A version of this article was published in the January 2022 edition of Healthcare News.

The Departments of Health and Human Services, Labor, and Treasury (collectively, the Departments) issued a series of rules and notices in 2021 since the passing of the bipartisan No Surprises Act on December 27, 2020 as part of the Consolidated Appropriations Act of 2021 (HR 133; Division BB–Private Health Insurance and Public Health Provisions).

These include:

An overview of these items follows to help your organization better prepare for the impacts of the act.

No Surprises Act Overview

The No Surprises Act essentially expands consumer protection at the federal level by shielding patients from surprise medical billing and excessive cost-sharing.

A surprise medical bill, also known as out-of-network (OON) billing or balance billing, occurs when a patient receives a bill for the difference between the OON provider’s fee and the amount the patient’s health insurance covers after co-pays and deductible.

Even though some would refer to surprise billing as an occurrence when patients unknowingly get care from providers outside their health plan’s network, the reality is this can happen to anyone, knowingly or unknowingly, in both emergency and non-emergency care. The balance may be a minimal amount or a more surprising charge in the thousands of dollars, leading to potential devastating financial hardships.

Who Does the No Surprises Act Protect?

These surprise billing protections apply to consumers who obtain their health coverage through:

- An employer including a federal, state, or local government

- Federal or state-based marketplaces

- An individual market health insurance issuer

The rule doesn’t apply to individual federal programs such as Medicare, Medicaid, Indian Health Services, Veterans Affairs Health Care, or TRICARE because these programs already explicitly prohibit balance billing.

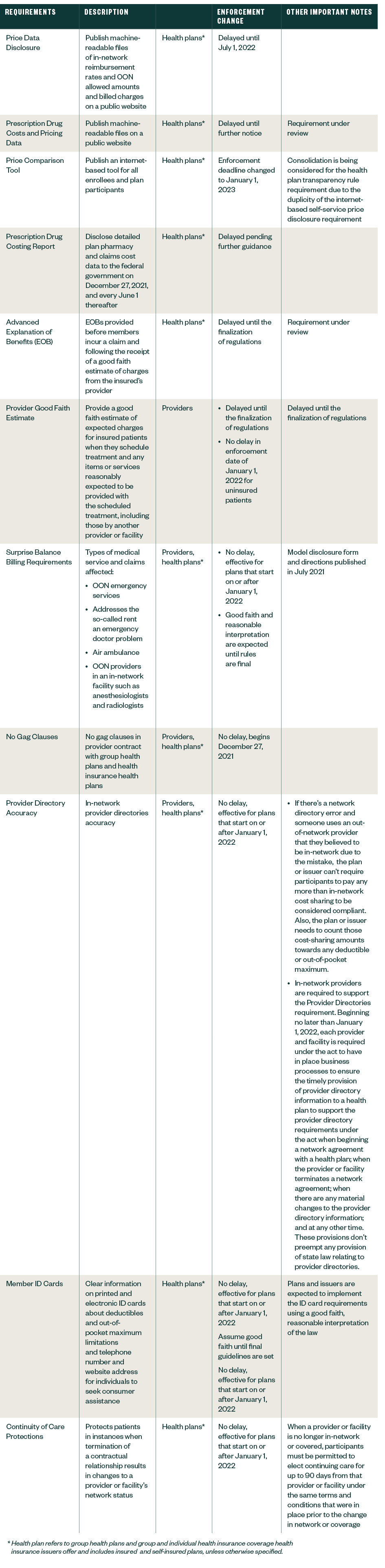

Requirements Related to Surprise Billing; Part I, Issued July 1, 2021

The first IFR served to implement several important requirements for group health plans, group and individual health insurance issuers, carriers under the Federal Employees Health Benefits (FEHB) Program, health care providers and facilities, and OON providers of air ambulance services.

It effected the intent of the act, which is to offer consumer protections against surprise medical billing.

IFR Summary, Part I

Bans on Surprise Billing for Emergency Services

The act ensures provision of emergency services on an in-network basis without any prior authorization, regardless of where they occur, whether the provider is an in-network provider or an out-of-network provider at an in-network facility.

Bans OON Cost-Sharing for Emergency and Certain Non-Emergency Services

Patient cost-sharing, such as coinsurance or a deductible, can’t be higher than if an in-network doctor provided such services, and any coinsurance or deductible must be based on in-network rates.

Cost sharing for these services count towards meeting in-network deductibles and out-of-pocket maximums.

