Real estate developers and homebuilders who want to reduce their tax burden, and contribute to a greener future in the process, should consider an Internal Revenue Code (IRC) Section 45L tax credit. The following will provide an overview of the credit, its value, eligibility requirements, and the certification process.

What Is the Section 45L Tax Credit?

The Section 45L tax credit rewards developers and homebuilders who construct or renovate single family homes, multifamily properties, and manufactured homes that meet the minimum energy-efficiency standards prescribed by ENERGY STAR.

Section 45L of the IRC went into effect in 2006 to incentivize new construction or substantial renovation of energy-efficient single-family homes and multifamily properties.

The Inflation Reduction Act of 2022 implemented significant changes to the Section 45L tax credit.

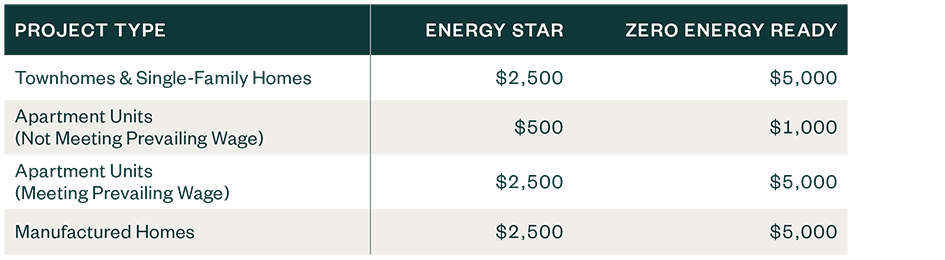

Effective January 1, 2023, the Section 45L tax credit is available to homebuilders and developers through 2032. The credit ranges from $500 to $5,000, per residential dwelling unit, based on the following criteria:

- Type of development

- Applicable ENERGY STAR program

- Paid or unpaid prevailing wage labor rates—there’s no apprenticeship requirement

Section 45L tax credits may be pursued for projects with lease-up or sales before January 1, 2023, with amended tax return filings. Energy efficiency testing for units acquired prior to January 1, 2023, are modeled using IECC 2006 standards and not ENERGY STAR.

When Is the Section 45L Tax Credit Claimed?

The credit is claimed when the residential units are first sold or leased to another party for use as a residence. The placed-in-service date of the residential units doesn’t impact the tax year the credit can be claimed.

Section 45L Tax Credit Benefits

The tax credit reduces tax liability dollar for dollar, and can be applied in conjunction with other income tax deferral strategies for new construction projects, such as cost segregation or the Section 179D tax deduction.

Section 45L Tax Credit Per Unit Through 2032

Eligibility Criteria, Considerations, and Process

Eligible Parties

To qualify for Section 45L tax credits, you must pay for, or have basis in, the construction of a residential property located in the United States and sell or lease the units to an unrelated party for use as a residence.

Consult a tax professional to determine whether the credits may be utilized. In some cases, loss situations and alternative minimum tax issues can limit the use of the credit. Section 45L is classified as a general business credit and is nonrefundable. The ability to utilize a generated credit in a different tax year is subject to carryback and carryforward provisions in place for general business credits.

Initial Assessment

During the design phase, assess if the as-designed features meet minimum ENERGY STAR or Zero Energy Ready requirements as a part of the ENERGY STAR single-family or multifamily programs.

Generally, a provider can help you assess this by reviewing design drawings and specifications. In many areas of the country, current building codes conveniently align with the standards set forth in the ENERGY STAR programs. The credit is also available for manufactured homes.

ENERGY STAR Certification

Prescriptive compliance paths set forth by ENERGY STAR’s single-family and multifamily new construction programs must be followed to certify the units for the credit. These compliance paths include the following:

- Builder registrations

- Construction checklists

- Inspections

- Energy modeling

- Submittals for certification

As part of the inspection requirements, an inspection must be completed during construction, just before drywall is hung on interior walls. An additional inspection is needed upon completion of construction.

Claiming the Section 45L Tax Credit

Form 8908 is used to quantify and report the credits with your federal tax return filing. Further, the property’s basis must be reduced by the amount of the credit claimed, increasing taxable gain on sale, or reducing basis available for depreciation losses. This basis reduction doesn’t apply to projects pursuing the low-income housing tax credit under Section 42 when determining the adjusted basis.

It is important to work with a tax professional that understands your specific tax situation to help address utilization and that you meet the eligibility and documentation requirements of Section 45L.

With the Section 45L tax credit and ENERGY STAR, you can save money while contributing to a more sustainable future.

What Happens if Units Are Sold or Leased in Two Separate Tax Years?

The tax credits generated in a situation such as this can be illustrated using the following example:

A 200-unit apartment complex completed in 2023 has 125 units that were first leased during the developer’s same tax year.

The remaining 75 units were leased in tax year 2024. Prevailing wages for laborers on the construction project were not paid.

An analysis of all 200 units achieved an ENERGY STAR for Multifamily New Construction certification, which results in a $500 per unit Section 45L tax credit.

This generates a Section 45L tax credit of $62,500 for the developer in tax year 2023. The 75 units leased in 2024 yield a tax credit of $37,500 for tax year 2024.

We’re Here to Help

For questions about how your organization can benefit from the Section 45L tax credit, contact your Moss Adams professional.

Additional Resources