If your company wants to establish an employee stock ownership plan (ESOP), or has already worked through an ESOP transaction, it’s important to take the time to consider and understand its impact on your organization’s financial statements.

Both ESOP structures, leveraged and non-leveraged, have unique accounting considerations. Learn how ESOPs work and how they can benefit business owners and employees.

Leveraged ESOPs

Most ESOPs start as a leveraged ESOP. In this setup, the ESOP trust borrows money to buy stock from the selling shareholders. Ownership of the shares is transferred to the ESOP but held in a suspense account until the trust makes periodic payments on the loan.

Over time, the trust allocates that stock to ESOP participants as it repays the loan.

Seller-Financed Direct Loans

A seller-financed direct loan ESOP is when the ESOP trust buys shares directly from a seller in exchange for a note.

Transaction Process

The process includes the following steps:

- The selling shareholder sells their shares to the ESOP trust, in exchange for a note. The shares are collateral on the loan and can’t be allocated to participants until they’re unencumbered.

- Each year, the company makes cash contributions to the ESOP to cover the principal and interest on the loan.

- Once the cash is contributed, the ESOP trust can repay the note to the seller.

- Each time the trust makes a payment, that releases shares from suspense because they’re no longer needed for collateral on the loan. The ESOP trust’s recordkeeper can allocate the previously suspended shares to the participant’s retirement account based on the allocation method defined in the plan document for the attribution year.

Bank-Financed Direct Loans

A bank-financed direct loan ESOP is very rare but occurs when the ESOP trust borrows money from a bank.

Transaction Process

The process includes the following steps:

- The bank lends money directly to the ESOP trust backed by company and shareholder guarantees.

- The ESOP trust can now buy shares from the selling shareholder for cash.

- The company makes annual contributions to the ESOP trust.

- The ESOP trust then makes annual payments to the bank for principal and interest on the loan.

- As the trust repays the loan to the bank, its recordkeeper can allocate the previously suspended shares to the participant’s retirement accounts based on the allocation method defined in the plan document.

Indirect Loans

An indirect loan ESOP is when a company borrows money with an outside loan from a bank or selling shareholder—the outside loan—and makes a corresponding loan to the ESOP—the inside loan.

Transaction Process

The process includes the following steps:

- The bank or selling shareholder lends money through an external loan to the company.

- The company makes a corresponding loan to the ESOP trust.

- The ESOP then uses the money to buy shares from the shareholders.

- As the ESOP makes its annual contribution, it then repays its loan to the company and takes a portion of those shares held in the suspense account and allocates them to participants in the plan.

- The company repays the outside loan in accordance with the terms of that lending agreement.

Balance Sheet Implications

ESOP companies have specialized accounting under the Financial Accounting Standards Board (FASB) Accounting Standards Codification® (ASC) 718-40, Employee Stock Ownership Plans.

According to ASC 718-40, a leveraged ESOP company records the debt of the ESOP as a liability, and the shares purchased as a contra-equity account on the balance sheet of the plan sponsor until those shares are no longer used for collateral on the borrowing.

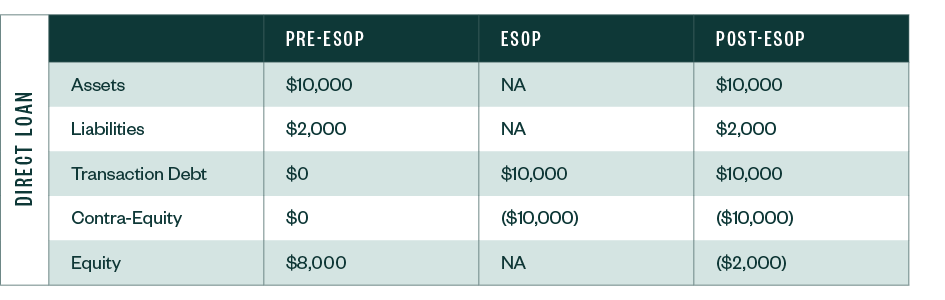

Here's how that would look on a balance sheet for a direct loan.

This example is a $10 million leveraged ESOP transaction. In the third column, you see the effects of the increased debt and the contra-equity account on the balance sheet post-transaction.

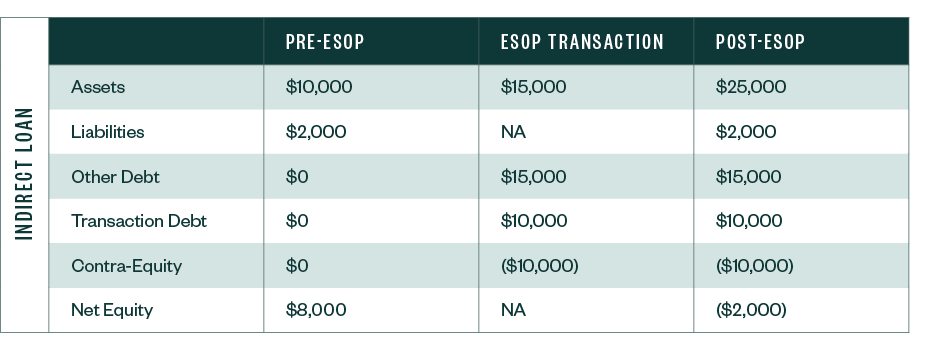

Alternatively, here’s how a balance sheet would look for an indirect loan.

This example is a $10 million leveraged ESOP transaction in which the company borrows $25 million from a bank (outside loan) in the hopes of using it elsewhere. In the third column, you see the effects of the increased debt and the contra-equity account on the balance sheet post-transaction.

Accounting rules don’t allow the company to record the ESOP inside loan receivable as an asset. At face value, this is a double hit to the company’s balance sheet because not only is it more leveraged, but it also reduces equity significantly.

As the trust repays the debt, the company reduces the contra-equity at the historical cost of the shares released from the suspense account.

At the same time, the company records ESOP compensation expense as the average fair value of the shares released during the reporting period. Any difference between historical cost and average fair value is recorded to additional paid in capital or retained earnings.

Non-Leveraged ESOPs

With a non-leveraged ESOP, the company contributes cash to the ESOP and the ESOP buys company shares, or the company contributes shares directly into the ESOP. Such contributions are reported at fair value of the shares.

Often, an ESOP will be non-leveraged in the year or two leading up to a leveraged transaction. Once the ESOP loan in a leveraged ESOP is repaid, the ESOP will be considered non-leveraged.

Some companies will never use leverage, and only contribute cash or shares to the ESOP on an annual basis. They make these decisions early in the planning process as selling shareholders contemplate their exit strategy.

We’re Here to Help

When you’re considering a leveraged or non-leveraged ESOP structure, or have already undergone an ESOP transaction, it’s important to understand how the accounting can impact your financial statements.

For questions about these and other types of ESOP accounting, contact your Moss Adams Professional.