Depreciation is one of the largest expenses reported on many federal and state income tax returns. Fixed assets make up a significant portion of the balance sheet for companies across multiple industries. Maintaining fixed assets has become more complex, presenting potential tax compliance risks and missed cash flow opportunities.

Why Do Challenges Exist Around Maintaining Tax Depreciation?

Legislative changes and resource constraints cause the most pain points when it comes to maintaining fixed assets.

In addition to guidance for capitalizing or expensing property, there have been several legislative changes in recent years that impact how property is accounted for and depreciated for tax purposes. Many of these changes arose late 2017 with the tax law commonly referred to as the Tax Cuts and Jobs Act (TCJA), though there have been modifications and clarifications since its enactment.

Bonus Depreciation

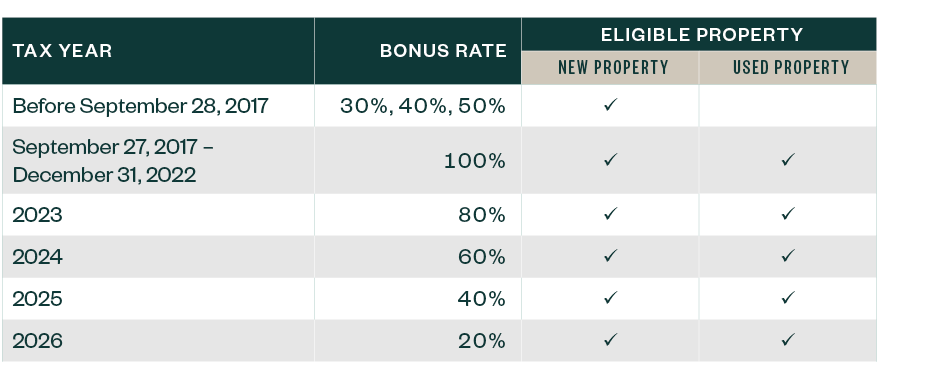

Since 2017, there have been several changes to bonus depreciation, including the applicable percentage rate and eligible property.

For eligible property acquired and placed in service on or before September 27, 2017, a taxpayer could immediately deduct 50% of the cost with bonus depreciation. For eligible property acquired and placed in service after September 27, 2017, and before January 1, 2023, 100% bonus depreciation applies. Starting in 2023, bonus deprecation will begin to phase down 20% per year.

Bonus Depreciation Rates by Year

Eligible property was expanded to include existing used property acquired by a taxpayer after September 27, 2017.

Section 179 Expensing

In 2018, Section 179 thresholds and limitations were updated. Eligible property was expanded to include certain improvements to nonresidential real estate for eligible taxpayers:

- Roofs

- Heating, ventilation, and air conditioning (HVAC) systems

- Fire protection and alarm systems

- Security systems

- Qualified improvement property

Leasehold Improvements

Prior to TCJA, Congress created certain improvement property asset classifications to incentivize investment in existing commercial real estate, including qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property. In general, these classifications allowed taxpayers to depreciate the costs of qualifying leasehold improvements over 15 years and apply bonus depreciation.

The TCJA eliminated these classifications and replaced them with one qualified improvement property (QIP) classification which applies to interior and nonstructural improvements made by a taxpayer to an existing commercial building. A technical error in the TCJA rendered QIP as 39-year property not eligible for bonus depreciation until a correction was made in 2020, updating the recovery period to 15 years and making the property eligible for bonus depreciation.

Real Property Cost Recovery

There’s a requirement to use separate alternative depreciation system methods and recovery periods if specific tax elections are made or international tax provisions are claimed by the company.

To add to the administrative burden, separate depreciation books and records must be maintained if the company operates in states that don’t conform to federal law, which is increasingly common given all the recent federal changes.

These recent changes leave professionals scrambling to stay current with depreciation rules while trying to meet internal and tax compliance needs. In addition, software programs must regularly be updated to stay current and maintain the integrity of the fixed asset data.

Should You Maintain Tax Books Internally or Seek Professional Services?

If you answer yes to any of the questions below, consider seeking assistance from a tax professional with experience in your industry to help maintain fixed assets:

- Are you using Excel spreadsheets to maintain depreciation?

- Are multiple systems used for different depreciation reporting needs, such as book, federal tax, states, or other?

- Has it been a while since the fixed asset software was updated to incorporate current tax depreciation rules? Do any overrides or top-side adjustments need to be made to correct for current rules?

- Are depreciable fixed assets one of the largest items on the company’s balance sheet?

- Do fixed assets take up a considerable amount of your team’s time?

