At the April 8, 2020, Financial Accounting Standards Board (FASB) meeting, the FASB voted to add a project to its technical agenda to amend the effective dates for Topic 606, Revenue from Contracts with Customers, and Topic 842, Leases, for certain entities.

The FASB issued proposed Accounting Standards Update (ASU), Revenue from Contracts with Customer (Topic 606) and Leases (Topic 842): Effective Dates for Certain Entities, on April 21, 2020.

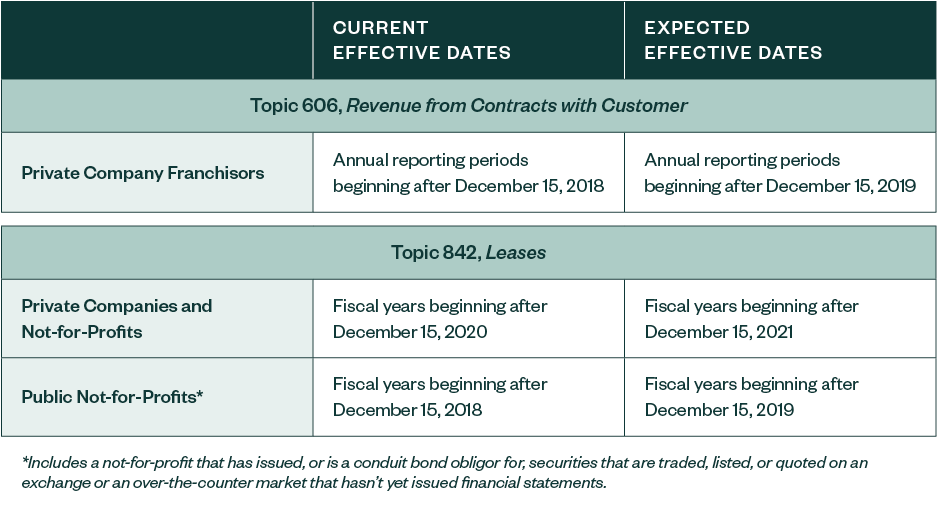

The proposed ASU would defer the effective dates of Topic 606 and Topic 842 for certain entities as described below. Comments are due by May 6, 2020.

Key Provisions

During the meeting, the board discussed the effects COVID-19 could have on companies, and addressed plans to support those companies as they navigate the impact of the COVID-19 pandemic.

Revenue

To address concerns in regard to the timing of revenue recognition under Topic 606 for initial franchise fees, the board voted to add a project to its technical agenda to evaluate how to reduce the costs of applying Topic 606 to initial franchise fees.

It also voted to defer the effective date of Topic 606 by one year for franchisors that aren’t public business entities.

Leases

Due to the COVID-19 pandemic, the board acknowledged entities could be facing limited resources. As a result, the board voted to add a project to its technical agenda to defer the effective date of Topic 842 by one year for private companies and not-for-profit entities.

This will include not-for-profits that have issued, or are conduit bond obligors for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market that haven’t yet issued financial statements—referred to as public not-for-profits.

Potential Effective Dates

The updated effective dates are expected to be as follows.

All dates and provisions described are subject to change pending the drafting and issuance of a final Accounting Standards Update (ASU).

We’re Here to Help

For more information on how these changes may affect your business, contact your Moss Adams professional.