Software companies have transformed business operations in a variety of industries by creating products that drive efficiency and productivity. To support continued innovation in the software industry, US Congress has expanded the availability of R&D tax credits, which can provide substantial tax-savings opportunities for a broad range of software companies.

Software companies have transformed business operations in a variety of industries by creating products that drive efficiency and productivity. To support continued innovation in the software industry, US Congress has expanded the availability of R&D tax credits, which can provide substantial tax-savings opportunities for a broad range of software companies.

Many expenses often incurred by software companies during their R&D are eligible, including wages for software developers and product managers, charges for cloud computing services, and contractor development expenses. Even startup companies can potentially benefit by applying credits to payroll tax liabilities.

An overview of the R&D credit follows as well as insight into how software companies may qualify.

R&D Overview

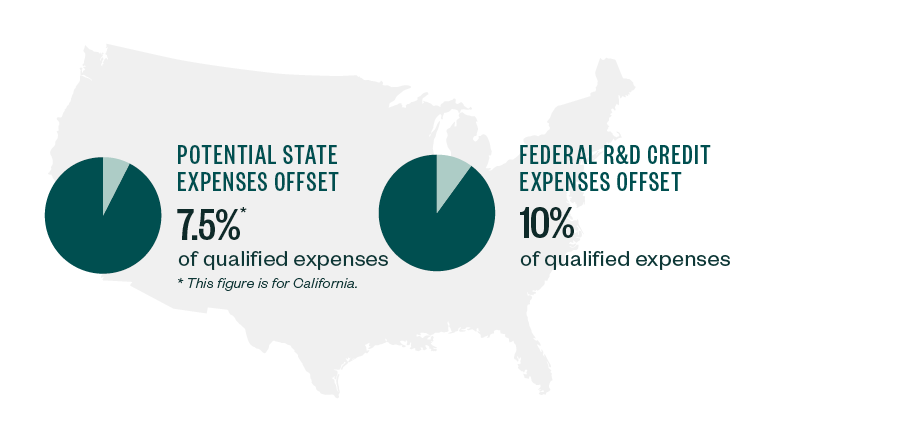

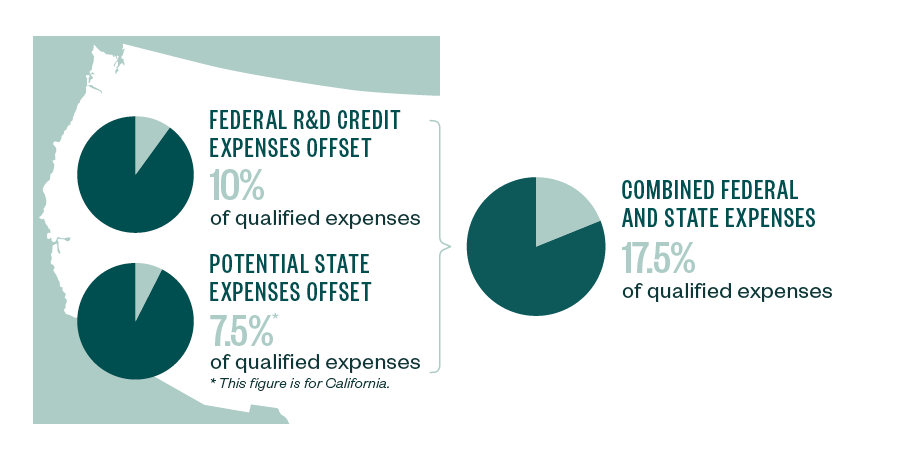

For software companies that meet the credit qualifications, the federal benefit can exceed 10% of qualified expenses. Many states even provide additional credit benefits against state tax liability. For example, California, a hotbed of software development and technological innovation, provides a credit of up to 7.5% of qualified expenses. While the California credit must be applied to income tax liability, the federal credit can, in some circumstances, be applied against federal payroll tax, which can offset the high cost of conducting business in some high-cost states.

