On April 10, 2020, the IRS broadly expanded earlier tax filing and payment deadline relief to encompass most other filings due before July 15, 2020.

Notice 2020-23 updates the previous relief provided by Notice 2020-18 and Notice 2020-20 in response to COVID-19. This new notice is likely welcome news for taxpayers who’ve had concerns about other near-term deadlines, as well as lingering questions about the impact of the deferral on certain other filings.

The new notice not only clarifies what was included in the earlier notices, but also expands the relief to forms due after April 15, including tax-exempt filings due May 15 and second quarter estimates due June 15.

In short, it broadly defers filings, payments, and certain time-sensitive actions due on or after April 1, 2020, and before July 15, 2020, which also helps fiscal filers with non-standard due dates. Details of the new notice follow.

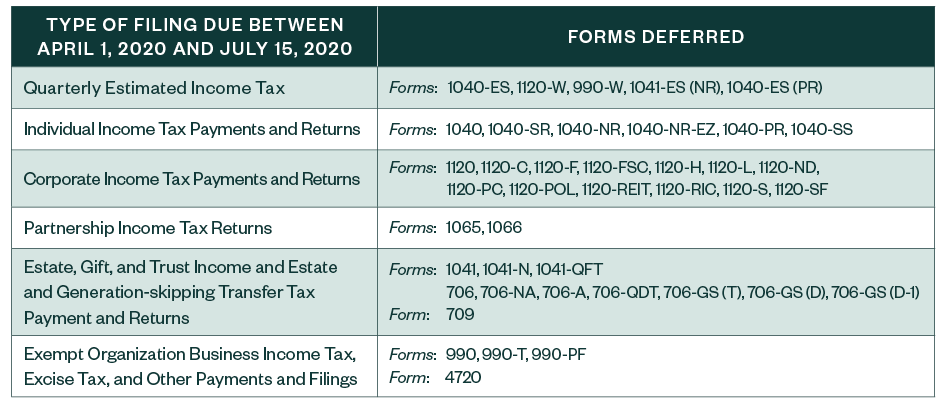

List of Forms and Payments Automatically Extended to July 15, 2020

The notice provides the following specified forms, including any related payments, with a due date between April 1, 2020, and July 15, 2020, are automatically deferred to July 15, 2020.

Additional forms and payments include:

- Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent, and any supplemental Form 8971, including all requirements contained in Section 6035(a) of the code

- Estate tax payments of principal or interest due as a result of an election made under Sections 6166, 6161, or 6163 and annual recertification requirements under Section 6166 of the code

Extended Schedules, Returns, and Other Forms Attached to Specified Forms

The notice also clarifies that all schedules, returns, and other forms that are attachments to specified forms are also deferred until July 15, 2020. The specifically-identified examples included in the notice are:

- Schedule H

- Schedule SE

- Forms 3520, 5471, 5472, 8621, 8858, 8865, and 8938

Installment payments under Section 965(h) due on or after April 1, 2020, and before July 15, 2020, are also deferred. The inclusion in the notice formalizes IRS guidance provided earlier in their FAQs.

Waived Interest and Penalties

Similar to prior relief, the notice also states that interest, penalties, and any addition to tax for failure to file any specified form or attachment will be disregarded for the deferral period.

Any payments due on July 15, 2020, that aren’t paid by that date will be begin to accrue interest and penalties on July 16, 2020.

Relief for Elections Due with a Specified Form

Any elections that are made or required to be made on a timely-filed specified form, or as an attachment to a specified form, will be considered timely made if the specified form or attachment is filed by July 15, 2020.

Postponement of Specified Time-Sensitive Actions

Taxpayers required to perform specified time-sensitive actions on or after April 1, 2020, and before July 15, 2020, will have until July 15, 2020, to perform the action.

This includes:

- Filing of Tax Court petitions

- Reviewing a decision rendered by the Tax Court

- Filing a claim for credit or refund of any tax, including Form 4466

- Bringing suit upon a claim for credit or refund of any tax

This notice won’t apply if the period for filing a petition with the Tax Court, or for filing a claim or bringing a suit for credit or refund, expired before April 1, 2020.

Specified time-sensitive actions also include items identified in Revenue Procedure 2018-58, which includes a list of actions deferred for taxpayers in a federally-declared disaster area.

A few of the more prominent items identified in the procedure include:

- The adoption, election, retention, or change in accounting method or period

- Elections related to net operating loss carrybacks

- Entity classification elections on Form 8832

- Quick refund claims on Form 4466

- Filing an electing small business trust election

- Certain deadlines for like-kind exchanges and involuntary conversions

The notice also identifies as a specified time-sensitive action an investment during the 180-day period for a Qualified Opportunity Zone (QOZ), as described in Section 1400Z-2(a)(1)(A).

Similarly, the notice also provides additional time to the IRS to perform time-sensitive actions described in Reg. Sec. 301.7508A-1(c)(2), deferring these deadlines to July 15, 2020.

This includes assessment of tax and bringing suit with respect to a tax liability. Additional time is given to IRS employees as many of them don’t have access to the resources they need to carry out their activities.

This postponement of action includes any taxpayer who:

- Is currently under examination

- Has a case with the Independent Office of Appeals

- Files amended returns or submits payments for tax where the time for assessment would otherwise expire during this period

We’re Here to Help

To learn more about how the expanded deadlines will impact your tax filings, contact your Moss Adams professional.