On May 27, 2020, Governor Gavin Newsom issued an updated, proposed budget that includes two significant changes to the state’s tax law that could have a meaningful impact on a taxpayer’s California tax profile. The proposed legislation would limit tax benefits available to California taxpayers through the following two provisions:

- Suspension of California net operating loss (NOL) deductions for 2020, 2021, and 2022 for certain taxpayers

- Limitation of certain California tax credits for 2020, 2021, and 2022

In addition, Newsom’s proposed budget includes limitations to the usage of low income housing credits and film production credits.

The Democratic Party currently holds more than two-thirds majorities in both houses of the state legislature. Therefore, it appears that these tax provisions have a reasonable likelihood of obtaining the two-thirds majority vote, which is required by California law, to pass provisions that increase taxes. Further, California law requires a budget bill be passed by the state legislature by midnight on June 15, or legislators forfeit their salaries until a budget bill is passed. As such, it’s important for taxpayers to understand the potential impact that this tax legislation could have on their cash taxes and effective tax rate.

Proposed Net Operating Loss Limitation

The proposed legislation, which applies to individuals, flow-through entities, and C corporations, disallows the use of California NOL deductions if the following conditions apply:

- The taxpayer recognizes business income

- The taxpayer has a federal adjusted gross income—or, for corporations, income subject to tax—that’s greater than $1,000,000, after accounting for modification for registered domestic partners computing income as spouses

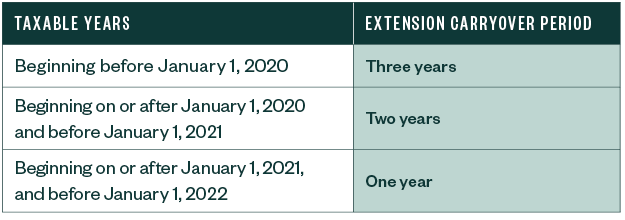

The carryover periods for NOL deductions disallowed by this provision will be extended as follows:

Proposed Business Tax Credit Limitation

Any business credit will only offset a maximum of $5,000,000 of California tax. California defines the term business credit as including the California Research Credit and the California Competes Tax Credit, among other business credits.

The carryover periods (if applicable) are extended by the number of years that a credit is disallowed by reason of this limitation.

We’re Here to Help

Taxpayers should consider proactive tax planning opportunities to manage their California income tax position in light of the proposed limitations on the availability of NOLs and incentive tax credits to shield taxable income. This is particularly important because NOLs have been utilized as a cash flow strategy during the COVID-19 pandemic.