To further benefit companies, credits are based on the location in which R&D is performed, so additional credits may be available in multiple states when a company performs R&D within each jurisdiction. For example, a company with developers in California and Arizona can claim credits in each state, as well as a federal credit.

Credit Calculation

While the credit may result in a tax credit exceeding 10% of R&D expenditures, there are potential limitations. The credit is technically for increasing research activities and is calculated in part based on the difference between current year R&D expenses and amounts spent in previous years.

There are two methods of calculating this difference for the federal tax credit.

Traditional Calculation

The traditional credit method entails calculating a historical average based on the first year R&D was performed, then comparing that average to current R&D activity and company revenues.

Alternative Simplified Calculation

The Alternative Simplified Calculation (ASC) method uses only up to three prior years to calculate the prior-year average. This is a viable alternative when financial information or documentation isn’t available for earlier periods, but may result in a smaller credit for companies that haven’t performed R&D for a three-year period.

For state credits, one or more of these two approaches may be employed, depending on the state.

Payroll Tax Election

As a major boost for startups, the federal credit also provides benefits for companies that aren’t yet profitable. This incentive may benefit startups that don’t yet pay income taxes but do pay payroll taxes. For these companies, up to $250,000 of the R&D credit may be applied to a portion of its social security payroll tax each year, provided that certain criteria are satisfied.

The payroll election criteria are as follows:

- Gross receipts must be less than $5,000,000 during the year the election is made

- The taxpayer must not have gross receipts more than five years prior to the year in which the payroll election is made

Any credits in excess of quarterly payroll tax liability will rollover into future quarters until the credit is exhausted. Any amount that exceeds the $250,000 limitation can be taken as a general business credit and applied against income tax in the future.

Net Operating Losses

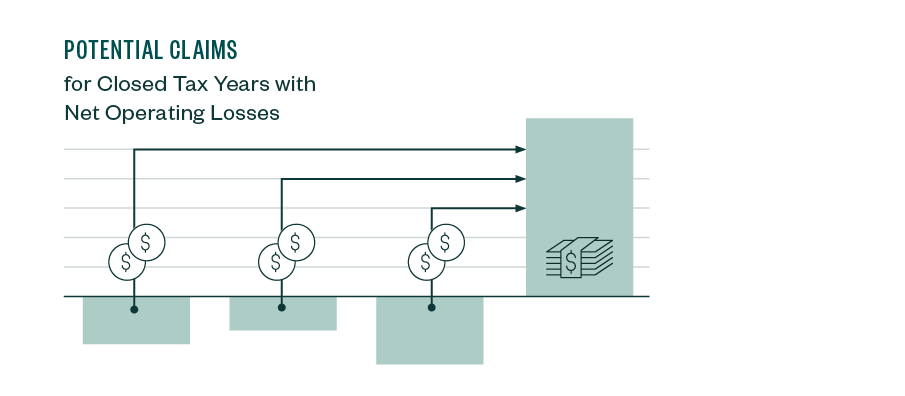

In addition to the payroll election, the credit may also benefit companies that have been in losses for several years. Many companies perform activities that qualify for the credit, but don’t claim them due to lack of awareness. Any federal credits a company would have been entitled to claim in closed tax years can be rolled forward for up to 20 years.

This option may be particularly beneficial when a company has nearly exhausted net operating losses. It enables the company to use credits generated from prior R&D expenditures to offset future tax liability, even when the R&D activity was performed in closed tax years and the company had no income tax liability during subsequent open tax years.

Qualified Activities and Expenses

Qualified Activities

A variety of activities performed during software development may qualify for the credit. These can include simulation or testing of software functionality and performance, evaluation of technical criteria when selecting software architectures, and design and implementation of cloud-based software applications.

R&D undertaken to acquire, process, and analyze large quantities of information, which is frequently encountered when dealing with big data analytics, artificial intelligence, and cloud computing technologies, may qualify as well.

