2020 may well be a discussion topic for decades as the COVID-19 pandemic severely impacted nearly all aspects of life. The rural telecommunications community certainly had no immunity to the pandemic’s reach as data from the Moss Adams Telecommunications Benchmarking Study demonstrates.

2020 shined a spotlight on the local internet service provider. Among the general population, broadband internet grew to become an essential service and an integral piece of the nation’s infrastructure, vital to economic stability and growth.

Rural telecommunications carriers not only weathered the pandemic, but even excelled, providing important services to customers living and doing business within their geographical footprints, and beyond.

Below, we explore key takeaways from the Moss Adams 2021 Telecommunications Benchmarking Study.

2021 Benchmark Methods

We based the study on 2020 data from 140 companies. Participants comprised 62 cooperatives, and 78 privately held businesses.

Participants came from 39 of the 50 states and included 80 companies under legacy rate-of-return and 60 companies under model-based support—ACAM I, ACAM II, or Alaska Plan.

Participating Companies

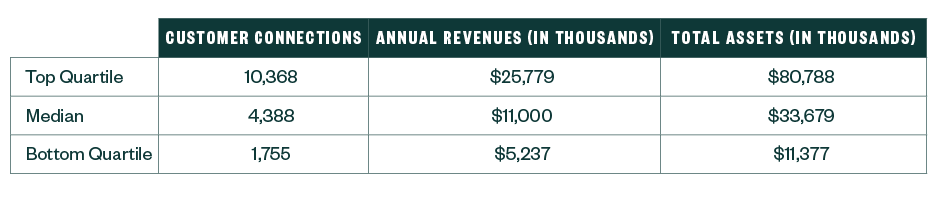

Companies of all sizes participated in the study, as the following table illustrates.

The study defines a customer connection as a physical connection that provides service to a residential or business customer.

Often, one customer connection provides multiple services such as voice, internet, and video; however, for the purposes of the study, we counted such instances as one connection regardless of the number of services one customer connection might carry.

This review of the benchmarking data focuses on:

- Broadband internet

- Staffing resources

- Network investment

- Overall profitability

Broadband Internet

Clearly, never before has the availability and reliability of high-speed broadband internet become more important than during the lockdowns of spring 2020.

Video conferencing became commonplace, and education, work, entertainment, and more had to rely on fast, robust internet services to operate virtually.

Broadband Growth and Fiber Optics

In the rural telecommunications space, this fostered significant customer growth, speed tier upgrades, and continued investment in fiber optic network facilities.

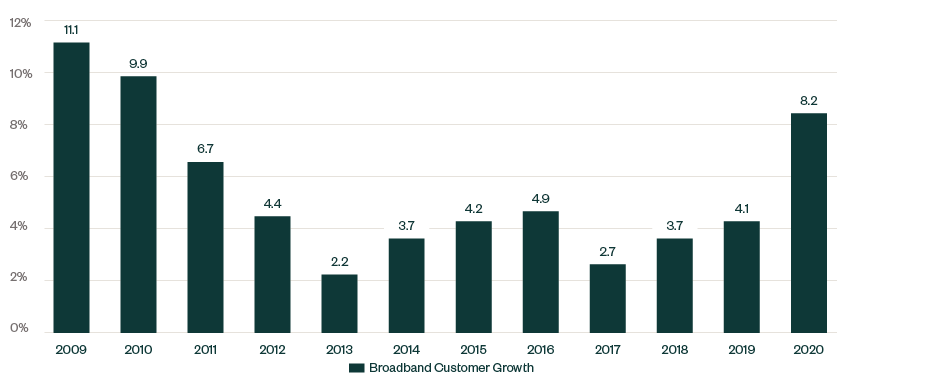

The graph below shows that the median benchmarking study participant experienced 8.2% growth in broadband customers from 2019 to 2020.

The industry hasn’t seen this level of growth in more than 10 years, since the transition away from dial-up internet to DSL.

