How the R&D Credit Can Help New Companies Offset Payroll Taxes

New businesses and start-up companies may be eligible to apply the R&D tax credit against their payroll taxes for up to five years.

The R&D credit was permanently extended as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015. The bill included enhancements starting in 2016, including offsets to the alternative minimum tax and payroll tax for eligible businesses.

While the credit used to offset payroll taxes is based on eligible R&D expenses, it only applies to costs incurred after the bill was signed into law. The maximum benefit an eligible company can claim against payroll taxes each year under the PATH Act is $250,000 annually until December 31, 2022, after that the Inflation Reduction Act increased the election to $500,000.

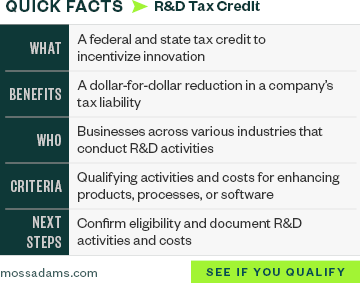

The R&D Payroll Tax at a Glance infographic serves as a quick reference to help simplify the process of determining eligibility and applying the credit. To gain some clarity around common misconceptions about the R&D tax credit, please see our article.

Below, get answers to the most common questions about how the R&D tax credit can be applied against payroll taxes:

- When Does the Payroll-Tax Offset Take Effect?

- How Quickly Does a Company Need to Get Started?

- Which Companies Qualify for the Payroll-Tax Offset?

- Which Companies Qualify as Having Gross Receipts for Five Years or Fewer?

- How Is $5 Million in Gross Receipts Defined?

- What Are Some Examples of Qualifying Activities for the R&D Tax Credit?

- What Are Eligible R&D Expenditures?

- What Are Some Potential Benefits of the Payroll-Tax Offset?

- Are There Risks to When Claiming the R&D Credit?

- What Documentation Is Required to Claim the R&D Credit?

- Can Proper Documentation Assist Companies’ Financial Statement Reporting per FASB ASC Subtopic 740-10?

When Does the Payroll-Tax Offset Take Effect?

The payroll-tax offset is currently available for qualified expenses incurred during the prior tax year. The R&D credit must be calculated and shown on a taxpayer’s federal income tax return with the portion of the credit applied to offset payroll taxes identified and elected when the return is filed.

The additional $250,000 would be used to offset the employer paid Medicare payroll tax of 1.45% each calendar quarter. The R&D payroll tax credit attributable to the employer paid Medicare tax must not exceed the tax imposed. Any unused R&D credits will be carried forward and applied to a succeeding calendar quarter as a credit.

The offset is then available on a quarterly basis beginning in the first calendar quarter after a taxpayer files their federal income tax return.

For example, taxpayers need to file their 2022 federal income tax return by June 30, 2023, to apply the payroll-tax offset to the third quarter. As a result, the earliest taxpayers are likely to see a benefit is October 2023 when they file their quarterly payroll tax return for the third quarter.

How Quickly Does a Company Need to Get Started?

The current opportunity to offset payroll taxes is based on expenses from the prior tax year, so it’s important to start planning—companies can benefit from acting quickly to determine their eligibility under the new rules. This will help companies understand which types of information they’ll need to be gathered at the end of the year.

The R&D credit must be specified, elected, and filed in the original tax return before it can be used to offset payroll taxes. Under the current rules, taxpayers can’t file for the credit on an amended return.

Which Companies Qualify for the Payroll-Tax Offset?

The payroll-tax offset allows companies to receive a benefit for research activities even if they aren’t profitable.

To be eligible for the credit, companies must meet the following qualifications:

- Have gross receipts for five years or fewer—interest income counts toward gross receipts

- Accumulate less than $5 million in gross receipts in the year the credit is elected

- Conduct qualifying research activities and expenditures

- Determine they have payroll-tax liability

Which Companies Qualify as Having Gross Receipts for Five Years or Fewer?

Companies aren’t eligible if they generated gross receipts prior to 2016. However, companies that existed prior to 2016 but didn’t receive gross receipts could still qualify.

Although the law is intended to benefit small businesses, larger businesses could potentially still profit. For example, a significant percentage of life sciences companies don’t have gross receipts for long periods of time because they’re waiting for their drug to receive approval from the US Food and Drug Administration.

How Is $5 Million in Gross Receipts Defined?

