In 2019 and 2020, adoption dates are approaching for accounting-standards changes the Financial Accounting Standards Board (FASB) introduced in 2013. While that may seem like old news, there are some public-entity classification requirements that could create complexities for not-for-profit (NFP) organizations.

In 2019 and 2020, adoption dates are approaching for accounting-standards changes the Financial Accounting Standards Board (FASB) introduced in 2013. While that may seem like old news, there are some public-entity classification requirements that could create complexities for not-for-profit (NFP) organizations.

While the FASB’s reporting requirements only apply to public entities, many not-for-profit organizations qualify as public entities without knowing it—meaning they’re responsible for adopting the standards.

Here are key public-entity classifications, information about the standards, and reporting details your organization should know.

Background

In 2013, the FASB issued an accounting standard update that amended its Accounting Standards Codification (ASC) Master Glossary to include the definition of a public business entity. In doing this, the FASB purposefully excluded NFP organizations from its definition to allow for flexibility in the application of standards in future years.

Because of this exclusion, many NFP organizations, including institutions of higher education, weren’t affected by the accounting standards and effective adoption dates applicable to public businesses. However, accounting standards and effective dates for public entities still apply to an NFP if it qualifies as a public entity.

Public-Entity Classifications

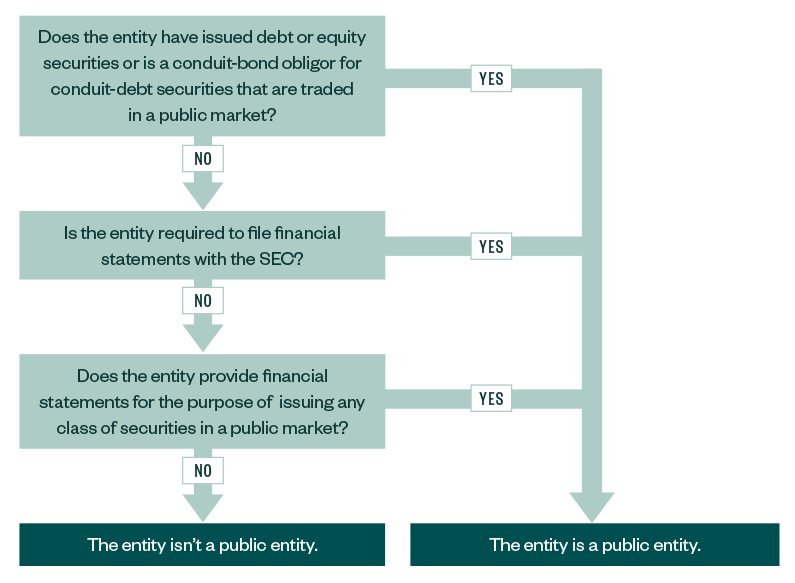

The ASC includes a couple definitions of a public entity. However, for this article, we’ll defer to only one definition, which classifies a business entity or NFP as a public entity if it meets a series of conditions, as shown in the below flow chart.

Additional Definition

The ASC’s alternate definition for a public entity is used for certain ASC Topics. It’s slightly different from the above definition, noting an entity is a public entity if it meets any of the following criteria:

- Has equity securities that trade in a public market, either on a domestic or foreign stock exchange or in an over-the-counter market, including locally or regionally quoted securities

- Makes a filing with a regulatory agency in preparation for the sale of any class of equity securities in a public market

- Is controlled by an entity covered by the preceding criteria, meaning a subsidiary of a public entity is itself a public entity

Conduit Debt Securities

If an NFP is a conduit bond obligor for conduit-debt securities traded on a public market, the NFP is a public entity that’s responsible for meeting FASB reporting requirements applicable to a public entity. According to the FASB ASC Master Glossary, conduit debt securities are defined as follows:

“Certain limited-obligation revenue bonds, certificates of participation, or similar debt instruments issued by a state or local governmental entity for the express purpose of providing financing for a specific third party (the conduit bond obligor) that is not a part of the state or local government’s financial reporting entity. Although conduit debt securities bear the name of the governmental entity that issues them, the governmental entity often has no obligation for such debt beyond the resources provided by a lease or loan agreement with the third party on whose behalf the securities are issued. Further, the conduit bond obligor is responsible for any future financial reporting requirements.”

In other words, a conduit debt security is effectively a government-issued loan that the third-party recipient—in this case, the NFP—is responsible for paying. When repaying the debt, the NFP is responsible for complying with standards issued at the time of the loan as well as all relevant reporting requirements that are released at later dates.

Hidden Public Conduit-Debt Securities

Each year, the lending industry introduces new parameters for financing NFP and government sectors. Now, financial institutions and financing authorities have teamed up to create ways to package tax-exempt bond proceeds.

For example, financial institutions often issue loans that are funded through tax-exempt bonds issued by an authority. Depending on the agreement, NFPs may still be subject to the covenants, 990 Schedule K requirements, statutory bond requirements, and other terms of the agreement normally reserved for tax-exempt bonds.

The bonds—whether offered through private or public placement—could subject an NFP organization to certain public-entity reporting requirements if the tax-exempt bonds are considered public, conduit debt. That means you must use caution and read debt agreements carefully to assess whether receiving the loan would classify your NFP as a public entity.

Of note, conduit debt securities that are issued in a private-placement offering and sold directly to qualified investors aren’t considered available to the public. However, NFPs should still take caution when receiving these loans. The loan should be regularly reassessed to make sure the securities aren’t reintroduced to the public markets.

Next Steps

Use caution and your best judgment when assessing whether your NFP is a public entity. If it is, it’s important to comply with the standard requirements and effective dates for public entities to avoid penalties.

We’re Here to Help

For more information about the FASB’s accounting standard update or implications for your NFP, please contact your Moss Adams professional.