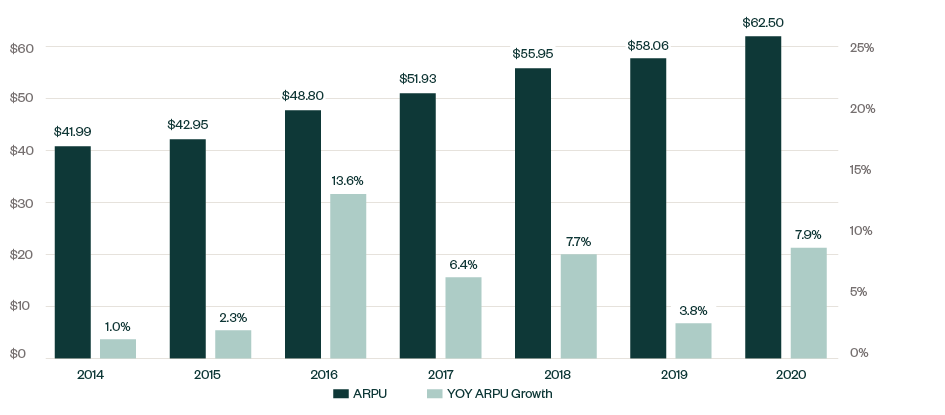

At the same time customers were being added; existing customers upgraded their services to higher speed broadband packages. This is partially evidenced by the increase in broadband customer average revenue per user (ARPU) from $58.06 in 2019 to $62.50 in 2020—a 7.7% increase in broadband ARPU.

Continued deployment of fiber optic network facilities made this growth possible—see more on network expansion below. The median company reported that 77.6% of its residential customers had fiber connections to the premises, up from 70% reported in 2019.

This expansion of fiber to the premises not only allows for increased download speeds, but also increased upload speeds—essential for quality video conferencing performance, gaming, and other activities.

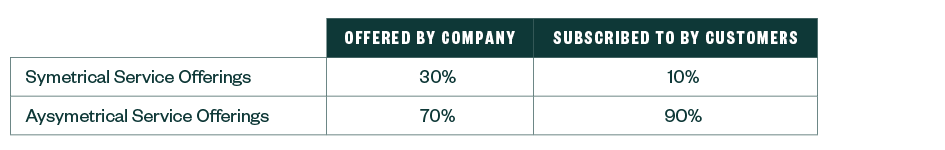

More service offerings offer symmetrical service options—for example, same download speed as upload speed, such as 100MB download by 100MB upload. Typically, upload speeds reach only a fraction of available download speeds.

The table below details the median company’s symmetrical versus asymmetrical broadband service offerings and the subscribers’ mix.

Although symmetrical service offerings total 30% of the median company’s broadband options, only 10% of customers subscribe to it.

Voice-Data vs. Broadband Only

Another continuing significant trend in the rural telecommunications industry shows movement away from selling broadband internet with a phone line, or voice-data, to selling broadband as a stand-alone service, or broadband only.

In total, broadband-only customers in the benchmark study totaled approximately 31% of all broadband customers. This indicated a 5% rise from the prior year.

Comparing legacy rate-of-return carriers to elected model-based support—ACAM I, ACAM II, or Alaska Plan—further illustrates the trend. This is a logical result due to the added support that legacy rate-of-return carriers receive for broadband only customers, whereas model-based support carriers receive no additional support while losing the local revenue. There is lesser incentive for model-based support carriers to offer broadband only services.

The median legacy rate-of-return carrier reported 33.2% of its broadband customers as broadband only, as compared to 11.3% reported by carriers under model-based support.

Staffing

Staffing costs have long been the single largest cash expense to rural telecommunications carriers. The challenges of 2020 required companies to find creative solutions to provide a safe working environment for both customer-facing and back-office employees, while maintaining continual focus on efficiency.

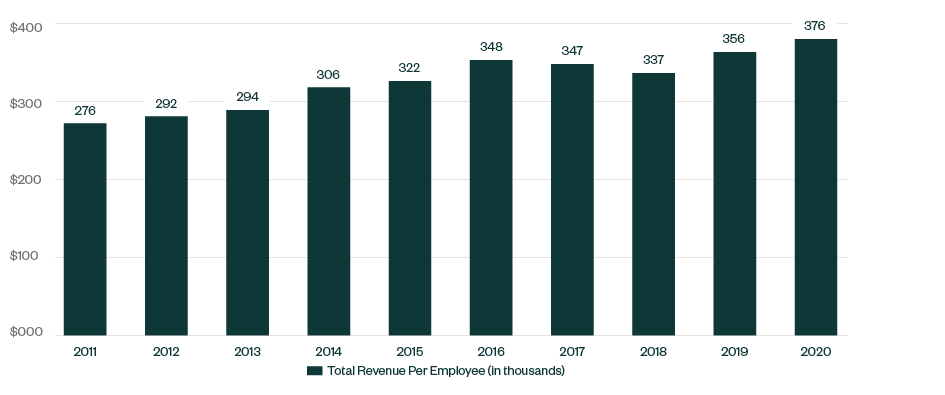

In the benchmarking study, we traditionally used revenue per employee to compare employee efficiency across study participants.

