This tax year is a good time to start planning charitable giving.

The tax benefit of charitable giving could vary substantially, depending on the techniques used and the impacts of tax code changes. Below, we’ll analyze and compare two popular methods of giving. This will help you determine tax impact so you could capitalize on the tax benefit.

What Are the Most Popular Methods of Tax-Efficient Charitable Giving?

Charitable giving usually involves cash because it’s the simplest approach; however, it could be an inefficient means of giving from a tax perspective. The best approach starts with talking with your tax and financial advisor team about what will work best for you.

There are multiple options for giving assets, including gifts of appreciated securities, qualified distributions from your IRA, and charitable trusts. Knowing about your charitable giving vehicle options could help you give even more tax efficiently.

The two most popular charitable giving vehicles are donor-advised funds (DAFs) and private foundations.

What Is a Donor-Advised Fund?

DAFs let you gift cash, appreciated securities, and other appreciated assets to the charitable organization. The fund then gifts the value of your gifts, over a time period, to the charitable organizations you designate.

DAFs can be useful if you want to make a contribution, and need a current-year tax deduction, but you’d like time to decide where the money will go. You can make a gift now, and the DAF holds the assets until you’re ready to distribute to a charity.

However, it’s important to remember, most sponsoring organizations of DAFs have a time limit as to how long you can go without making a charitable distribution, and a DAF requires giving to be to a 501(c)(3) public charity such as American Red Cross, houses of worship, and educational institutions.

Potential changes are underway as part of a bipartisan bill introduced to Congress, the Accelerated Charitable Efforts Act (ACE Act) to set time frames for distributions from DAFs.

What Is a Private Foundation?

A private foundation is a not-for-profit organization generally created by a single, primary donation from an individual or a business whose funds programs are managed by its trustees or directors.

A private foundation gives the donor much more control than a DAF. A private foundation can hire and compensate staff, including family members of the primary donor, and the organization’s board has full control over grant making.

For example, a private foundation may make grants directly to individuals facing hardships and emergencies, such as victims of hurricanes or wildfires.

You can find an overview of private foundations here. If you’d like to understand the difference between a private foundation and a public charity, please read our article.

Can a Donor-Advised Fund Give to a Private Foundation?

Assets held in a DAF are meant to be granted to a public charity. Unlike a private foundation, a DAF doesn’t need to distribute any funds. When it does, the DAF must make its grants to another public charity.

Therefore, a DAF can’t make gifts to split-interest trusts, such as charitable remainder trusts or a chartable lead trust, nor can a DAF make contributions to a private nonoperating foundation—although a private operating foundation gift is permissible.

A private foundation can grant to a DAF but with some limitations. The proposed bill would add an additional restriction by requiring DAFs distribute the funds to a public charity within the same year.

Donor-Advised Funds Versus Private Foundations

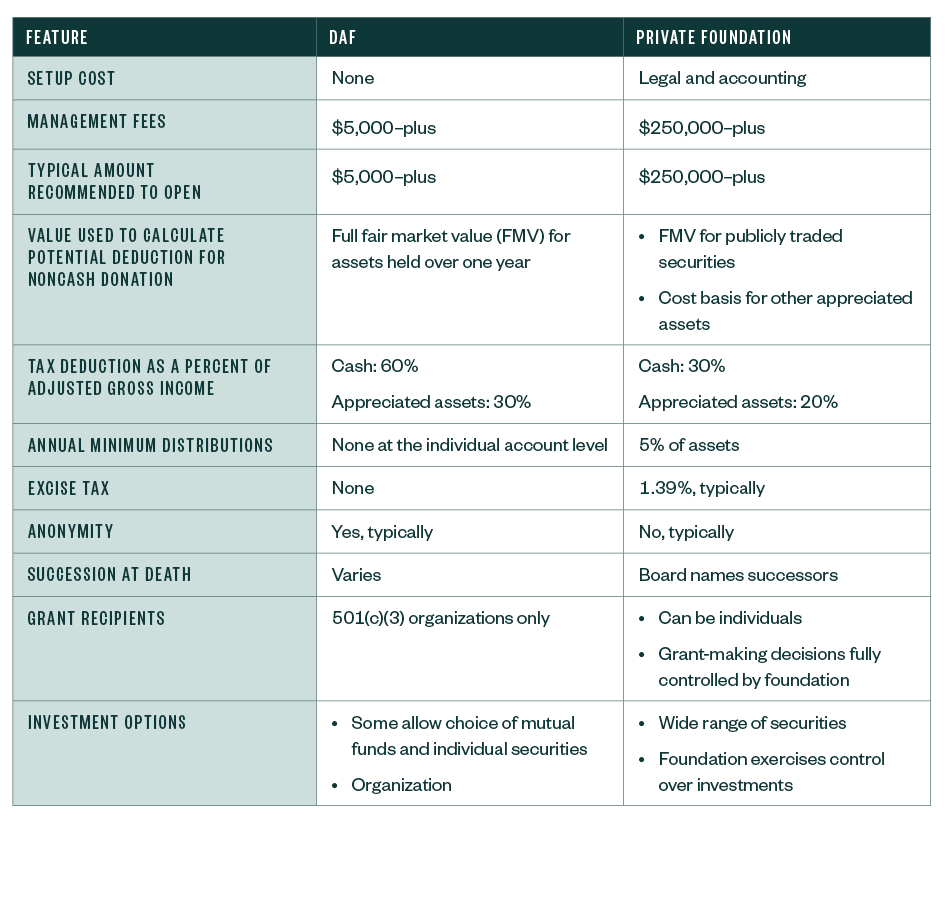

There are some important differences between DAFs and private foundations. The rules are complex and outcomes can vary, but the table below shows typical differences.

We’re Here to Help

If you have any questions about your year-end charitable giving, please contact your Moss Adams professional.