5 Common Misconceptions about the R&D Tax Credit—and Whether You Qualify

While tax reform, often referred to as the Tax Cuts and Jobs Act (TCJA), introduced many new changes for businesses, the R&D tax credit continues to provide reliable opportunities for reducing income tax liabilities—often saving companies hundreds of thousands of dollars.

However, many companies aren’t fully benefiting from the R&D credit because of common misconceptions about its applicability to their operations.

Businesses that fail to claim the R&D credit often do so because of confusion around documentation, qualifying activities and expenditures, and how the credit can be used.

Gaining clarity around these topics can provide the foundation for identifying and claiming the R&D credit—and lowering a company’s tax burden.

The following will be addressed and answered in the article below:

- What Is the R&D Tax Credit?

- How Does Your Company Know If It’s Eligible for the R&D Tax Credit?

- How Could Your Company Benefit from the R&D Tax Credit?

- How Did the R&D Tax Credit Change in 2015?

- Common Misconceptions: 5 Reasons Companies Don’t Think They Qualify

- How to Determine R&D Eligibility: The Four-Part Test

- How Can My Organization Claim the Credit?

- What Documentation Is Necessary to Claim the Credit?

- Does the R&D Credit Bring Increased IRS Scrutiny?

- How Tax Reform Changed the R&D Credit

- What’s Next for the R&D Tax Credit: Amortization of R&D Expenses Starting in Tax Year 2022

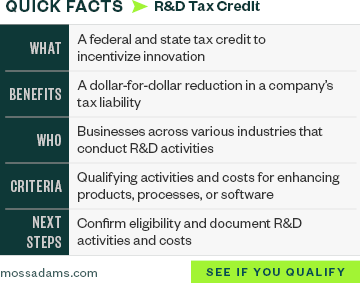

What Is the R&D Tax Credit?

The R&D tax credit is available to companies developing new or improved business components, including products, processes, computer software, techniques, formulas or inventions, that result in new or improved functionality, performance, reliability, or quality. It’s available at the federal and state level, with over 30 states offering a credit to offset state tax liability.

How Does Your Company Know If It’s Eligible for the R&D Tax Credit?

R&D credit eligibility is much broader than many companies realize, applying not only to product development, but also activities and operations, such as new manufacturing processes, software development, and quality enhancements. Start-ups may also be eligible to apply the R&D tax credit against their payroll tax for up to five years.

Your organization could be eligible for the R&D tax credit if it:

- Devotes time and resources to creating new or innovative products

- Improves existing products

- Develops processes, patents, prototypes, or software

- Hires designers, engineers, or scientists

R&D tax credits can also be retroactive. Depending on when your tax return was filed, you may be able to claim R&D credits for three prior open tax years. Loss companies may be able to go back even further; some states also allow more than three years for retrospective claims.

How Could Your Company Benefit from the R&D Tax Credit?

It’s a dollar-for-dollar tax savings that directly reduces a company’s tax liability. There’s no limitation on the amount of expenses and credit that can be claimed each year. If the federal R&D credit can’t be used immediately or completely, then any unused credit can be carried back one year or carried forward for up to 20 years. Each state has its own carryover rules.

The R&D tax credit regularly provides a wide range of businesses with a source of extra cash—up to 10% of annual R&D costs for federal purposes and much more when state credits are factored in.

How Did the R&D Tax Credit Change in 2015?

The Protecting Americans from Tax Hikes (PATH) Act of 2015 made the R&D credit permanent and expanded its application to create a potential tax benefit for small businesses and start-up companies. The TCJA retained these provisions.

Because of the permanency of the R&D credit, companies can now rely on and incorporate it into their annual tax-planning strategy.

Common Misconceptions: 5 Reasons Companies Don’t Think They Qualify

Even with this stability, however, there are common factors that companies assume prevent them from claiming the credit.

1. The Organization Isn’t Paying Federal Income Tax

Start-up companies and small businesses may be eligible to apply up to $1.25 million—or $250,000 each year for up to five years—of the federal R&D credit to offset the Federal Insurance Contributions Act (FICA) portion of their payroll taxes each year.

To be eligible, a company must meet two requirements:

- Have less than $5 million in gross receipts for the credit year

- Have no gross receipts or interest income dating back more than five years

The R&D credit is calculated on the federal income tax return as usual and may be applied against payroll taxes starting the quarter after the credit is elected. For calendar-year taxpayers, the R&D credit can be applied against payroll taxes as early as April of the following year.