The graph below shows the 10-year trend in total revenue per employee.

Total revenue per employee continues to trend upward; however, Universal Service Funding (USF) support revenues and other revenues not necessarily employee-driven can influence that outcome.

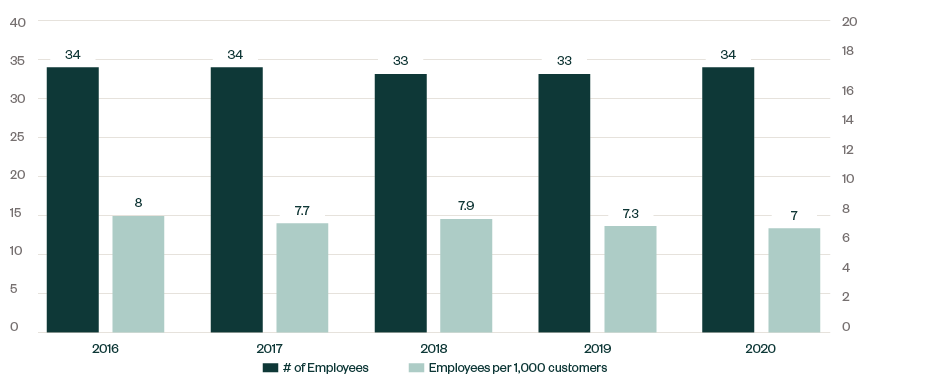

As such, in 2020 we introduced a new metric that compares the number of employees to customers.

The graphic below overlays the median number of employees with the number of employees per 1,000 customers throughout the past five years. As this number dropped from eight employees per 1,000 customers in 2016 to seven in 2020, the data appears to support that companies realized some efficiencies peculiar to 2020 the previous four years.

Network Investment

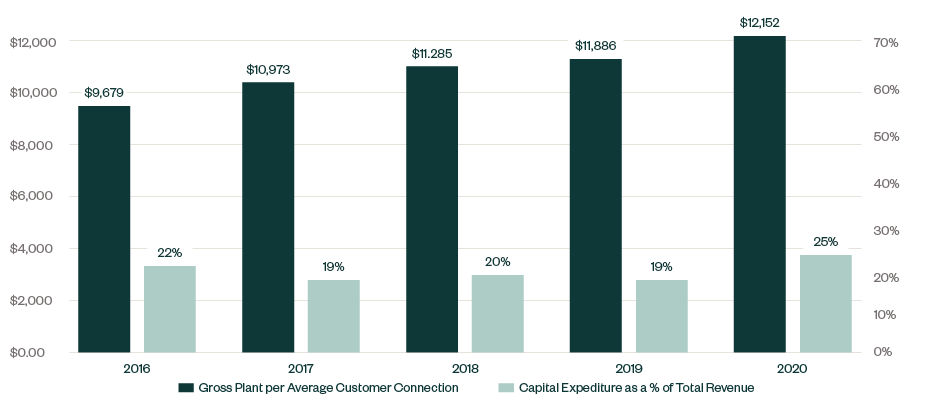

Rural telecommunications is capital intensive. The median company reported the per connection gross network investment at $12,152, up from $11,886 in 2019.

Companies continue to deploy fiber to the premises throughout their networks and 2020 saw an increase in network spending compared to previous years.

The graph below presents the median of network investment as a percentage of total company revenues on top of the total gross investment per customer connection for the same period.

This level of investment, in terms of as a percentage of revenue, hasn’t been seen in the rural communications industry since before the Federal Communications Commission’s (FCC) 2011 USF/ICC Transformation Order, and points to the ongoing need for network investment to meet the FCC’s ever-expanding requirements of voice and broadband providers.