A company must have less than $5 million in annual gross receipts to be eligible. For new businesses, the gross receipts must fall under the $5 million limit after being annualized for a full 12 months. For businesses that are related or share common ownership, the gross receipts need to be calculated on a combined basis for purposes of determining eligibility under this provision.

The IRS issued interim guidance on the definition of gross receipts in March 2017. In the guidance, the IRS confirmed gross receipts include the following:

- Total sales—defined as the net of returns and allowances

- All amounts received for services

- Income from investments, including interest income

Although the gross-receipts limitation helps define a company’s eligibility for the credit, it’s important to note the R&D credit itself isn’t based on gross receipts. The actual credit is based on the company’s eligible R&D expenses.

What Are Some Examples of Qualifying Activities for the R&D Tax Credit?

Regardless of industry, companies are potentially eligible for the R&D credit if their activities meet the following requirements, known as the four-part test:

- Technical uncertainty. The activity is performed to eliminate technical uncertainty about the development or improvement of a product or process, which includes computer software, techniques, formulas, and inventions.

- Process of experimentation. The activities include some process of experimentation undertaken to eliminate or resolve a technical uncertainty. This process involves an evaluation of alternative solutions or approaches and is performed through modeling, simulation, systematic trial and error, or other methods.

- Technological in nature. The process of experimentation relies on the hard sciences, such as engineering, physics, chemistry, biology, or computer science.

- Qualified purpose. The purpose of the activity must be to create a new or improved product or process, including computer software, that results in increased performance, function, reliability, or quality.

Additional thresholds may apply if a company develops software for internal use. Additionally, activities must be performed in the United States and can’t be funded by another party.

For more information on company qualifications, please see our guide—Claiming the Federal R&D Tax Credit.

What Are Eligible R&D Expenditures?

Eligible R&D costs include:

- Wages. W-2 taxable wages for employees offering direct support and first-level research supervision.

- Supplies. Supplies used in research, including so-called extraordinary utilities but not capital items or general administrative supplies.

- Contract research. Certain subcontractor expenses if the subcontractor’s tasks qualify when performed by an employee. These can include labor, services, or research, but payment can’t be contingent on results. In addition, the taxpayer must retain substantial rights in the results, whether exclusive or shared.

- Computer rental or lease costs. This could include payments made to cloud service providers for the cost of renting server space, as longs as payments are related to hosting software under development versus payments for hosting a stable software release.

What Are Some Potential Benefits of the Payroll-Tax Offset?

Brand-new businesses can potentially claim the credit for up to five years with a maximum of $2.5 million in total credits claimed on their quarterly federal payroll tax returns.

New businesses and start-up companies will likely see a benefit up to 10% of their eligible R&D costs. For most companies that incur at least $300,000 in eligible R&D costs, the federal credit to offset payroll tax will be equal to 10% of total R&D expenses.

For example, a company with $500,000 of eligible expenses—let’s say engineering costs—could receive a $50,000 credit. On the other hand, a company with over $2.5 million in eligible expenses in 2022 could receive a credit equal to the full $250,000 annual limitation.

If the amount of the credit exceeds a company’s Social Security tax liability—also known as the Old Age, Survivors, and Disability Insurance (OASDI) tax—in any given quarter, the excess can be carried forward to the next calendar quarter.

Social Security Tax

The payroll-tax offset can only be applied to the Social Security portion of payroll taxes. Companies are required to pay Social Security tax of 6.2% on up to $137,700 of each employee’s salary. For example, a company that employs 50 employees with an average salary of $75,000 would pay approximately $232,500 in Social Security payroll taxes.

Accordingly, a company would need to have more than $4 million in annual payroll subject to Social Security tax and $2.5 million in eligible R&D costs to offset the maximum $250,000 in payroll taxes each year under the new law.

Are There Risks When Claiming the R&D Credit?

Most employers are required to deposit their payroll taxes to the federal government on a monthly or semiweekly basis as well as file a payroll tax return via Form 941 at the end of each quarter. In some cases, the credit may be applied against payroll taxes on a monthly or semiweekly basis rather than waiting until the end of each quarter to get a refund.

Once a company starts using this credit, it receives a much higher level of scrutiny from the IRS. R&D credits are often a high priority for the IRS, which assembles industry-specific project teams with technical specialists that assist in reviewing R&D credit claims.

Even at the small business level, it’s common for IRS technical specialists to be involved in R&D credit examinations. In general, however, larger credits receive more scrutiny from the IRS and often require more review and documentation.

