A version of this article was previously published in the July 2018 edition of the Portland Daily Journal of Commerce.

Tax reform, commonly known as the Tax Cuts and Jobs Act (TCJA), reduced the top corporate tax rate from 35% to 21% while reducing the top individual tax rate from 39.6% to 37%.

Tax reform, commonly known as the Tax Cuts and Jobs Act (TCJA), reduced the top corporate tax rate from 35% to 21% while reducing the top individual tax rate from 39.6% to 37%.

The purpose of new Internal Revenue Code Section 199A is to give comparable tax relief to owners of certain domestic trades or businesses organized as pass-through entities, such as:

- Partnerships

- LLCs

- S corporations

- Sole proprietorships

TCJA accomplishes this by providing the owners of pass-through entities with a deduction of up to 20% of their allocated qualified business income (QBI), potentially reducing the highest individual marginal tax rate of 37% to 29.6%.

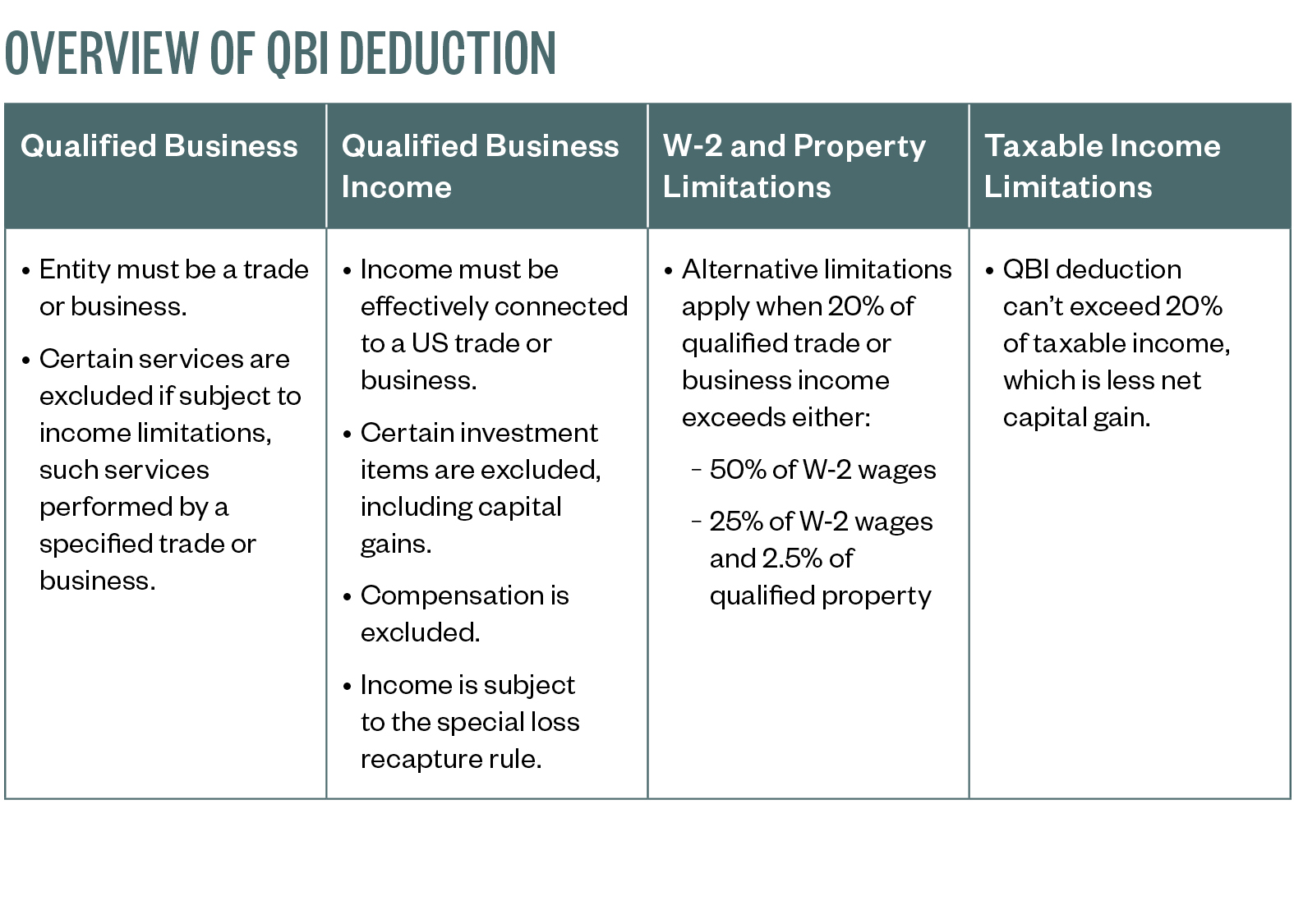

The implementation of Section 199A is quite complex and subject to a series of limitations. However, it presents a significant tax-savings opportunity for taxpayers earning qualifying income through pass-through entities.