Profitability

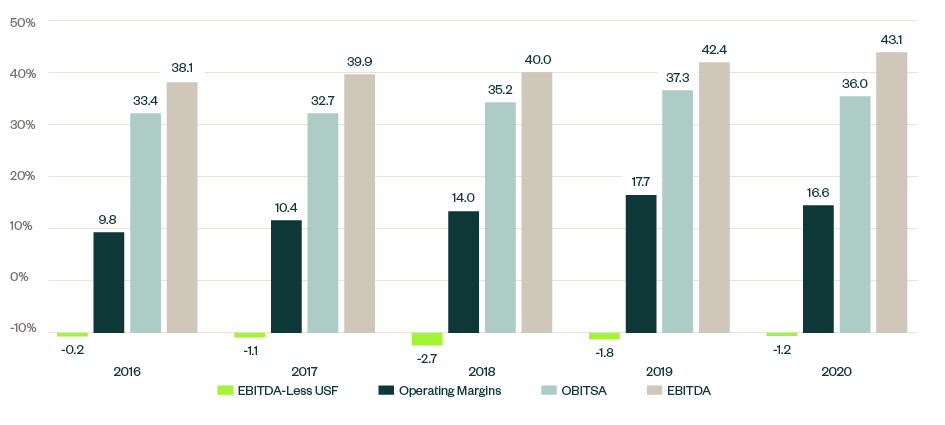

The industry again experienced strong profitability results in 2020; albeit slightly down in operating income before depreciation and amortization (OBITDA) and operating margins from 2019—and that’s whether you use operating margins, earnings before interest taxes depreciation and amortization (EBITDA) or OBITDA.

12.5% growth in broadband internet revenues bolstered profitability while maintaining 2019 levels of federal USF. Specific to USF, interest has risen in evaluating a company’s profitability excluding federal and state universal service support—EBITDA-less USF or controllable margins.

Companies want to prepare for a future with less or no USF given the persistence of caps on federal USF, such as budget control mechanisms, per line caps on support, expense limitations, and other constraints.

The graphic below shows the median company’s profitability figures along with EBITDA-less USF for the past five years.

As noted above, the median company still reports negative EBITDA-Less USF.

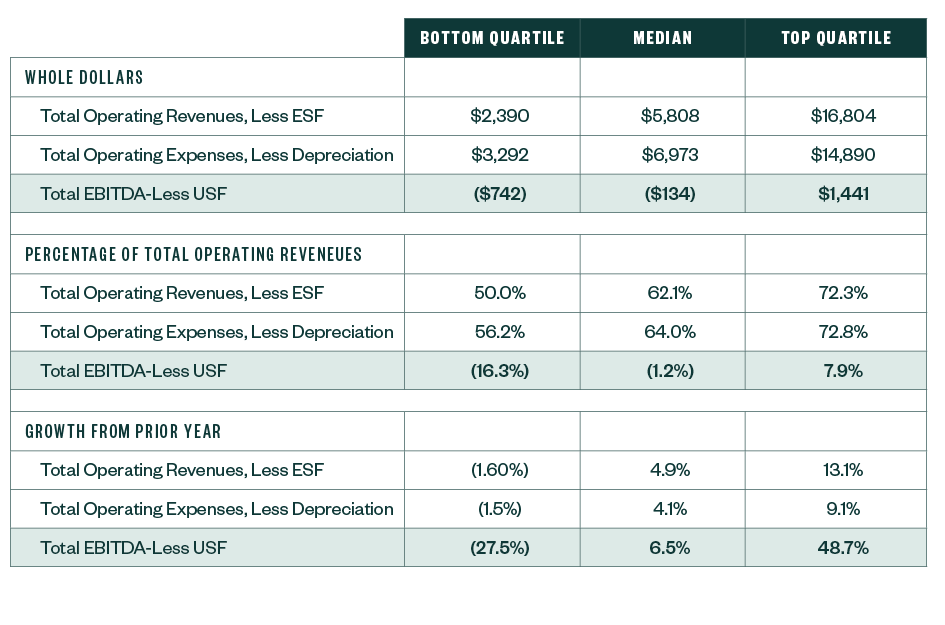

The following table provides more details including bottom and top quartiles.

Although it reports a negative EBITDA-Less USF, the median company appears to be improving in this area, showing a 6.5% positive change from 2019 to 2020.

We’re Here to Help

To learn more insights, please contact your Moss Adams representative for a scorecard catered specifically for your company.