Publicly traded companies have many options when selecting a professional to assist with fair value measurements. However, because they may not deal with these issues every day, many CFOs don’t know what they should expect from the professionals they engage and, as a result, often can’t evaluate the level of service they receive.

This can result in working arrangements with professionals who don’t have adequate fair value expertise, potentially causing additional work for the CFO and their team, general frustration, and a significant deficiency or material weakness reported by the auditor.

While there’s no exact answer for selecting a valuation professional to assist with fair value estimates, there are traits to look for that can improve a company’s chances of developing and reporting reasonable, consistent, and reliable results.

Below are five key characteristics CFOs should expect from a valuation professional conducting a fair value measurement for their company.

To learn more about protecting personal finances, preparing for due diligence, or other valuations considerations, see our related articles.

1. Adherence to Fair Value Standards

Fair value standards are part of US generally accepted accounting principles (GAAP), which are continuously revised in attempts to remain relevant to the speed of business.

Recently, under GAAP, the Financial Accounting Standards Board revised accounting standards for revenue recognition, lease accounting, and financial instruments—affecting virtually all companies in the United States, no matter their size or whether they’re public or private.

The Certified in Entity and Intangible ValuationsTM (CEIVTM) Mandatory Performance Framework, issued in 2017, outlines not only how to perform the valuation, but also the documentation requirements professionals must use to support the inputs required by the model’s valuation.

Miss any of these important steps, and a control issue may rear its head.

Valuation professionals must be vigilant in maintaining a strong working knowledge of GAAP and the standards that directly affect fair value estimates to be able to provide a reasonable and supportable fair value estimate.

2. Active Participation in Standard-Setting Organizations

Companies stand to benefit from working with professionals who are leaders and participants in standard-setting organizations, such as the American Institute of CPAs (AICPA), and professional groups, such as The Appraisal Foundation’s Appraisal Issues Task Force (AITF).

The AICPA sets ethical and auditing standards for the accounting profession and develops the CPA exam. The AITF provides expertise for accounting standard-setters and regulators to use in the development of new accounting standards and valuation approaches.

The newest guidelines set by the AICPA and regulators inevitably require interpretation. As such, working with a valuation professional who’s involved with these professional organizations makes it more likely a company will receive a fair value estimate that complies to current standards—making it both reviewable by an audit firm and repeatable.

3. Strong Referral Source

CFOs often select their top choice in accounting firms to provide audit services, but independence requirements prohibit an auditor from conducting the following services:

- Actuarial

- Enterprise resource planning system selection

- Internal audit

- IT

- Sarbanes-Oxley Act, also known as SOX, compliance

- Valuations

Although independence concerns prevent an auditor from conducting fair value measurements for their clients, an auditor can often refer a valuation professional whose work they’ve successfully reviewed—and who may come from a competing firm—knowing they will provide a high level of service and expertise.

Because a referral from an auditor puts their firm’s reputation in play, a company can usually expect good work from a referred source.

Independent valuation professionals can find it challenging to stay current on evolving GAAP standards as they relate to fair value. As such, CFOs stand to benefit from obtaining feedback from their auditor about the auditor’s past experiences with firms that provide fair value work.

4. More Partner Attention

Companies should expect a partner to invest in their relationship and not immediately pass a fair value assignment to a junior analyst.

Unfortunately, after committing to this type of work, sometimes the partner, director, or senior manager who began the relationship may disappear and assign it to someone more junior—someone whose time isn’t perceived to be as valuable, or who’s simply less busy.

A fair value estimate project may require staff assistance depending on the size and structure of a business, but it’s also reasonable to expect an appropriate amount of partner involvement.

A high staff-to-partner ratio may indicate that a partner will, out of necessity, spend most of their time reviewing the work of others instead of personally impacting and influencing your conclusions.

5. Industry Expertise

A fair value measurement can often only be considered acceptable and hold up under scrutiny if the valuation professional understands your industry.

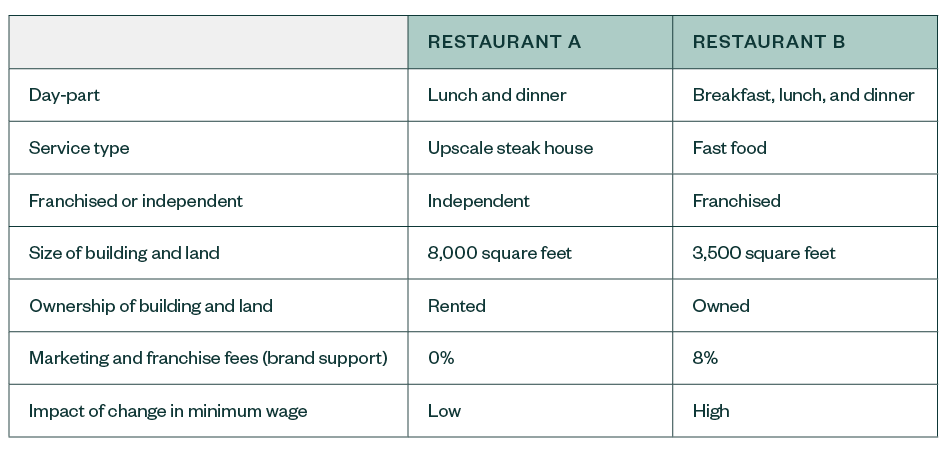

Example of Two Restaurants

Differences in the above chart can drive significant differences in value conclusion, which makes it imperative that a professional be familiar with the industry in which they work.

For example, Restaurant A is an upscale, urban, steak house. Its wait- and kitchen-staff are typically paid at levels above the minimum wage, mitigating any immediate impact that a change in state or local laws could have.

Restaurant A rents its facility, which drives a systematic difference between the two restaurants in terms of earnings before interest, taxes, depreciation, and amortization (EBITDA). This is because rent is an expense reported above the line, and depreciation resulting from ownership is added back to EBITDA, but the reality is both restaurants require a physical presence. Restaurant A also isn’t required to pay a franchise or co-op marketing fee in addition to local advertising.

Restaurant B owns its property, making it in part a real estate company with returns allocated to the business asset and real-property investment.

Given the price points and day-parts served, each restaurant is impacted differently by an up- or down-turn in discretionary spending levels.