In August 2014, the Financial Accounting Standard Board (FASB) issued an update that introduces a new requirement in generally accepted accounting principles (GAAP) for management to assess, at each interim and annual reporting period, an entity’s ability to continue as a going concern and to provide related disclosures in certain circumstances.

In August 2014, the Financial Accounting Standard Board (FASB) issued an update that introduces a new requirement in generally accepted accounting principles (GAAP) for management to assess, at each interim and annual reporting period, an entity’s ability to continue as a going concern and to provide related disclosures in certain circumstances.

Accounting Standards Update (ASU) No. 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern is effective for all annual periods ending after December 15, 2016, and interim periods within annual periods beginning after December 15, 2016.

The standard clarifies that substantial doubt about an entity’s ability to continue as a going concern exists when conditions and events, considered in the aggregate, indicate it’s probable that the entity will be unable to meet its obligations as they become due within one year after the date the financial statements are issued or are available to be issued, which we’ll refer to as “issued” for the purposes of this article.

The term probable—meaning the future event or events are likely to occur, according to the FASB—is consistent with its use in Topic 450, Contingencies.

This Insight outlines what companies need to consider when adopting the standard:

- Evaluation of conditions and events

- Evaluation of management’s plans

- Disclosures

Following is a closer look at each of these categories.

Evaluation of Conditions and Events

Management should perform an evaluation of whether there are conditions and events that raise substantial doubt about an entity’s ability to continue as a going concern. This is done in connection with preparing financial statements for each annual and interim reporting period. It should be based on relevant conditions and events that are known or reasonably knowable at the date the financial statements are issued.

When making the initial evaluation, management should consider information about each of the following conditions and events, among other relevant conditions, that are known or reasonably knowable at the date the financial statements are issued:

- The entity’s current financial condition, including its current liquid resources (for example, available cash or available access to credit)

- Conditional and unconditional obligations that are due or anticipated to be due within one year following the issuance of the entity’s financial statements (whether or not they’re recognized in the entity’s financial statements)

- Funds necessary to maintain operations considering the entity’s current financial condition, obligations, and other expected cash flows within one year after the financial statements are issued

- Negative financial trends. This includes recurring operating losses, working capital deficiencies, negative operating cash flows, or other adverse key financial ratios.

- Possible financial difficulties. Indications might be a failure of a financial covenant, default on loans, being denied supplier credit, needing to restructure debt or seek new debt, noncompliance with statutory capital requirements, or needing to dispose of substantial assets.

- Internal matters. Examples of this include labor difficulties, substantial dependence on the success of a project, uneconomic long-term commitments, or a need to significantly revise operations.

- External matters. Indicators might include significant litigation, loss of a key customer, franchise, license, patent or supplier, or an uninsured natural disaster.

In some cases, plans intended to mitigate adverse conditions or events may already be formally approved by the appropriate level of management or the board of directors; however, management’s initial assessment is precluded from consideration of the effects of such plans unless the plans have been fully implemented as of the date that the financial statements are issued.

Evaluation of Management's Plans

When relevant conditions or events indicate substantial doubt about an entity’s ability to continue as a going concern, management should evaluate whether plans intended to mitigate those conditions and events will alleviate substantial doubt when implemented based on the available information at the date the financial statements are issued.

Management’s plans may include activities such as completing an equity or debt financing, restructuring existing debt, reducing or delaying expenditures, or selling a significant asset or component of the business.

Plans should only be considered to the extent the available information indicates both of the following:

- It’s probable that management’s plans will be effectively implemented within one year after the financial statements are issued.

- It’s probable that management’s plans, when implemented, will mitigate the conditions or events that raise substantial doubt.

Management determines that substantial doubt is alleviated when it’s probable their plans will both be effectively implemented and mitigate the relevant conditions or events.

