On June 21, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) 2018-08. The update provides clarity on accounting for certain types of contributions and simplifies reporting of some types of gifts and donations.

Key Provisions

The update clarifies that a transaction qualifies as an exchange transaction if the resource provider receives commensurate value in return. Transactions in which the provider doesn’t receive commensurate value should be classified as contributions.

The update also provides additional guidance on when a contribution is conditional. A contribution is conditional when the agreement includes both of the following factors:

- A barrier that must be overcome

- A right of return or right of release from an obligation to transfer assets

The ASU provides a listing of some indicators for determining whether an agreement contains a barrier.

This guidance applies both to recipients and providers of resources, including business entities acting as providers, except in circumstances wherein assets are transferred from a government entity to a business entity.

Effective Dates and Transition

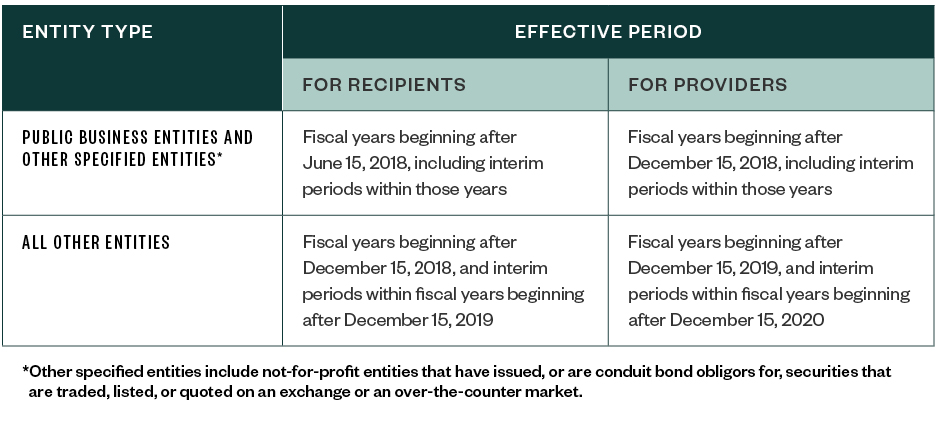

ASU 2018-08 is effective for:

Early adoption is allowed at the beginning of an annual or interim period for which financial statements haven’t yet been issued or made available. The standards should be applied only to the portion of revenue or expense that hasn’t yet been recognized before the effective date.

In the period of adoption, entities should disclose the nature of, and reason for, the change in accounting principle. They should also explain the reasons for significant changes in each financial statement line item, resulting from applying the updated standards. Retrospective application is permitted.

We’re Here to Help

For any questions or to better understand how this new standard may affect your business, contact your Moss Adams professional.