2. The Company Isn’t Focused on R&D

It’s not only high-tech or life sciences companies with dedicated research departments that qualify for the R&D tax credit. Indeed, most companies don’t have R&D laboratories and instead perform R&D in their test kitchens or fields, wineries or distilleries, or on production floors. Wherever experimentation occurs, R&D may be found.

Our R&D Tax Services page contains examples of qualifying activities across industries.

3. Employees Aren’t Degree-Holding Engineers or Scientists

Companies with large numbers of engineers and scientists stand out as prime candidates for the R&D tax credit because the credit was created to encourage research and experimentation based on the hard sciences.

This holds true regardless of who performs the activities and can include employees with many different job titles and backgrounds. Experimentation performed by both employees and third-party contractors who engage in the improvement of projects and processes may be included.

4. The Company Isn’t Developing Anything New

The R&D tax credit is for taxpayers that design, develop, or improve products, processes, techniques, formulas, or software. It’s calculated on the basis of increases in research activities and expenditures—and as a result, it’s intended to reward companies that pursue innovation with increasing investment.

R&D doesn't have to be new to the industry. It simply needs to be new to the company, which must have activities that meet the four-part test below.

5. The Company Is Subject to Alternative Minimum Tax (AMT)

Historically, many companies performing R&D haven’t benefited fully from the credit because the company—or its shareholders, in the case of pass-through entities—were subject to the alternative minimum tax (AMT).

For tax years beginning on or after January 1, 2016, individuals or eligible small businesses (ESBs) who are subject to AMT can offset regular taxes and AMT using the R&D tax credit. ESBs are nonpublicly traded companies with average revenue of $50 million or less over the previous three years.

This means R&D credits that may have been previously unusable for ESBs can now be applied to reduce AMT.

How to Determine R&D Eligibility: The Four-Part Test

Any company that encounters and resolves technological challenges may be eligible for the R&D tax credit. That said, eligibility depends largely on whether the work a company does meets the criteria established by a four-part test set forth in the Internal Revenue Code (IRC) and Treasury Regulations.

Four-Part Test

Companies that consider their activities to be business as usual may actually find themselves innovative once they look at the four-part test.

- Qualified purpose. The purpose of the research must be to create a new or improved business component, resulting in a new or improved function, performance, reliability, or quality. A business component can be a product, process, computer software, technique, formula, or invention—a broad definition that applies to many different industries.

- Elimination of uncertainty. A company must demonstrate it has attempted to eliminate uncertainty about the development or improvement of a business component. Uncertainty exists if the information available to the company doesn’t establish the capability or method for developing or improving the business component, or the appropriate design of the business component. Many companies are confident in their ability to achieve technical objectives or have an established method for finding solutions, but the design is seldom established at the project’s onset.

- Process of experimentation. A company must demonstrate—through modeling, simulation, systematic trial and error, or other methods—that it has evaluated one or more alternatives for achieving the desired result. Some activities naturally follow an iterative trial and error process. For example, engineering, software development, or clinical research activities all rely on a process that can evaluate one or more alternatives. The definition is also broad enough to apply to many other types of activities.

- Technological in nature. The process of experimentation must rely on the hard sciences, such as engineering, physics, chemistry, biology, or computer science. It’s important to note companies aren’t required to exceed, expand or refine existing scientific principles.

As a first step, a company should review its operations for eligible activities. Companies that go on to claim the credit must also be prepared to identify, document, and support their qualifying R&D activities.

How Can My Organization Claim the Credit?

The amount of R&D tax credit a company can claim will depend on many factors, but the potential tax savings make it worth the time to investigate. For example, R&D tax credits have the potential to offset income tax, which can reduce a company’s tax burden in the years qualified activities occur.

Companies that haven’t previously taken advantage of the credit also have the option to look back at all open tax years—typically three to four years, depending on when tax returns were filed—to claim the missed opportunity.

If a company doesn’t currently have taxable income or is otherwise limited in how much tax credit it can use, the federal tax credit can be carried forward for 20 years or potentially applied to offset the company’s federal payroll tax under the newly expanded rules. State credits may also be carried forward for a length of time determined by the state.

What Documentation Is Necessary to Claim the Credit?

Because R&D tax credits may be claimed for both current and prior tax years, companies can benefit from documenting their R&D activities, so they’re well positioned to increase the amount of credits claimed.

To claim this credit, taxpayers must evaluate and document their research activities contemporaneously to establish the amount of qualified research expenses paid for each qualified research activity. While taxpayers may estimate some research expenses, they must have a factual basis for the assumptions used to create the estimates.