Qualified Business Income

The QBI deduction is available to individuals, estates, and trusts that have QBI from pass-through entities for taxable years 2018 through 2025.

Under Section 199A, a qualified trade or business is any trade or business other than (a) a specified service trade or business, or (b) a trade or business involving the performance of services as an employee. A specified service trade or business includes doctors, lawyers, accountants, performing arts, athletics, financial and brokerage services, but specifically excludes engineering and architecture businesses.

While income from service businesses is initially excluded from 199A, it may qualify for the QBI deduction provided taxable income falls below certain thresholds. QBI doesn’t include wages or guaranteed payments made to an owner of an S corporation or partnership. The QBI deduction must also be calculated separately for each trade or business the taxpayer owns.

QBI-Deduction Limitations

The new QBI deduction allows owners of qualified businesses a deduction equal to 20% of their income from those qualified businesses in tax years 2018 through 2025. This deduction is equal to the lesser of:

- 20% of the taxpayer’s QBI

- 20% of the taxpayer’s taxable income less net capital gains

If taxable income before the QBI deduction is less than $157,500—$315,000 for married couples filing jointly—the QBI deduction is allowed with no limitation.

For service businesses mentioned previously, the 20% deduction is phased out with taxable income between $157,500 and $207,500—$315,000 and $415,000 for married couples filing jointly—and fully disallowed at the top of the phase-in range.

Alternative Limitations

For all other businesses, there are alternative limitations that kick in once taxable income thresholds have been surpassed: the wage limitation and the wage-plus-qualified-basis limitation.

For this calculation, compare 20% of the qualifying income or loss to the greater of the following:

- 50% of the wages paid by the business

- 25% of the wages paid by the business plus 2.5% of qualifying basis of property used in the business

The lesser amount establishes the deduction available from a particular business. This calculation is then repeated for each qualifying business owned by a taxpayer. It’s important to note losses from one business may offset the income from profitable businesses and reduce the overall amount of QBI.

Once the overall limitation is applied to calculate a tentative QBI deduction for each trade or business, they’re combined together. Taxpayers can then determine the tentative deduction for the year by adding the following to this combined amount:

- 20% of the ordinary dividends received from real-estate investment trusts

- 20% of the net income or loss from any publicly traded partnerships they own

Tax-Planning Opportunities

Tax reform brought about a substantial amount of change—and opportunity. Of that opportunity, determining how to fully benefit from the QBI deduction may present the greatest chance to reduce a company’s overall tax burden.

The following questions can help companies determine how to increase their QBI deduction:

Has your compensation structure been evaluated in a way that satisfies the QBI deduction’s wage limitation?

Consider whether the QBI deduction is limited by the business payroll expense.

Is there an opportunity to pay bonuses to satisfy the wage limitation?

Performing a reevaluation of reasonable compensation could be worthwhile, in particular with year-end planning.

How is owner compensation for services reported in your existing entity structure?

It should be noted, guaranteed payments from a partnership or LLC structure don’t qualify as wages for purposes of the QBI alternative limitation. W-2 wages paid to an owner or shareholder of an S corporation do qualify, however.

Are individuals classified as employees or independent contractors?

By making the appropriate changes to qualify an individual as an employee, companies may be eligible to increase their wages alternative limitation, and QBI deduction.

Is there an opportunity to increase deductions or spread income over multiple years?

If a company foresees its wage, property, or service-business limitations being a limiting factor, it may make sense to spread income over more than one year. This could result in taxable income falling below the limitation threshold, garnering an increased QBI deduction.

How will depreciation elections impact the QBI deduction?

With increases to allowable bonus depreciation and Section 179 expensing, businesses now have an increased opportunity to immediately write off purchased equipment—whether new or used. These elections directly impact the amount of QBI deduction.

If married, is it advantageous to file jointly?

Previously, married couples generally found it was more tax advantageous to file a joint return. With the introduction of the QBI deduction, this assumption may need to be re-evaluated.

Next Steps

The above examples show why it’s important for businesses and individuals to implement TCJA provisions into their 2018 tax planning as soon as possible. In doing so, they may discover changes that can be made to increase the QBI deduction and immediately generate 2018 tax savings.

The Treasury Department is expected to draft extensive regulations in the near future addressing a number of uncertainties related to the QBI deduction.

We’re Here to Help

For more information about how the QBI deduction could affect you or your business, visit the Moss Adams tax reform webpage.