Calculations of the consumer cost-sharing amounts must use one of the following methodologies:

- An amount an applicable All-Payer Model Agreement determines under section 1115A of the Social Security Act

- An amount specified state law determines if no such applicable All-Payer Model Agreement exists

- The lesser amount of either the billed charge or the qualifying payment amount, which is generally the plan’s or issuer’s median contracted rate, if neither of the above apply

Bans OON Charges for Ancillary Care

The act bans charges for ancillary care, such as for an anesthesiologist, radiologist, or assistant surgeon, where surprise bills may happen, and for all in-network facility care.

Bans Other OON Charges Without Advance Notice

Health care providers and facilities must provide patients with a plain-language, one-page notice explaining the requirement for patient consent to receive care on an OON basis before that provider can bill at the higher OON rate.

The act requires certain health care providers and facilities to post the one-page notice on a public website outlining:

- The requirements and prohibitions applicable to the provider or facility under Public Health Service Act Sections 2799B-1 and 2799B-2 and their implementing regulations

- Any applicable state balance billing limitations or prohibitions

- How to contact appropriate state and federal agencies if someone believes the provider or facility violated the requirements described in the notice

Calculations of the OON Payment to the Provider or Facility

One of the payment methods below will determine the calculations:

- An amount an applicable All-Payer Model Agreement (APM) determines under section 1115A of the Social Security Act

- An amount a specified state law determines, in the absence of an APM

- An amount the plan or issuer and the provider or facility agreed to use, if no such applicable APM or specified state law exists

- An amount an independent dispute resolution (IDR) entity determines, if none of the three conditions above apply

Notice of Proposed Rulemaking (NPRM), Issued September 16, 2021

This notice intended to implement certain provisions of the No Surprises Act, entitled Reporting Requirements Regarding Air Ambulance Services, Agent and Broker Disclosure Requirements and HHS Enforcement.

If finalized, this proposed rule would establish:

- New reporting requirements regarding air ambulance services

- New disclosures and reporting requirements regarding agent and broker compensation

- New procedures for enforcement of Public Health Service Act (PHS Act) provisions against providers, health care facilities, and providers of air ambulance services

- New disclosure and reporting requirements applicable to issuers of individual health insurance coverage and short-term, limited-duration insurance regarding agent and broker compensation

- Revisions to existing PHS Act enforcement procedures for plans and issuers

The public comment period ended October 18, 2021.

Frequently Asked Questions (FAQs), Issued August 20, 2021

The Departments of Labor, Health and Human Services (HHS), and the Treasury jointly prepared the FAQs.

The summary of the enforcement changes resulting from the FAQs follow. Please note requirements with an approaching enforcement change date.

Requirements Related to Surprise Billing; Part II, Issued September 30, 2021

The second IFR built on the protections in the July 2021’s IFR and shed light on the provisions related to the IDR process, good faith estimates for uninsured—or self-pay, such as patients who may be insured but aren’t submitting their claims to their insurance—individuals, the patient-provider dispute resolution process, and expanded rights to external review.

