In this third quarter update, we cover some of the most important tax issues for companies in the technology, clean technology, life sciences, and communications and media industries and touch on what your organization can do to stay ahead of them.

In this third quarter update, we cover some of the most important tax issues for companies in the technology, clean technology, life sciences, and communications and media industries and touch on what your organization can do to stay ahead of them.

Hurricane Relief

It’s devastating to see the destruction caused by hurricanes Harvey and Irma, but we’re heartened by the overwhelming response of people willing to help. We hope you and all of your loved ones are safe.

The IRS issued Notice 2017-48 and Notice 2017-52 to support those who want to give to the relief effort. These notices provide for preferential treatment for leave-based donation programs and enable companies to set up programs for employees to contribute vacation, sick, or personal time to charities in a tax-beneficial manner. The amount donated doesn’t appear in an employee’s W-2, making it fully deductible by the employee at the moment it’s donated and requiring no further action.

Tax Reform

Tax reform continues to move forward in Washington, DC, but the prospects and contents remain unclear. The most current available information was released in a joint statement in late July 2017 by lead congressional and administrative tax negotiators, also known as the Big Six. These include House Speaker Paul Ryan, Senate Majority Leader Mitch McConnell, Treasury Secretary Steve Mnuchin, National Economic Council Director Gary Cohn, Senate Finance Committee Chairman Orrin Hatch, and House Ways and Means Committee Chairman Kevin Brady.

The Big Six has dropped the border adjustability tax, which would have imposed a tax on the value of any imported good, and appear to be focusing on the following goals:

- Reducing tax rates to whatever extent possible

- Allowing unprecedented capital expensing

- Placing a priority on permanence

- Creating a system that encourages American companies to bring back overseas jobs and profits

Congress is expected to release an outline of its tax reform package in late September 2017.

Revenue Recognition Changes

By now, most finance professionals in the technology, life sciences, and communications and media industries have heard of the upcoming changes in accounting required by the new Financial Accounting Standards Board (FASB) Accounting Standards Codification® (ASC) Topic 606, Revenue from Contracts with Customers. For public companies, the new revenue recognition rules go into effect for years beginning after December 15, 2017; for private companies, they take effect for years beginning after December 15, 2018.

As companies work through the impact of the accounting changes, they stand to benefit from concurrently considering the tax implications, such as:

- Obvious changes related to timing

- Separate reporting needs for different revenue components, such as contingent payments and distinct performance obligations

- Impact on state taxes and transfer-pricing arrangements

India Implements Comprehensive GST Effective July 1, 2017

India, in an effort to both modernize and streamline its tax net, has implemented a comprehensive goods and services tax (GST) to replace a number of federal and state-level taxes.

GST is payable on all taxable supplies rendered in India, including supply of services. Because it’s generally a destination-based tax, the tax is imposed at the place of supply. This means importers of services will need to charge GST and exporters of services are entitled to a tax exemption.

This impacts US companies with Indian R&D centers, outsourcing operations, and sales and marketing entities. Read more about the implications of India’s new tax in our Insight.

Capital Gains Taxes: Aligning US Investor Expectations with Emerging Markets’ Tax Regimes

Although the US can be an expensive jurisdiction in which to do business, the US taxation system can be beneficial for foreign investors who can generally buy and sell shares in American companies without having to pay US taxes on the capital gains. With the full implementation of the Foreign Account Tax Compliance Act (FATCA), maintaining this exemption after 2018 will require a bit of documentation.

Capital Gains Taxes in Brazil, China, and India

Not all countries are as progressive. A number of emerging market countries—notably Brazil, China, and India—impose tax on the sale of shares for companies formed in their jurisdictions. Additionally, India and China apply the capital gains tax (CGT) on some indirect transfers, such as the sale of a Cayman Islands holding company that owns an operating company in India or China.

These rules change with some regularity. Even though China implemented a CGT on non-Chinese investors in 2009, tweaks and modifications to the tax continue. In the last two years, India implemented rules to statutorily override its litigated loss in the Vodafone case and terminated the CGT exemptions in its treaty with Mauritius.

In 2017, Brazil began imposing a CGT at progressive rates on gains earned by non-Brazilians from the sale of Brazilian shares. The 15% CGT applies to capital gains up to approximately $1.5 million and increases in tranches to 22.5% for capital gains in excess of $9.5 million.

IRS Foreign Tax Credit

US investors looking for opportunities in foreign markets might believe the IRS will provide them with a foreign tax credit, but this isn’t always the case. Even though this tax credit exists, using it often isn’t a straightforward task, and US investors who sell shares in Brazilian, Chinese, or Indian companies frequently find themselves paying tax twice on the same gain.

A US investor is only allowed to take foreign tax credit on the computed amount of US federal income tax the investor pays or would otherwise pay on a specific basket of foreign-source income to which the foreign gain relates.

