On April 21, 2020, the Centers for Medicare and Medicaid Services (CMS) published the proposed rule for fiscal year (FY) 2021 Inpatient Rehabilitation Facility Prospective Payment System (IRF PPS). The rule affects discharge dates on or after October 1, 2020.

Each year, CMS publishes updates to the regulations for inflation factors, wage adjustments, and other patient-care related payment adjustments. Below is an overview of the FY 2021 IRF PPS, including proposed changes and other relevant updates.

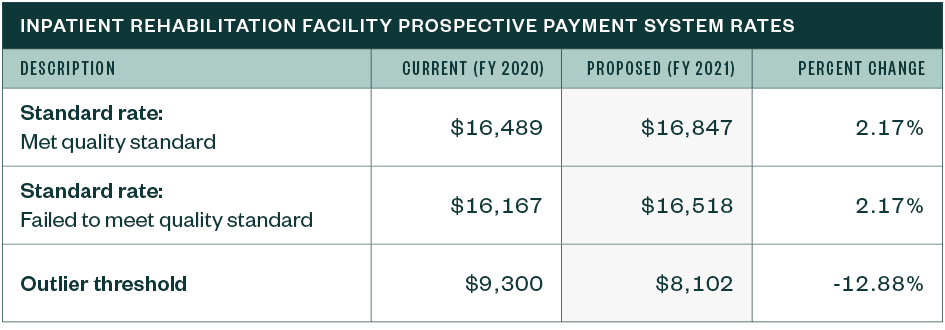

Proposed Changes to IRF Payments

CMS has proposed the following updates to inpatient rehabilitation facility payment rates.

Other Notable Updates

Core-Based Statistical Area Designation

The FY 2021 IRF PPS rule proposes to adopt the most recent Office of Management and Budget (OMB) Core-Based Statistical Area (CBSA) delineations and apply a 5% cap on any wage index decreases, compared to FY 2020, in a budget-neutral manner.

As a result, the following changes will occur:

- 34 counties that are currently classified as urban will become rural.

- 47 counties that are currently rural will become urban.

- Some counties will move from one CBSA to another.

Coverage Requirements

The proposed FY 2021 IRF PPS rule puts forward the following amendments to inpatient rehabilitation facility coverage requirements:

- Remove the post-admission physician evaluation requirement

- Codify existing documentation instructions and guidance

- Allow nonphysician practitioners to perform certain requirements that rehabilitation physicians were required to perform

Additional Updates

Other provisions of the proposed rule include updates to the following:

- The case mix group (CMG) relative weights and average length of stay values for FY 2021, in a budget neutral manner

- The IRF PPS payment rates for FY 2021 by the proposed market-basket increase factor—based on the most current data available—with a proposed productivity adjustment required by Section 1886(j)(3)(C)(ii)(I) of the Social Security Act

- Descriptions of the calculation of the IRF standard payment conversion factor for FY 2021

- The outlier threshold amount for FY 2021

- The cost-to-charge ratio (CCR) ceiling and urban and rural average CCRs

- Descriptions of the method for applying the reduction to the FY 2021 IRF increase factor for IRFs that fail to meet the quality reporting requirements

Economic Impact

The overall economic impact of this proposed rule is an estimated $270 million in increased payments from the US Federal Government to IRFs during FY 2021.

Public Comments

Public comments can be submitted no later than 5:00 p.m. Eastern Standard Time on June 15, 2020. Reference CMS-1729 P in your comment submission.

Before submitting comments, consult with the rule’s submission instructions so you adhere to the proper method.

We’re Here to Help

For more information about the proposed rule and possible implications for you and your organization, contact your Moss Adams professional.