- Does your team attend less than two trainings per year on federal tax updates?

- Does your company take advantage of international tax provisions, such as the Foreign Derived Intangible Income deduction?

- Does your company operate in multiple states or foreign countries?

- Do you feel like you’re not applying the correct tax methods or taking advantage of accelerated depreciation opportunities?

- Does your company regularly engage in transactions that lead to re-valuation of assets?

What are Business Impacts of Incorrect Tax Depreciation Reporting?

Erroneous depreciation reports can directly impact a company’s cash flow. Costly penalties can be assessed when too much depreciation is claimed. Missed cash flow opportunities could result when accelerated depreciation opportunities aren’t taken advantage of.

Errors may stem from the use of an incorrect depreciable life or method, including the improper application of bonus depreciation.

Examples of Too Much Tax Depreciation Claimed

The following examples show companies overstating depreciation expenses. Bonus depreciation percentages vary by year. For simplicity, the following examples assume 100% bonus depreciation applies.

Company Constructs Office Space

A company spends $10 million to construct office space in an existing building. The company classifies the entire $10 million as 15-year QIP and claims 100% bonus depreciation, reporting a depreciation expense of $10 million. $2 million relates to façade, roof, and HVAC updates that must be depreciated over 39 years. The company overstated its depreciation expense by $1.972 million, which is $2 million claimed less $28,000 allowable.

Beverage Company Retrofits Elevators

A beverage company spends $400,000 retrofitting existing freight elevators in a building. The amount is treated as five-year property and 100% bonus depreciation is claimed. The cost should have been classified as 39-year property. Consequently, the company overstated its depreciation expense by $394,400, that’s $400,000 claimed less $5,600 allowable.

Design Firm Has Offices in Paris, London, and Munich

The cost of new office furniture is depreciated over seven years and 100% bonus depreciation is applied. Under federal law, assets used outside of the United States must be depreciated using a nine-year alternative depreciation system period and the assets aren’t eligible for bonus depreciation. The company has overstated its depreciation expense for assets used at these foreign locations.

Examples of Missed Accelerated Tax Depreciation Opportunities

The following are three examples of a company understating its tax depreciation expense. Where applicable, it’s assumed the companies are corporations that pay tax at the 21% corporate tax rate.

Sawmill Company Updates Dry Kilns

A sawmill company spends $500,000 replacing doors, roofs, and siding on dry kilns at its various sites. The cost is capitalized as 39-year property and a depreciation expense of $7,000 is claimed. Dry kilns, including improvements to them, should be depreciated over seven years and are eligible for 100% bonus depreciation. The company understated its tax depreciation expense by $493,000, missing out on $103,530 of tax deferral—$493,000 multiplied by 21% tax rate.

Aerospace Company Retrofits a Hanger

An aerospace company spends $700,000 to retrofit an airplane hangar to be a paint booth, adding specialty ventilation systems, plumbing, and electrical systems to facilitate aircraft painting activities. The entire cost is classified as 39-year property and a depreciation expense of $9,700 is claimed. Such improvements should be depreciated over seven years and are eligible for 100% bonus depreciation. As such, the company understated its depreciation expense by $690,300, missing out on roughly $145,000 of tax deferral benefit—$690,300 multiplied by 21% tax rate.

Property Investor Acquires Complex

A property investor acquires a multifamily apartment complex for $40 million. $30 million is treated as 27.5 year building property and $10 million is treated as non-depreciable land. Approximately $1.1 million is claimed as depreciation expense during year one. If the investor had done a cost segregation to identify 15-year land improvements and five-year personal property eligible for 100% bonus depreciation, the investor could have claimed $5.5 million of depreciation, creating additional tax deferral benefits.

Case for Outsourcing Fixed Assets

Working with an experienced tax depreciation professional with knowledge of your industry can help you plan for tax-deferral opportunities, identify potential risks and process improvements, and advise on tax law changes that directly impact your business.

In general, the appropriate depreciation lives, methods, and special provisions depend on the specific use and nature of an asset, necessitating the industry experience to keep you in compliance and seek out opportunities.

Resources are saved without the need to invest in and update costly fixed asset software programs. Most tax professionals will have access to major software programs that incorporate current federal, state, and international tax rules.

They can also handle larger volumes of data, being able to provide most reporting needs from one system. Assistance with budgeting, forecasting, and scenario analysis can also be done in real time.

We’re Here to Help

For guidance on processing and maintaining fixed assets, and calculating tax depreciation, contact your Moss Adams professional. You can also visit our Tax Credit & Incentive Services for additional resources.