Sourcing Income

The trickiest part of applying a foreign tax credit is sourcing investment income—generally, the United States sources capital gains on the sale of stock to where the investor lives. For example, although the United States has an income tax treaty with India, the treaty doesn’t provide any sourcing protection and US investors selling Indian companies generally pay tax twice on the same gain—India’s CGT and US capital gains or income tax. The US doesn’t have a treaty with Brazil, which means investors always face double taxation on capital gains.

Foreign Investors Not Subject to Tax on Gains Derived from Sale of Partnership Interest

On July 13, 2017, the US Tax Court rejected the IRS position requiring foreign investors in US operating partnerships to pay tax on the gains derived from the sale of partnership interest.

The Tax Court’s ruling offers potential tax benefits for foreign investors in US partnerships because the disposition of a partnership interest creates gain that, according to the Tax Court, should be sourced to the residence of the seller, not the US location of the business.

This means the sale of a partnership interest by a foreign person would generally be classified as foreign-source income and should generally be exempt from US federal income tax, with some exceptions, such as those pertaining to the sale of real property.

Oregon Moves to Market-Based Sourcing

Effective for tax years beginning on or after January 1, 2018, a new Oregon law requires taxpayers to use a market-based apportionment methodology for sales other than tangible personal property.

With this change, sales are sourced to Oregon if the service is delivered to a location in Oregon, which means businesses that sell into Oregon may need to address their Oregon tax exposure. See our Alert for more details.

Multistate Tax Commission Amnesty Program

The Multistate Tax Commission (MTC) has announced a special limited-time amnesty program for online marketplace sellers, waiving all past tax liabilities. This is notable, given that under a normal voluntary disclosure agreement or amnesty program, the lookback period is limited to a three- or four-year period.

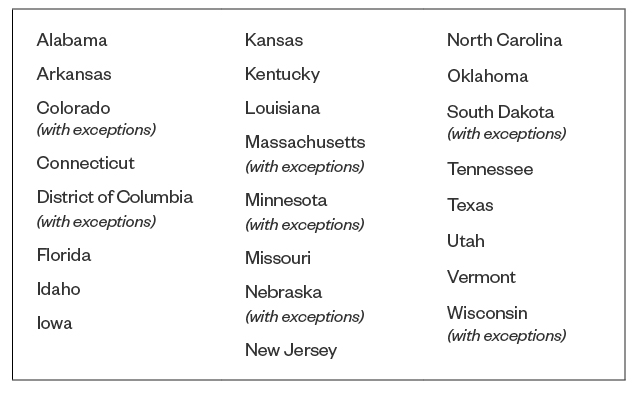

The following states are participating in the MTC voluntary disclosure program for online marketplace sellers:

Participating states are waiving sales and use tax and income and franchise tax liability—including penalties and interest—for all prior tax periods without regard to any lookback period, unless otherwise indicated. Certain states take exception to this guideline, as noted above, and will require the payment of certain back taxes. Read our Alert for more information.

How to Structure a Company for Venture Capital Financing

Corporate structures matter in venture capital financing, and businesses that choose the wrong structure might find that no venture capital firm will invest in their company. Watch our video to see international tax professionals Andy Mattson and Christine Ballard walk through the implications of different corporate structures, such as C corporations and offshore holding, on a company’s fundraising efforts and operational growth.

Changing from Cash Basis to the Accrual Method of Accounting

Many technology companies start their businesses using the cash method for income tax reporting purposes. However, for some companies, the accrual method of accounting can be worth the effort—or even be required—depending on their fact pattern. As these companies mature, they may exceed the IRS threshold for using the cash basis and be required to change tax accounting methods.

Gross Receipt Thresholds

Depending on the type of entity, the IRS imposes gross receipt thresholds to limit which companies are allowed to use the cash basis for income tax reporting.

Gross receipts are calculated using the average of the prior three years. If the average is below the threshold set by the IRS, a company is able to use either the cash or accrual method. Once a company’s gross receipts exceed the prescribed dollar threshold, however, the accrual method is required.

Revenue and Expenses

Under the cash method, a company generally accounts for revenue and expenses when cash moves in and out of the business. For example, a company isn’t taxed on receipts until the company actually receives the cash or cash equivalent as payment. Similarly, on the expense side, a company isn’t able to recognize expenses until it pays cash or cash equivalent.

Under the accrual method of accounting, a company records revenue and expenses in the period to which they relate or actually occur, instead of when the cash moves in or out of the company.

Contracts

Many technology companies enter contracts for which cash is received in advance for services to be provided over a contract period. Under the cash basis, this income must be included in revenue upon receipt. However, depending upon the terms of the contract, it may be beneficial to employ the accrual method instead because it allows a company to potentially defer recognition of a portion of this income to a later tax period.

We’re Here to Help

Moss Adams continuously reviews the regulatory and tax landscape for technology, clean technology, life sciences, and communications and media companies. For more information about any of the issues discussed above or for insight on how they may impact your business, contact your Moss Adams professional.