Although many companies in the technology industry are likely engaged in activities that would otherwise be eligible for R&D credits, the rules surrounding the credit are complex and always changing. New legislation, regulations, court cases, and IRS guidelines have drastically shifted the landscape of R&D tax law and will continue to do so in the future.

Considering these complexities and potential financial penalties, companies can benefit from having their activities analyzed by a CPA, attorney, or enrolled agent familiar with the tax law and accounting rules that govern the R&D credit as well as the IRS examination and appeals process.

To deter companies from claiming credits without the proper level of review and documentation, the IRS can impose significant penalties. Failure to pay the proper amount of payroll tax may also result in trust fund recovery penalties, which can include a 100% penalty and personal liability for the amounts due.

What Documentation Is Required to Claim the R&D Credit?

It’s important for companies to have the right documentation in place. It’s also key to know there isn’t a one-size-fits-all approach to documentation.

The adequate level of documentation varies based on the size and scope of the claimed credit amounts.

Companies should expect a greater time commitment in the first year when they’re getting set up to claim an R&D credit. They’ll also need to put appropriate measures in place to completely use the credit going forward.

Depending on the company, it’s possible any historic R&D spending incurred may need to be evaluated.

Proving Nexus

Taxpayers often will need to provide a nexus between their R&D expenses and qualified research activities. This can be challenging—even for companies that have some level of project tracking in place. This is because time- and expense-tracking systems aren’t generally intended to track eligible R&D expense to business components or R&D activities.

The subjectivity and interpretation of R&D rules make it difficult to develop the perfect software tool for tracking eligible expenses and documentation, particularly when considering annual updates to tax law, regulations, and IRS guidance. For this reason, it’s important to note that while project-accounting and time-tracking systems aren’t prerequisites to claiming the R&D credit, implementing them can supply important insight into your company’s activities.

Meeting the Four-Part Test

At minimum, taxpayers’ qualitative documentation should demonstrate how their underlying activities meet the four-part test. Examples of adequate documentation can vary by industry, but it’s possible for companies to leverage documentation they generate in their day-to-day operations. Qualitative documentation may also require review and analysis of any contracts between companies and their customers, partners, or vendors.

Taxpayers that have some level of familiarity with the R&D credit should carefully evaluate their methodology and documentation standards with respect to R&D credits being used under the new rules.

Additional Industry-Specific Guidance

Companies in the software and pharmaceutical industries especially can benefit from reviewing the IRS audit guidelines applicable to their industries. These are available on the IRS website:

- Audit Guidelines on the Application of the Process of Experimentation for All Software

- Pharmaceutical Industry Research Credit Audit Guidelines

We’ve also prepared industry-specific articles about the R&D tax credit:

- Aerospace

- Agribusiness

- Construction

- Food & Beverage

- Forest Products

- Industrial Hemp & CBD

- Oil & Gas

- Software Companies

- Spirits

- Technology Companies

- Vineyards & Wineries

The payroll-tax offset is available to eligible new businesses and start-up companies for up to five years. Any unused R&D credits that aren’t elected to offset payroll taxes may be carried forward for up to 20 years and used when the business becomes profitable. This length of time makes thorough documentation even more important.

Can Proper Documentation Assist a Company’s Financial Statement Reporting for FASB ASC Subtopic 740-10?

Financial Accounting Standards Board (FASB) accounting standards codification (ASC) Subtopic 740-10 specifies a tax position won’t be recognized in a company’s financial statements unless it’s likely the position will be sustained upon examination.

All public companies and entities adhering to US generally accepted accounting principles are required to analyze and disclose uncertain tax positions on their financial statements. Many corporations are also required to report those positions on their federal income tax return.

For public companies and companies with audited financial statements, the rules surrounding how R&D credits are recognized on their financial statements can be very complex and subjective. These credits often receive a high level of scrutiny from lenders, investors, and financial statement auditors, especially when a company hasn’t performed an R&D study for management to use in their decision-making processes.

Many unprofitable companies claim R&D credits every year with little support and without fully considering the risk of an audit by taxing authorities. With the help of specialists, these companies can generate more certainty around their credits and assist management with R&D-credit decision-making processes.

To learn more, please read our article, 3 Key Attributes to Look for in an R&D Tax Credit Service Provider.

We’re Here to Help

To learn more about the R&D payroll-tax offset, whether your business qualifies, or our other R&D tax services, go to our R&D Tax Credit Spotlight and contact your Moss Adams professional.