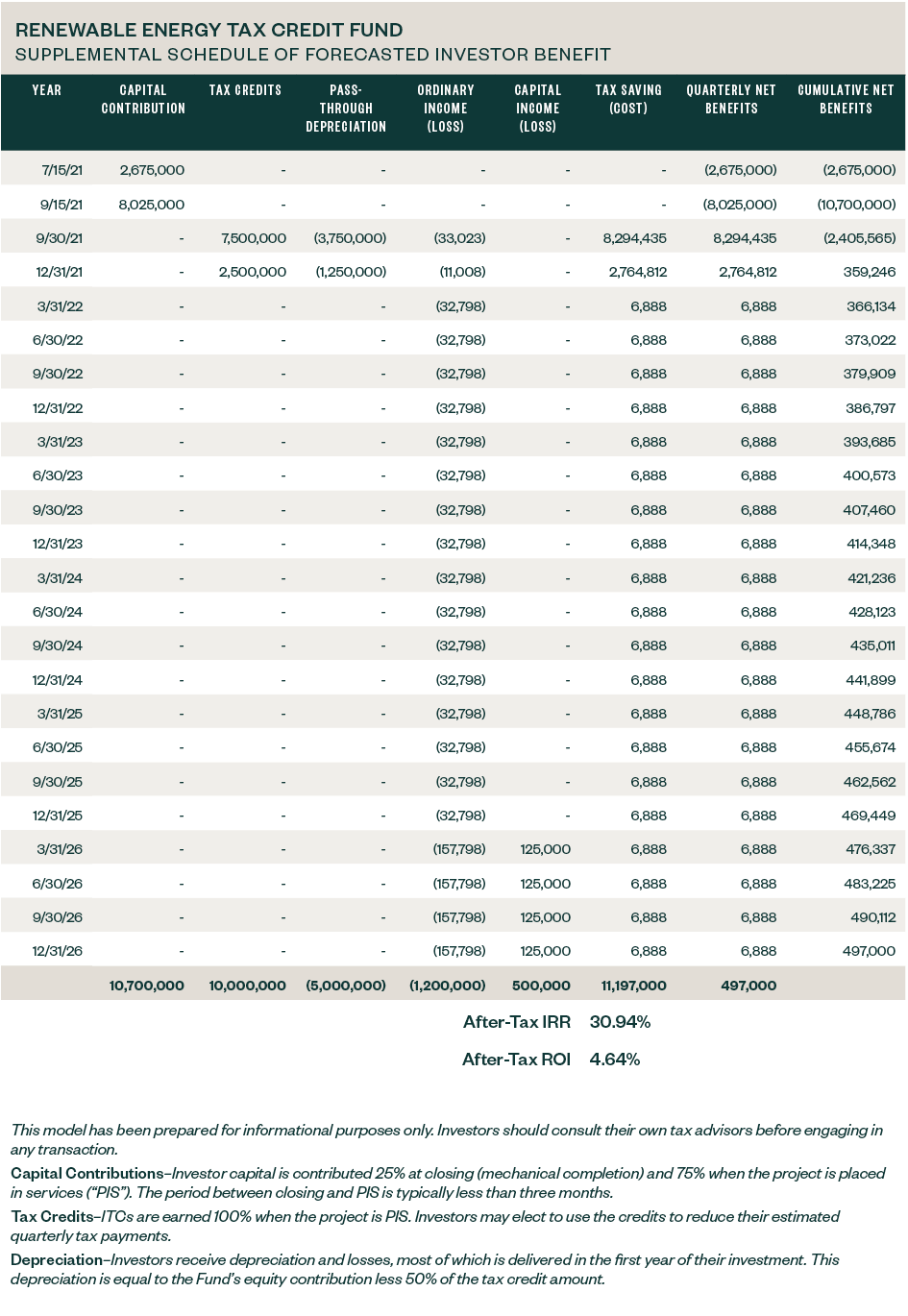

One-Year Model Example

A large renewable energy fund generates federal ITC from a series of solar investments the fund makes.

In the below model, the investor pays $1.07 for the credits and receives credits and losses from depreciation and operating losses. The syndicator is taking their asset management fee from the preferred return based on the performance of the solar assets.

At exit, a capital gain occurs when the fund puts its interest in the project entity. The IRR is fairly strong, coming in at approximately 31% after tax, but the after-tax return on investment is lower, coming in at 4.7%.

An investor in this structure would earn 72% of their total return in five months. The calculated returns included in this model are linear, so the IRR or return on investment would ultimately be the same no matter the size of investment.

