On December 2, 2017, the Senate passed the Tax Cuts and Jobs Act, a sweeping tax reform bill that seeks to reduce tax rates for corporations and individuals following a strategy outlined in our previous Alert. A similar tax bill was passed by the House of Representatives on November 16, 2017. The White House and Congressional leadership plan to have a unified tax reform bill ready for the president to sign into law before the Christmas holiday.

On December 2, 2017, the Senate passed the Tax Cuts and Jobs Act, a sweeping tax reform bill that seeks to reduce tax rates for corporations and individuals following a strategy outlined in our previous Alert. A similar tax bill was passed by the House of Representatives on November 16, 2017. The White House and Congressional leadership plan to have a unified tax reform bill ready for the president to sign into law before the Christmas holiday.

Property owners and investors who’ve purchased, constructed, or made significant improvements to their real estate holdings can take advantage of current tax rates by using strategies and deductions that may not be as valuable in future years if income tax rates are reduced, as proposed.

Accelerated Depreciation

Tax law generally requires real estate owners to recover the cost of their real property investments proportionately over a long period—27.5 or 39 years—in the absence of a detailed review of the assets. However, taking this default approach often overlooks additional current-year deductions that may be available.

One approach to accelerating tax deductions is cost segregation, a tax-deferral strategy used by building owners and operators to increase near-term depreciation deductions by identifying elements of the building that qualify for shorter lives than the building. Applying a cost segregation strategy can significantly accelerate the benefit of depreciation—especially in the first few years of ownership. However, a tax rate reduction reduces the value of cost segregation, so the time to act is now, while rates are still high.

Example

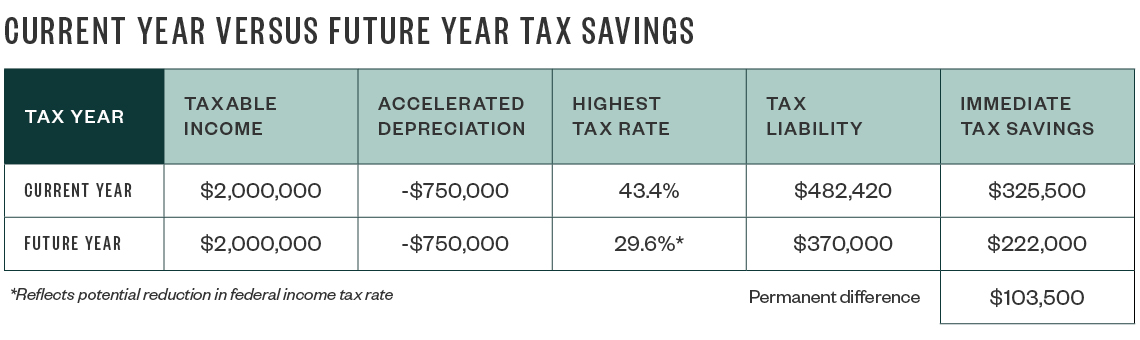

An individual owner of a large portfolio of apartment properties has $2 million in taxable income in the current year with a tax liability of $807,920, assuming the highest tax rate of 39.6% plus the net investment income tax of 3.8%—for a combined highest tax rate of 43.4%.

The taxpayer commissions a cost segregation study, resulting in $750,000 of additional depreciation deductible in the current year. The owner’s taxable income after applying the $750,000 deduction from the cost segregation study is now $1,250,000 with a tax liability of $482,420. This means the owner’s current year tax liability is $325,500 less because of the accelerated depreciation from the cost segregation study.

Assume in a future year that the highest federal income tax bracket is lowered to 29.6% and the net investment income tax is abolished. The owner can reduce his or her taxable income by applying a cost segregation study with the same $750,000 of additional depreciation as before; however, the owner’s tax liability in the future year decreases by only $222,000—or a permanent difference of $103,500 less than the current year scenario.

Even if tax rates don’t go down, an accelerated depreciation strategy used on one or more properties each year still benefits taxpayers by lowering tax liabilities in the near term, which frees up cash to invest back into their business or other opportunities. Cost segregation studies also benefit taxpayers with net operating losses by increasing their current year losses, which, under current law, may then be carried back and used to offset taxable income from prior years. However, one of the proposed changes in the House and Senate tax reform bills would disallow this.

Depreciation Recapture

Depreciation recapture occurs when a taxpayer accelerates depreciation and sells real or personal property for a profit in a subsequent year. The taxpayer then owes ordinary income taxes on gains attributable to the additional depreciation, which partially mitigates the initial tax deferral benefit.

Investors who hold property for fewer than five years typically avoid cost segregation due to recapture; however, they may want to reconsider their tax planning strategy as a drop in the tax rate could translate into more money saved—even after accounting for recapture.

Example

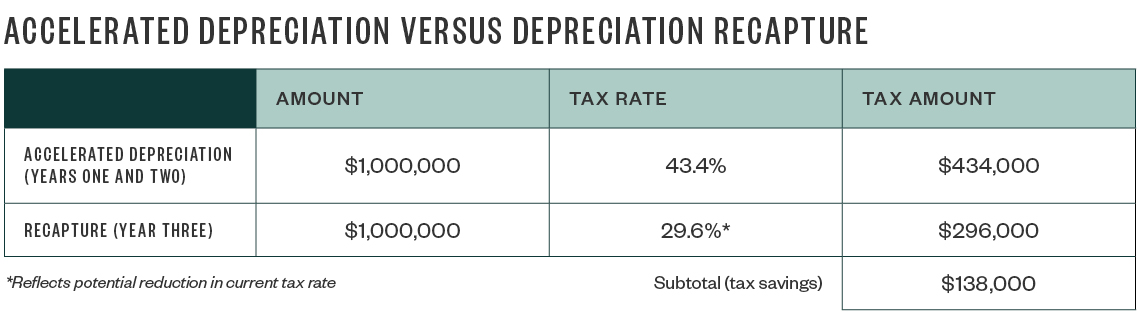

Assume an investor purchases a facility and saves $434,000 in taxes at a 43.4% tax rate through accelerated depreciation in years one and two before selling the property in year three. If reduced rates apply in year three, accelerated depreciation will be recaptured at those reduced and ordinary rates. Assuming the highest ordinary rate goes down to 29.6%, the investor will realize a permanent tax difference of 13.8%.

Ultimately, the tax implications of the sale of real property should be considered to make an informed decision about whether cost segregation represents a beneficial strategy for each unique situation.

Next Steps

Tax strategies create opportunities for businesses and individuals to defer taxes. Consider which opportunities are available while tax rates are high and opportunities are still available.

We’re Here to Help

If you have questions about how your business can benefit from these tax provisions or claim a missed deduction, contact your Moss Adams professional.