The current expected credit loss (CECL) standard is creating new challenges for financial institutions. To help these institutions transition to the standard, we surveyed a select group of banks and credit unions across the nation on their experience with CECL, the data from which is compiled in our CECL Survey Report. Here are the key insights, trends, and lessons learned.

The current expected credit loss (CECL) standard is creating new challenges for financial institutions. To help these institutions transition to the standard, we surveyed a select group of banks and credit unions across the nation on their experience with CECL, the data from which is compiled in our CECL Survey Report. Here are the key insights, trends, and lessons learned.

Background

The Financial Accounting Standards Board (FASB) issued CECL on June 16, 2016. The biggest accounting change in decades for financial institutions, the new CECL guidance modifies or replaces existing impairment models for financial assets, such as trade receivables, loans, debt securities, and purchased credit-deteriorated assets.

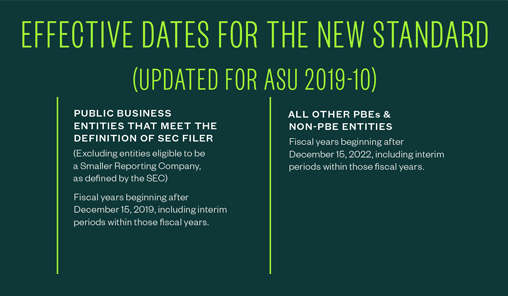

Financial institutions will need to undertake robust implementation efforts to comply with the standard, which goes into effect for most public-business entities filing with the SEC in 2020. Here’s a breakdown of the effective dates for various institution types.

Preparation

Organizations are currently at various stages of implementation. Of those surveyed, 49% felt very prepared for implementing CECL, and 49% felt somewhat prepared, while only 2% of the respondents said they haven’t yet read the standard. Of those who felt very prepared, over half of those have $1-5 billion in assets, while institutions under $1 billion in assets are largely still working through the development process. Indications are that smaller community institutions are still finding their way within the CECL process.

Progress

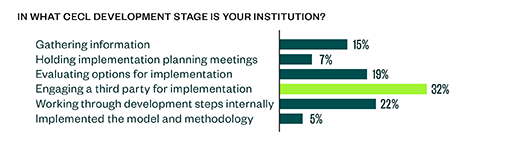

While it’s clear that institutions are in very different development phases of CECL implementation, many are still analyzing how to move forward, whether internally or working with vendors to assist.

Challenges

The survey broke down anticipated and actual challenges that participants are facing.

Anticipated Challenges

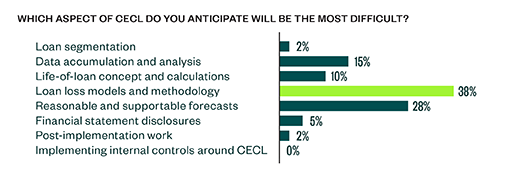

Participants had mixed responses on what challenges they anticipated would be their biggest. The top three were:

- Developing and implementing the actual credit loss models

- Applying the concept of reasonable and supportable forecasts

- Accumulation of historical loan-level data and analysis

Current Challenges

We asked respondents where their institution needs the most help in moving forward with CECL. Responses included the following:

- Identifying data limitations and data supplementation for missing data

- Model development for each loan segment and related testing

- Incorporating economic and other forecasts into the methodology

- Vendor management, including selection, monitoring, and managing expectation gaps and delays

- Understanding expectations of auditors, regulators, and the board of directors surrounding level and types of documentation needed

Data

A common theme since the standard was issued, historical data gathering was by far the biggest challenges for institutions. It’s critical for institutions to understand what data they actually have. This includes uncovering limitations of their current loan systems, such as offered data sets to align with segmentation, missing historical data, or the inability to validate the accuracy of data obtained. Until institutions actually dig in and understand what’s available to them, it’s difficult to plan for CECL.

Conversely, others noted there were benefits to the systems they had in place, and going through the segmentation process actually helped to identify a better correlation between identified segments and the predictability of losses within those pools. However, some who’ve attempted this process noted that outsourcing the data compilation ultimately worked best for their institution, given the efficiencies gained.

Areas of Uncertainty

We asked respondents what additional information they’re hoping regulators, accountants, and the FASB will provide to help with CECL.

Respondents offered several factors, but a general trend was many are concerned with implementation efforts. Many institutions are already using third-party providers for implementation of CECL, and they’re looking for clarification on what is expected from regulators and auditors surrounding that implementation, ongoing CECL calculations, and model or method verification. Through published frequently asked questions, banking regulators have addressed the use of third parties with CECL implementation, ultimately pointing to the interagency guidance on third-party service providers.

Institutions that aren’t working with third parties are also looking for tangible guidance on putting pencil to paper for implementation with real-world examples, such as methodology approaches and disclosures. FASB has been hesitant with this, maintaining that CECL doesn’t prescribe the use of certain specific estimation methods, and allowances for credit losses may be determined using various methods that reasonably estimate the expected collectability of financial assets and are applied consistently over time.

Although there have been communications from FASB and regulators to community institutions surrounding the weighted-average remaining maturity method for estimating credit losses, the comprehensive CECL implementation specific guidance community institutions are hoping for is not likely to come.

Due Diligence

Management is ultimately responsible for their CECL estimate, including the significant inputs surrounding qualitative factors for forecasts and the final output from the methodology. Institutions, therefore, shouldn’t rely on third parties without proper due diligence and controls surrounding calculation reperformance, monitoring, and verification or validation of models. Management will be expected to explain the inputs and outputs of the methodology to various stakeholders, including regulators, auditors, and those charged with governance.

Next Steps

Applying CECL is a multistep process—and a difficult one without an experienced team. Determining where in the CECL lifecycle your company falls can help you hit the ground running by implementing solutions specific to your company’s needs and scope. It can be helpful to use an outside advisor, but it’s important to find one who has the resources and flexibility needed to define, scope, plan and deliver a custom solution that fits your organization. When evaluating an advisor, make sure they’re able to meet your organization where it’s at in the CECL process and has the experience to help your organization at any stage, from data discovery to governance and internal controls, and anywhere in between.

We’re Here to Help

As methods for adopting CECL continue to evolve, our professionals are committed to helping you navigate the implementation process. If you’d like assistance with all aspects or a specific step in CECL implementation, please don’t hesitate to contact a Moss Adams professional. For more information on how organizations are transitioning to CECL, view the full report. And to learn more about CECL, its current and forecasted changes, and our unique perspectives, view our CECL Accounting Guide.