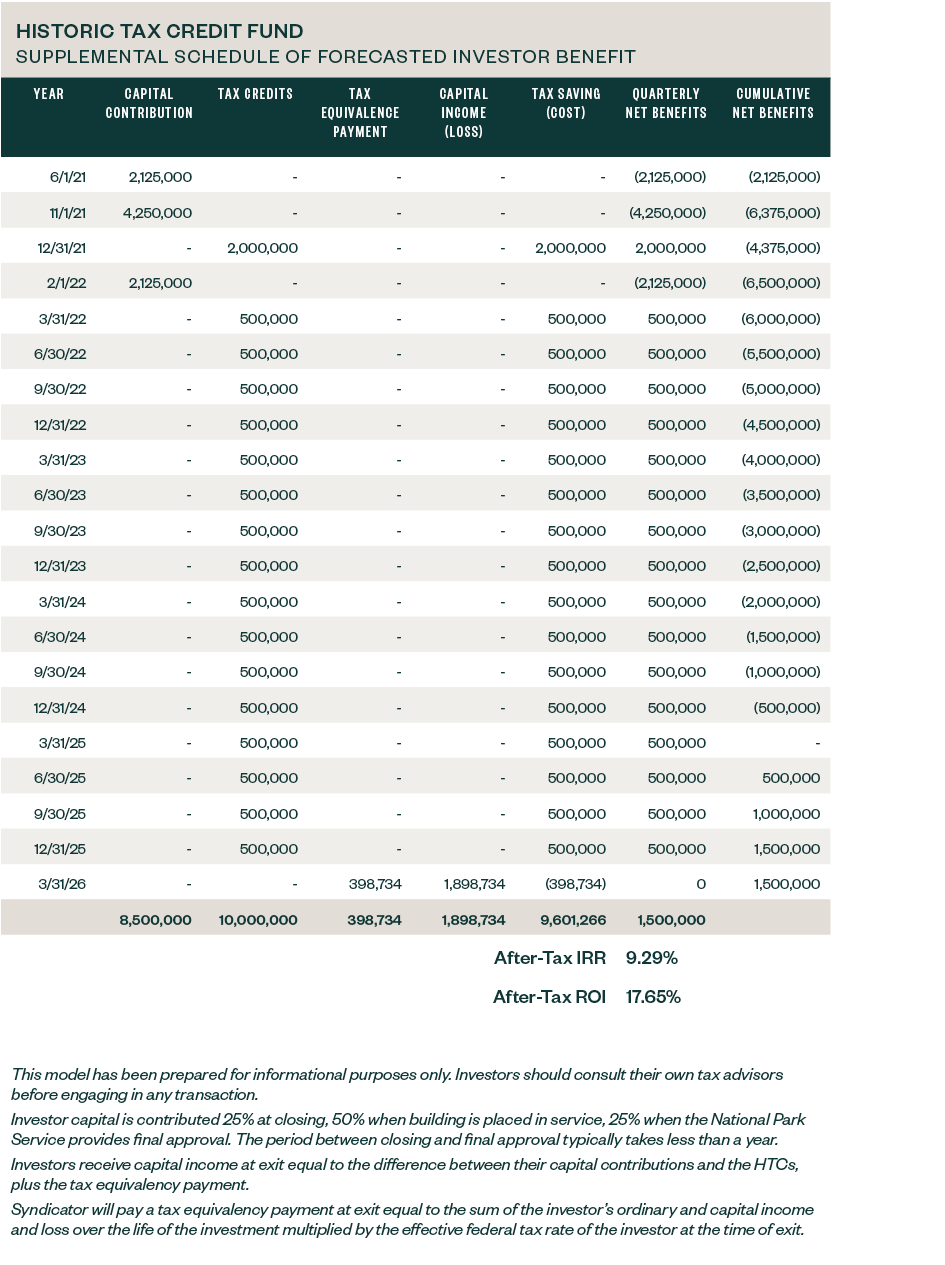

Five-Year Model

In the below model, the investor pays $0.85 cents for the credits and limited losses from the structure. The syndicator takes their asset management fee from the preferred return based on the performance of the project, which in this case is federal historic tax credit eligible.

At exit, a capital gain occurs when the fund puts its interest in the project entity. The IRR is lower than with the one-year investment, at approximately 8% after tax, but the after-tax return on investment is higher, at 15%.

An investor in this structure wouldn’t reach their breakeven point until the fourth year. The calculated returns included in this model are also linear, so the IRR or return on investment would ultimately be the same no matter the size of investment.

We’re Here to Help

These types of investments can be complicated, so it’s important to work with an experienced tax credit professional to fulfill benefit from these opportunities.

As with any investment, there are risks to tax credit investment—planning around these risks is doable but requires careful planning.

If done correctly, you can safely reduce your federal tax liability while diversifying your investment portfolio.

As an independent party to these types of investment transactions, we can help you determine the right fit for you or your business. Our network of developers and syndicators provide us with various opportunities for investments. As a CPA firm, we’re also positioned to advise on the many tax implications and considerations related to these investments.

For more information on purchasing tax credits and to view available inventory, please contact your Moss Adams professional.