IFR Summary, Part II

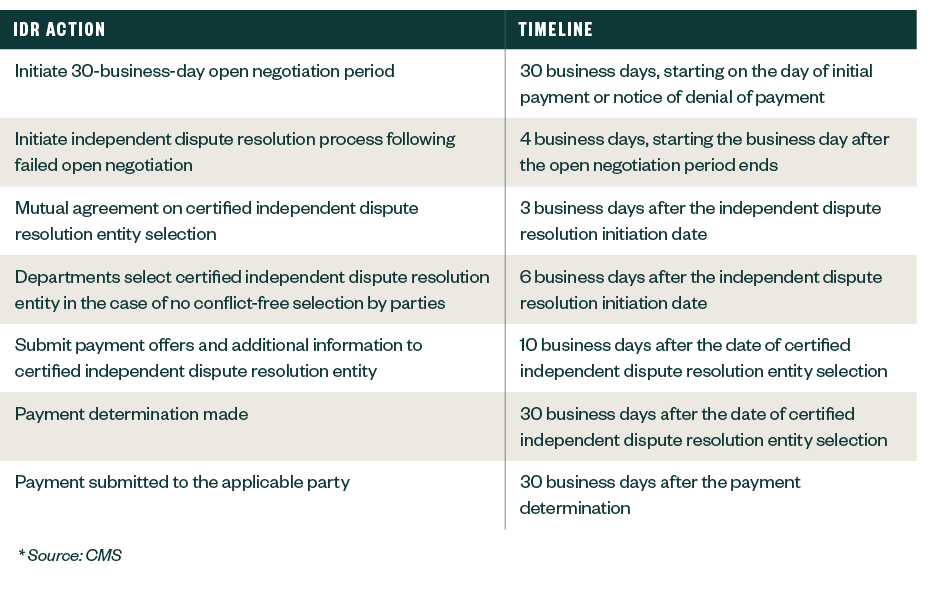

- Establishes the federal IDR process that OON providers, facilities, providers of air ambulance services, plans, and issuers in the group and individual markets may initiate to determine the OON rate for applicable items or services after an unsuccessful 30-day open negotiation period. Only services for which balance billing was prohibited under the Requirements Related to Surprise Billing; Part I rule are eligible for the federal IDR process.

- Outlines the Departments’ process to certify independent dispute resolution entities to conduct payment determinations on a rolling basis. Entities interested in becoming certified by January 1, 2022 had to submit their applications through a federal portal by November 1, 2021.

- Released the Calendar Year 2022 Fee Guidance for the Federal IDR Process, which detailed the allowable fees certified IDR entities can charge in 2022, as well as the administrative fee that parties to a dispute must pay to access the federal IDR process; $50 each for 2022.

The IFR also requires a good faith estimate (GFE) of expected charges by the convening provider for the items or services that are reasonably expected to be provided together with the primary item or service, including items or services that may be provided by other providers and facilities, to be provided to an uninsured—or self-pay—individual.

Starting in January 2022, uninsured or self-pay consumers who schedule care at least three business days in advance must be provided the GFE within one business day after the date of scheduling. If care is scheduled at least 10 business days in advance, the GFE must be provided within three business days of scheduling.

The same timeline of three business days applies if the consumer is window shopping for care—for example, care hasn’t been scheduled. The GFE should be reviewed and updated once care is scheduled.

The IRF also:

- Clarifies that consumers who have temporary or short-term medical insurance are excluded from the definition of individual health insurance coverage; thus, providers and facilities will be required to provide GFE to such consumers.

- Provides eligibility details for patient-provider dispute resolution process to determine a payment amount. An uninsured—or self-pay—patient who received a good faith estimate and then is billed charges of $400 or more than the good faith estimate meets the definition being billed substantially in excess and is eligible to initiate the Patient-Provider Dispute Resolution process within 120 calendar days of receiving the bill.

- Expands the scope of adverse benefit determinations eligible for external review to include determinations that involve whether a plan or issuer complies with the surprise billing and cost-sharing protections under the No Surprises Act and its implementing regulations

The written public comment period ended November 30, 2021.

Requirements Related to Surprise Billing; Part III, Issued November 17, 2021

The Departments and the Office of Personnel Management (OPM) released the third interim final rule with request for comments (IFC), entitled Prescription Drug and Health Care Spending on November 17, 2021, setting new requirements for health plans and health insurance issuers in the group and individual markets to submit annually to the Departments select information about prescription drug and health care spending.

The same information will be submitted by Federal Employees Health Benefits (FEHB) Program carriers in coordination with OPM. Using the information submitted, the Departments will release biennial public reports on prescription drug reimbursements, prescription drug pricing trends, and the impact of prescription drug costs on premiums and out-of-pocket costs starting in 2023.

The intention is to bring more transparency to how prescription drugs contribute to overall health care spending and serves the purpose of increasing competition to bring down overall health care costs.

IFR Summary, Part III

This IFC requires plans and issuers in the group and individual markets to submit certain information on prescription drug and other health care spending to the Departments annually, including all the following:

- Enrollment and premium information, differentiating average monthly premiums paid by employees versus employers

- Total health care spending, broken down by type of cost, hospital care, primary care; specialty care, prescription drugs, and other medical costs, including wellness services, such as prescription drug spending by enrollees versus employers and issuers

- The 50 most frequently dispensed brand prescription drugs

- The 50 costliest prescription drugs by total annual spending

- The 50 prescription drugs with the greatest increase in plan or coverage expenditures from the previous year

- Prescription drug rebates, fees, and other remuneration paid by drug manufacturers to the plan or issuer in each therapeutic class of drugs, as well as for each of the 25 drugs that yielded the highest amount of rebates

- The impact of prescription drug rebates, fees, and other remuneration on premiums and out-of-pocket costs

Deadline for first submission is December 27, 2021, with an annual deadline of June 1 of each year thereafter; however, there may be temporary deferral of enforcement with regards to the December 27, 2021 and June 1, 2022 deadlines.

