In the summer of 2019, craft breweries continued to experience growth and may even exceed their overall growth from 2018. Despite these increases, several factors present reasons for breweries and the industry overall to be cautious looking forward.

Below, we explore notable trends for craft brewery valuations during the summer of 2019 and their impact on the industry.

Market Overview

Large Brewers

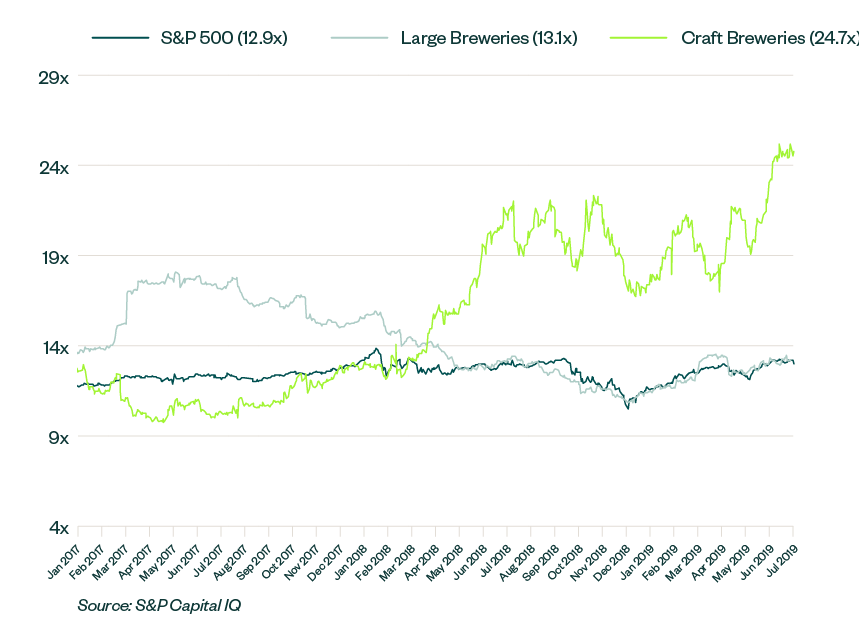

Large brewers are generally trading in line with the S&P 500 index earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples, 12.9x compared to 13.1x, while craft brewers are at 24.7x trailing EBITDA. The few remaining publicly traded craft brewers still experienced higher valuation multiples due to their substantial anticipated growth, which is driven by strong resonance with younger consumers.

Public Market Evaluations (Enterprise Value to EBITDA)

Mergers and Acquisitions

Larger regional and national craft brewers continue to look for opportunities to grow revenue and their market footprint, including considering smaller, growing breweries with strong brand presence to acquire.

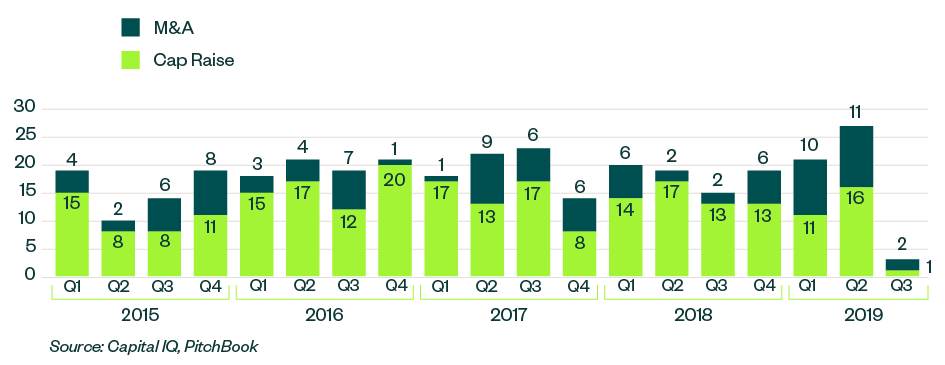

Valuation multiples for completed mergers and acquisitions (M&A) transactions, both public and private, continued to decline over the past few years as competition and distribution expansion proved more challenging.

These multiples also declined as a result of the slowing of overall industry growth and the general lack of interested buyers and investors.

Selected Activity for M&A and Financing Transactions

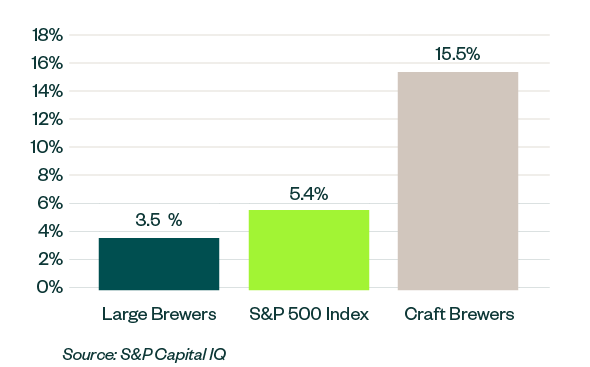

Brewery Growth

According to a recent study by the Brewers Association, some brewers are growing faster than they did in 2018. This growth, however, is often offset by other brewers losing volume more quickly. Many breweries are also seeing their previous growth turn into decline this year. While a majority of regional craft brewers also experienced growth so far this year, approximately a sixth of brewers that grew in 2018 showed a loss through June 2019.

In contrast, although there’s a wide variation in performance, microbreweries and brewpubs are generally still growing, and 2019 figures could exceed those of 2018. However, regional brewers continue to experience growth challenges as more new breweries take up more market share.

Estimated Sales Growth for Q3 2019 to Q2 2020

Additional Trends

Many breweries are looking for additional growth opportunities to broaden their appeal to increasingly fickle consumers with shifting consumption preferences. As more millennials opt for healthier and nonalcoholic options, larger brewers seek new opportunities to invest capital. Hard kombucha, hard seltzer, and nonalcohol or low-calorie beer options continue to become more prevalent across the country.

Future Outlook

Influence of New and Smaller Breweries

Brewery valuations will likely be impacted by the rate of new brewery openings, compared to closings, as well as the growth rate of smaller breweries.

While these breweries don’t represent a significant percentage of overall craft production volume, their performance could move craft beer’s overall industry growth rate up or down slightly.

Economic Uncertainty

As the broader US economy’s growth starts to slow and the possibility of a recession looms, less disposable income for consumers could impact potential beer purchases and further slow overall craft beer industry growth.

Additionally, the ongoing trade war and US tariffs imposed on various imported products is an unpredictable factor that could affect industry growth and profitability.

Investor Behavior

Investors will likely continue to largely sit on the sidelines as growth slows and more investment opportunities, such as breweries being put up for sale, arise in the industry.

Additionally, as industry challenges increase and valuations decline, investors will likely wait for more advantageous opportunities to invest, should they choose to in the craft beer industry. That being said, there will likely still be significantly increased consolidation in the coming years as industry and economical challenges persist.

We’re Here to Help

To learn more about how these trends might impact your business, contact Derek Groff at derek.groff@mossadams.com or your Moss Adams professional.