To determine whether the plans will be effectively implemented, management should evaluate the feasibility of the plans in light of the entity’s specific facts and circumstances. Generally, to be considered probable of being effectively implemented, plans must be approved by management or others with the appropriate authority before the date the financial statements are issued.

Management should further assess whether it’s probable that the plans will mitigate the conditions or events that raise substantial doubt. It should consider the expected magnitude and timing of the mitigating effect of the plans in relation to the magnitude and timing of the relevant conditions or events that those plans intend to mitigate.

Disclosures

No disclosures are required when management concludes that substantial doubt isn’t raised based on their initial evaluation of relevant conditions and events, prior to consideration of potential mitigating effects of management’s plans that aren’t fully implemented.

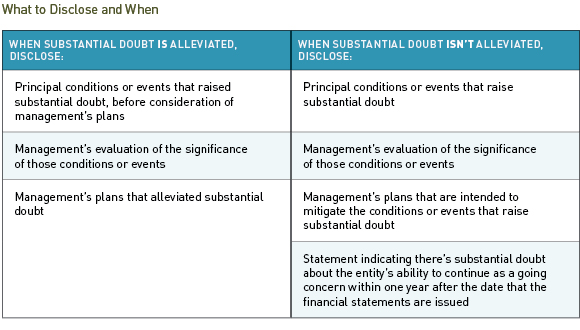

However, disclosures are required when conditions or events indicate there’s substantial doubt about an entity’s ability to continue as a going concern, including when management has determined its plans alleviate substantial doubt. The following disclosures are required depending on whether or not that substantial doubt is alleviated by management’s plans.

Disclosures should become more extensive in subsequent reporting periods as additional information becomes available and should explain how conditions or events have changed. When substantial doubt was determined to exist in a prior period but no longer exists in the current period, the entity should disclose how the relevant conditions or events that previously raised substantial doubt were resolved.

What's Next

The level of depth and thoroughness of management’s going concern evaluation should correspond to the specific circumstances and presence of adverse risk factors. Regardless of the presence of adverse factors, however, GAAP now requires all entities to perform such an evaluation.

Generally, the evaluation will require less effort and less documentation when an entity has a history of profitable operations, ready access to sufficient financial resources, and no other significant adverse conditions exist as opposed to an entity with one or more adverse conditions or events present.

Documentation

Management’s documentation of its going concern evaluation should be specific and include the factors considered and the following when applicable:

- Conditions and events, both positive and negative, relevant to the entity’s ability to continue as a going concern.

- Evaluation as to whether the conditions and events give rise to substantial doubt about the entity’s ability to continue as a going concern.

- Management’s specific plans to mitigate relevant conditions and events when substantial doubt is initially identified. Factors considered in management’s specific plans include the ability to effectively implement the plans and the range of possible outcomes.

- Conclusion as to the probability that the identified plans will be effectively implemented and that they’ll mitigate the relevant conditions or events that initially gave rise to substantial doubt.

- Consideration of required disclosures based on the conclusions reached.

Processes and Controls

In conjunction with the adoption of the new accounting standard, entities should also implement processes and internal controls over management’s periodic evaluation.

When designing processes and controls, management should take into account the relevant negative and positive conditions and events that exist and vary the nature and extent of the internal controls accordingly. Entities with more negative conditions and events will likely need to identify and implement more relevant controls than entities with fewer negative conditions and events.

The relevant controls are likely to include management review controls. Therefore, management should implement controls that are appropriately precise and include a review by individuals with the necessary authority and competence. Information prepared by the entity that’s used in the management review controls should also be designed to ensure that the information is complete and accurate.

Entities may be able to make incremental changes to existing internal controls to achieve these objectives instead of adding new controls.

We're Here to Help

To better understand how this new standard could impact your financial reporting, contact your Moss Adams professional. A going concern evaluation checklist and decision flowchart for ASC 205-40-55-1 are also available for management to consider when performing its evaluation of an entity’s ability to continue as a going concern.

|

|