The Departments announced that they won’t initiate enforcement action against a plan or issuer that submits the required information for 2020 and 2021 by December 27, 2022. FEHB carriers have until December 27, 2022 to report information for 2020 and 2021.

The written public comment period will end January 24, 2022.

What Should Providers and Health Plans Consider Before the January 2022 Effective Date?

There are several actions organizations should take now.

Complete a Gap Analysis

While sections of the act apply to select patient populations receiving specified services, the act has far-reaching implications that extend beyond revenue cycle.

Within a hospital facility, it impacts marketing and communications, provider relations, patient experience, contracting, scheduling, operating rooms, supply chain, and IT. The act applies to freestanding ERs, freestanding urgent care centers that are licensed to provide emergency services, and even private practices.

If not yet completed, a gap analysis is key to take stock of how your organization processes stand up to the rigor of the act requirements. Your organization should also have a well-communicated, carefully thought-out and actionable plan.

Differentiate Workflows for Uninsured or Self-Pay vs. OON Insured Patients

Insured patients with scheduled non-emergency services—exceptions apply for select ancillary care—can complete a written consent form prior to the date of service with OON providers as a waiver to the No Surprises Act’s protections. This, however, isn’t applicable to uninsured patients.

Organizations must think through their internal process workflows to differentiate between the patient insurance status as well as where they would store, manage, and retrieve notice and consent forms.

The workflow consideration extends to the processing of final patient bills. Electronic medical records (EMR) may be leveraged to better identify and scrub, or even hold back, OON patient accounts for manual review while organizations adapt to the new regulations. Policies and procedures should be reviewed and updated to reflect process changes.

Provide a Quality Good Faith Estimate

To aid compliance, CMS released 11 documents to help providers comply with the No Surprises Act’s requirement, which included a model form for good faith estimate of expected charges.

It’s critical to inventory the depth and breadth of services that would require good faith estimates. Additionally, facilities should develop clear communication and common understanding with providers for the urgency around the need for timely and accurate estimates.

In cases where separate bills are sent from the facility and the providers, it’s important to coordinate the final bill to make sure the total doesn’t exceed $400 of the estimate.

While the requirement goes into effect January 1, 2022 for uninsured and self-pay patients, it’s prudent to make a good faith practice run for the insured patient population as this usually represents the vast majority of the population served.

Have an Accurate Provider Directory

Health plans must amplify their efforts to have processes and procedures in place in maintaining an accurate and up-to-date provider directory.

Traditionally, provider directories are updated on the go, but may only be published at a much longer interval, commonly bi-annually. The act requires health plans to verify the accuracy of provider or facility information at least every 90 days; all directory changes must occur within two business days of submittal by the provider or facility.

Revisit Productivity Standards

New requirements mean new processes with an unavoidable learning curve. Productivity will be affected in many areas, perhaps more evidently in the patient access, financial counseling departments within revenue cycle as well as scheduling departments.

Increased, faster coordination will likely put a strain on productivity; therefore, a temporary adjustment to the productivity standards may be called for with a ramp up to normal as the learning curve subsides.

Caution About Noncompliance with Overlapping Transparency Rules

The Departments acknowledged in the August 2021 FAQs that some of the new Transparency in Coverage Rules are duplicative and overlapped with the Hospital Price Transparency rule that went into effect on January 1, 2021.

The Hospital Price Transparency rule requires hospitals to display files on their websites containing gross charges, payer-specific negotiated charges, discounted cash prices, and deidentified minimum and maximum negotiated charges. All hospitals also must display at least 300 shoppable services that a health care consumer may schedule in advance.

While the Departments delayed enforcement for many of the new transparency requirements, organizations should be cautious about noncompliance with the Hospital Price Transparency Rule.

Communicate Consistently and Frequently

It’s never too early to communicate the significance of the act and the ask on your team.

Change is never easy but becomes more palatable when expectations are communicated clearly and with appropriate notice. This helps employees understand what they’re asked to do.

Communication and education should also extend beyond the walls of the organization to reach providers and patients. Appointing a change champion may go a long way towards a more seamless transition.

Learn about additional considerations for providers and payers here.

We’re Here to Help

Contact your Moss Adams professional for help making an informed decision about navigating the complicated layers of the No Surprises Act and implementing practical, actionable steps to become compliant starting January 1, 2022.

You can also learn more about our Health Care and additional topics affecting the industry.