Providing extended time off and support for your employees to focus on their health and family may be part of your business culture, but it could also help you increase your cash flow and reduce federal income tax liability.

Businesses that voluntarily provide a paid family and medical leave benefit to employees could be eligible for the employer-paid family and medical leave tax credit—IRC Section 45S—a nonrefundable credit that may be used to offset federal income tax.

Determining your eligibility and accurately calculating and claiming the credit can be a complex process. Confidently pursue the credit and put money back into your business with guidance from our professionals.

Eligibility and Savings Overview

To claim the credit, your business and employees who take advantage of paid leave must meet certain requirements.

Business Criteria

Your organization must have policies in place that provide a minimum of:

- Two weeks paid family and medical leave—not including state or federal paid or mandated Family Medical Leave Act (FMLA) leave

- Paid leave—not including vacation, personal, or sick time—of at least 50% of an employee’s normal wages or salary

Policies must also include leave that covers one or more of the following:

- Birth of a child

- Adoption or fostering of a child

- Care for a spouse or family member with a serious health condition

- Employee’s own serious health condition

- Spouses and family member of certain active military members

Employee Criteria

Employees who use leave programs must meet at least the following criteria:

- Employed at least one year at time of leave

- Receive annual compensation less than 60% of the threshold for a highly compensated employee

- Take leave during any tax year through December 31, 2025

Potential Savings

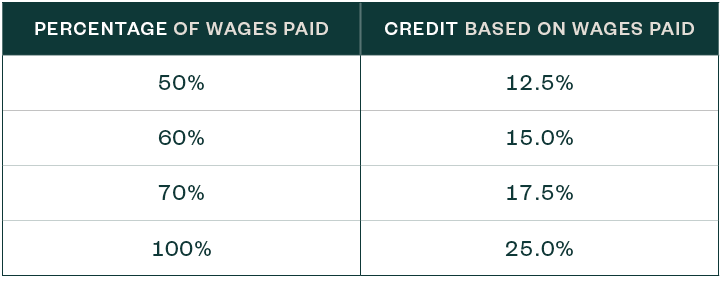

Credit calculations are based on the percent of wages paid during family and medical leave and can’t be calculated with the same wages used to calculate another general business credit.

Depending on the percent of wages your business pays during an employee’s leave, you may be eligible for the following credit amounts.

How to Claim Your Credit

Using the industry-leading digital tool MaxCredits®, we’ll determine your company’s eligibility and guide you through each step of the claims process including:

- Documentation Collection. By reviewing your payroll and other documents, we’ll determine each employee’s eligibility and identify wage limitations.

- Final Report Summary. You’ll receive an in-depth report detailing opportunities to claim the credit and an appropriate schedule for submissions.