Examples of contemporaneous documentation include these items:

- Payroll records

- General ledger expense detail

- Project lists

- Project notes

- Lab results

- Emails and other documents a company produces throughout the regular course of business

These records combined with credible employee testimony can form the basis of a successful R&D credit claim.

Does the R&D Credit Bring Increased IRS Scrutiny?

For taxpayers already claiming the credit and those who may want to determine eligibility, it’s critical to be thorough when calculating and documenting qualified research activities for R&D credit claims. A possible consequence is increased IRS scrutiny and disallowance of credits claimed.

The ruling in Siemer Milling Company (Siemer Milling) v. Commissioner of Internal Revenue is a reminder of those consequences. On April 15, 2019, the US Tax Court ruled in favor of the commissioner in finding that Siemer Milling lacked sufficient documentation to support the R&D credits claimed.

The Importance of Proper Reporting When Claiming R&D Tax Credits

In the case, the court disallowed over $235,000 dollars in R&D credits claimed by Siemer Milling during tax years 2010 and 2011. This disallowance was due in large part to the taxpayer’s failure to retain and provide supporting documentation demonstrating how the company’s activities met all four tests necessary to constitute qualified research expenses.

Siemer Milling claimed that expenses from activities related to development of new flour products and improvements to its production line qualified for the R&D credit. However, the company offered no documentation to demonstrate how the activities constitute experimentation in the scientific sense.

The court found the taxpayer simply stated that it was involved in new product development involving technical activities, but these conclusory statements were insufficient evidence on their own. Simply reciting the steps undertaken wasn’t enough to conclude the company had undertaken a methodical plan involving a series of trials to test a hypothesis to develop new processes or products.

Other Clarifications

This case did provide a few taxpayer-friendly facts on eligibility for qualified research expenditures:

- Technical uncertainties don’t need to be solved in the credit year but can span more than one year.

- To establish that a company participated in technical activities, it doesn’t necessarily have to employ individuals with specialized degrees.

- The US Tax Court discussed what types of documentation or support of estimates would be useful to properly support credits claimed.

How Tax Reform Changed the R&D Credit

Increase in Credit from Decrease in Tax Rates

Prior to tax reform, taxpayers couldn’t take a deduction under IRC Section 174 equal to the amount of the R&D credit. This prevented companies from getting a double tax benefit, and taxpayers were required to reduce their R&D expenses by the amount of the credit. The reduction in expenses created an increase to income and any corresponding taxes.

Taxpayers could avoid the reduction of their research expenses by electing to take a reduced credit in accordance with IRC Section 280C(c)(3), which was retained in the TCJA and calculated using the maximum corporate tax rate. However, because the maximum corporate tax rate was reduced from 35% to 21%, the AMT rate was eliminated, and taxpayers will see an increased credit.

Nevertheless, there’s still one limitation remaining on R&D credits to prevent taxpayers from using the credit to completely eliminate their tax liability. The rule, effectively known as the 25/25 limitation, restricts taxpayers with over $25,000 in regular tax liability from offsetting more than 75% of their regular tax liability using the credit.

Retention of Eligible Small Business Credits

Previously, corporations or owners of pass-through companies with less than $50 million in average revenue over the prior three years were allowed to use the R&D credit to offset AMT. Since the corporate AMT was eliminated by the TCJA, this provision will benefit individual taxpayers with R&D credit flowing through from a business that they have an ownership stake in.

Retention of Qualified Small Business Payroll Credits

Startup companies with less than $5 million in revenue will still be able to make an election that will allow them to offset up to $250,000 in payroll taxes for the first five years they have gross receipts. Starting in 2017, payroll credits must be elected on an original return.

Increased Usability for Individual Taxpayers

Before tax reform, individual taxpayers were sometimes prevented from using the credit because of AMT at the individual level. Now, the AMT exemptions for individual taxpayers are increasing. As a result, individual taxpayers are likely to use more of the R&D credits passing through to them from their businesses.

What’s Next for the R&D Tax Credit: Amortization of R&D Expenses Starting in Tax Year 2022

After 2021, companies will no longer be able to immediately expense costs that are treated as specified IRC Section 174 research expenses. Instead, they’ll be required to charge US-based research expenses to a capital account and deduct them over a five-year period. Expenses incurred for research performed outside of the United States will be charged to a capital account and deducted over a 15-year period.

We’re Here to Help

For more information about R&D credits or reducing your company’s risk of facing penalties, contact your Moss Adams professional, visit our Credits & Incentives page, or download Your Guide to Claiming the Federal R&D Tax Credit. For a free estimate of your company’s potential qualified activities, fill out a complimentary credit benefit estimate.