If you’re contemplating a business expansion or job retention project in Texas, it could prove beneficial to consider the Texas Enterprise Zone Program (EZP), a sales-and-use tax refund program meant to encourage private business investment, job creation, and job retention in the state’s more economically distressed areas.

In some instances, projects located outside of enterprise zones could also be approved for benefits as part of related job retention efforts.

Qualifying as an Enterprise Zone Project

A business could qualify for this tax refund on eligible items for use at the qualified business site for up to a defined amount when the:

- Community designates a business as an enterprise zone project

- Enterprise zone project’s designation is approved by the state

Below are some frequently asked questions that could apply to those looking into enterprise zones.

Who Is Eligible to Apply?

Texas communities must nominate businesses in their jurisdiction to receive an enterprise zone designation.

Upon achieving an enterprise zone designation through a competitive application process from the state, a business is then eligible to receive state sales-and-use tax refunds on qualified expenditures.

A business location outside of any designated enterprise zones could still qualify as an enterprise zone project and receive related benefits, upon approval.

Applications are accepted on a quarterly basis with deadlines falling on the first working day of March, June, September, and December.

The state of Texas allocates a limited number of projects per community. Texas has a maximum of 105 designations per biennium but only approves up to 12 designations per quarterly round, making it increasingly competitive to acquire an enterprise zone designation.

What Factors Determine an Enterprise Zone Designation?

Businesses must ensure that they meet minimum capital investment thresholds and create or retain jobs that employ a certain percentage of economically disadvantaged individuals and enterprise zone residents.

Applications are scored based on a variety of factors, including:

- Economic distress characteristics of the immediate geographic area

- Local efforts aimed at achieving development and revitalization of the community

- Private effort based on type and wage levels of the jobs created or retained

- Commitment level to the revitalization goals of all communities within the jurisdiction of the nominating community

What Are the Business Requirements to Qualify for the EZP?

Some of the basic business qualifications for EZP status include:

- Meeting minimum capital investment thresholds

- Creating and retaining jobs

- If the project is located within a designated enterprise zone, 25% of employees must be economically disadvantaged or residents of the zone.

- If the project is located outside of a designated enterprise zone, 35% of employees must be economically disadvantaged or residents of the zone.

What Are the Types of Texas Enterprise Zone Projects?

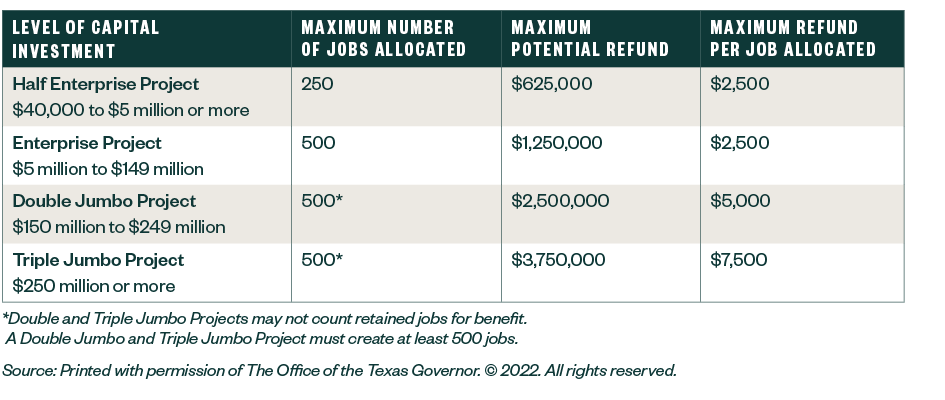

There are four types of projects:

- Half enterprise projects

- Enterprise projects

- Double jumbo projects

- Triple jumbo projects

Each requires varying levels of capital investment with a maximum number of jobs allocated, maximum potential refund, and maximum refund per job allocated. The qualifying factors of each are outlined below.

Jobs must be maintained through the end of the enterprise zone designation period, or for at least three years after the date on which tax benefits are received, whichever is later.

What Are the Incentives for Building in an Enterprise Zone?

The state’s sales-and-use tax credit refund is the main incentive for building in an enterprise zone.

The maximum allowable refund of state sales and use tax, both total and per-job, is awarded based on the organization’s planned capital investment and job retention or creation at the site. The maximum refund per job is between $2,500 and $7,500 depending on the level of investment made by the company.

An enterprise project designation is valid for up to five years, in addition to a 90-day window prior to the quarterly deadline application and designation date. Employment and capital investment commitments must be incurred and met within the 90-day window through the designated expiration date.

There’s a nonrefundable fee for consideration of an enterprise project, ranging from $500 to $2,250 depending on the proposed project status. Enterprise zones will be assessed 3% on the amount of any refund benefit that’s received under the state enterprise zone program.

Looking for Enterprise Zones in Texas?

Whether or not your current or future location is within or outside of an enterprise zone, you can work with a local community to secure enterprise zone benefits. This process can be complex, but in simple terms, you will be required to:

- Obtain the support of your local community to designate the project as an enterprise zone project

- Complete a Texas enterprise zone application

- Work with local government to draft a nominating ordinance and resolution

- Receive an enterprise zone project designation by the state

- Meet compliance obligations to monetize enterprise zone benefits

We’re Here to Help

Enterprise zones, which are also available in other states such as Oregon, can provide businesses with expansion opportunities through new tax strategies.

Contact your Moss Adams professional if you have questions about enterprise zones, specifically site selection projects or how to align your business expansion strategy with incentives such as enterprise zone benefits.

You can also find additional resources with our Tax Credits & Incentives Services.