Eligibility Test

To be eligible, your R&D activities must adhere to a four-part test that proves the following:

- R&D entails development of software that provides new or improved function, performance, quality, or reliability.

- R&D is undertaken to discover information that’s technological in nature. This requirement is satisfied if information available to the company doesn’t establish the capability or method developing the business component, or its appropriate design.

- Experimentation processes must be used to eliminate uncertainty. The process can be an evaluation of alternatives, simulation or modeling process capable of proving or disproving a hypothesis, or formal testing.

- Experimentation must rely on hard sciences or engineering disciplines, including computer sciences or engineering.

Simply using computer science doesn’t necessarily satisfy the criteria. However, because software development frequently involves some degree of simulation and modeling to assess design and performance using technical criteria, these activities can often be shown to meet the requirements.

Disqualified Activities

It’s important to note that some types of R&D activities don’t qualify for the credit, including:

- Development performed outside of the United States and US territories

- Software application configuration

- Routine maintenance and production

- Post-release bug fixes and routine quality control testing

- User interface or experience development for purely cosmetic design

Eligible Expenses

Businesses can include several categories of expenses when applying for the credit.

Wages

Employee wages for R&D activity, as well as supervision or direct support of such activity, may be included in the credit. If employees spend at least 80% of their time performing R&D, all of the employee compensation may be included in the credit calculation.

Employees this often applies to include:

- Chief technology officer

- Software and database architects

- Software engineers and developers

- Computer and data scientists

- Quality assurance testers

Contract Research

When beginning operations, software companies frequently employ contractors to perform development-related tasks using expertise that’s not available from in-house resources.

Up to 65% of expenses for contract R&D may be included in the credit calculation, provided that the work is performed in the United States or US territories.

Cloud Computing

With the advent of cloud computing, software companies also often have shared computer rental expenses, portions of which can be included in the credit.

For example, if a company leases multiple server instances for development, expenses for the nonproduction server expenses may be included in the credit.

Supplies

Supply expenses may be captured for nondepreciable items used to perform R&D.

For example, a prototype electronic device with its own custom software package may undergo multiple iterations for hardware changes. The materials used to fabricate the prototypes can be applied towards the credit.

Potential Challenges

There are several hurdles a software company may face when deciding whether or not to claim the R&D credit.

Highly-Compensated Employees

It’s crucial to assess the impact of highly-compensated employees on the credit, with a particular emphasis on those in executive roles. Software companies often scale rapidly, so compensation can rise quickly as the company scales.

When these employees contribute substantially to the total amount of qualified research expenditures, the IRS may closely scrutinize the executive’s activity as well as the reasonableness of wages allocated to the credit. Additional proof of executives’ qualified services may be required, such as technical documentation, emails, and calendar appointments pertaining to R&D.

Project Identification and Documentation

The IRS requires businesses employ a project-based approach that identifies each project for which a credit has been claimed and quantifies the amount of qualified expenditures associated with the project.

The IRS may also deny a credit claim if it determines a business hasn’t established it is entitled to the credit. It’s important that the credit calculation comports with IRS requirements, such as quantifying expenses when using project-based accounting and satisfying documentation requirements.

Internal-Use Software

Many businesses that aren’t traditional software development companies but that create custom software for their own internal use may qualify if the internal-use software isn’t sold, leased, licensed, or otherwise marketed to third parties.

Internal-use software functions include financial management, human resources management, or support services. The software, however, is subject to a three-part, high threshold of innovation test.

Funded Research

Software development funded by an outside party, such as custom software developed to suit a particular customer’s needs or under a work-for-hire agreement, may not qualify for the credit unless specific criteria is met.

We’re Here to Help

Assessing if your expenses are applicable for the R&D credit can be a complicated process that requires thorough documentation and a deep knowledge of credit methodology, so it helps to seek the service of a professional advisor.

To learn more about the R&D credit or how your company can apply, contact your Moss Adams professional.