On May 29, 2020, the Centers for Medicare and Medicaid Services (CMS) published the proposed rule in the Federal Register for fiscal year (FY) 2021 Hospital Inpatient Prospective Payment System (IPPS). The rule affects discharge dates on or after October 1, 2020.

Each year, CMS publishes updates to the regulations for inflation factors, wage index adjustments, and other patient-care related payment adjustments. Below is an overview of the FY 2021 IPPS, including proposed changes and other relevant updates.

Proposed Changes for Acute Care Hospitals

CMS has proposed the following updates, payment policies, and payment rates.

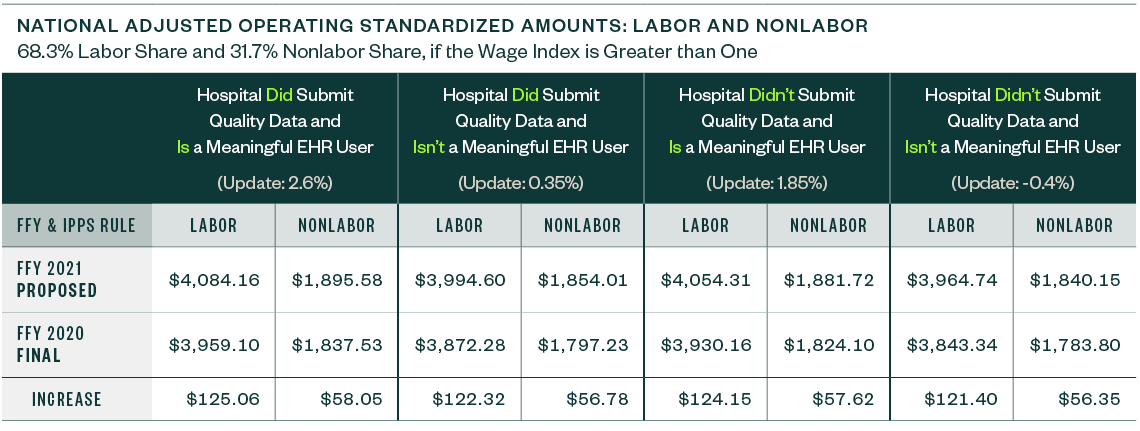

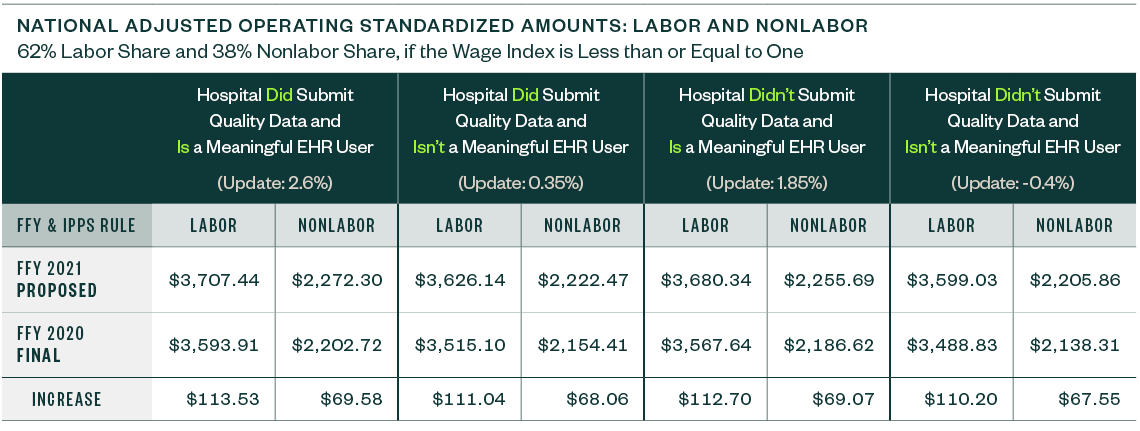

National Adjusted Operating Standardized Amounts

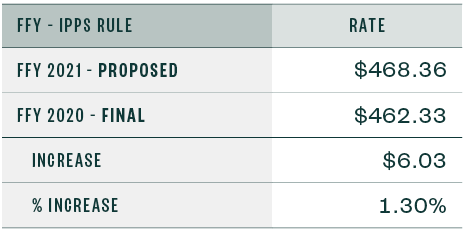

The national adjusted operating standardized amounts are proposed to increase 3.16% with the federal capital payment rate increasing 1.30%, as listed below.

The following metrics align with:

- Whether or not a hospital is a meaningful electronic health record (EHR) user

- If a hospital submitted quality data

Capital Standard Federal Payment Rate

Below are the capital standard federal payment rates for FY 2020 and 2021.

Medicare Severity Diagnosis Related Group

CMS proposes a Medicare Severity Diagnosis Related Group (MS-DRG) for chimeric antigen receptor (CAR) T-cell therapy cases. It also proposes classification changes, standardized amount adjustments, and relative weights recalibration.

Medicare Wage Index

The IPPS rule proposes to adopt the most recent Office of Management and Budget (OMB) Core-Based Statistical Area (CBSA) delineations.

The wage index update is based on cost reports beginning in 2017, and the wage index occupational mix adjustment is based on the Occupational Mix Survey from 2016.

CMS is also moving forward with the low-wage-index hospital policy that began in FY 2020. It’s proposing adjustments to standardized amounts to apply the policy in a budget-neutral manner.

Graduate Medical Education and Indirect Medical Education

CMS is proposing two changes to the Medicare policy for Graduate Medical Education (GME) and Indirect Medical Education (IME) funding regarding closing teaching hospitals and residency programs.

For purposes of residents transferring to other teaching hospitals with accredited programs, the date when a teaching hospital announces its closure date will be the key date to allow more flexibility for affected residents to transfer, rather than having to wait until the last day of operation. CMS also proposes to expand the displaced resident definition, and there’s also a proposed change for receiving hospitals. Learn more in the proposed rule.

Additionally, the IME formula multiplier is 1.35 for 2021 discharges. CMS estimates that this formula multiplier will result in a 5.5% IPPS payment increase for almost every 10% increase in a hospital’s resident-to-bed ratio.

Medicare DSH and Uncompensated Care Payments

CMS is proposing updates to the Medicare DSH estimate as well as the three factors used to compute uncompensated care payments.

Medicare DSH

The estimated Medicare DSH amount for FY 2021 is $15.359 billion, resulting in empirically justified amount of $3.840 billion. The remaining amount is Factor 1.

Uncompensated Care Factors

CMS is proposing the following uncompensated care factors for FY 2021:

- Proposed Factor 1 is $11.519 billion

- Proposed Factor 2 is 67.86%

When Factor 2 is applied to Factor 1, the result is an uncompensated care pool amount of $7.817 billion to be shared by qualifying hospitals. The 2021 pool is $534 million less than in FY 2020.

CMS is proposing to use Line 30 from FY 2017 Worksheet S-10 data for FY 2021 to determine Factor 3 for all hospitals, except Indian Health Service (IHS) and Puerto Rico (PR) hospitals. For IHS and PR hospitals, CMS is proposing to use a low-income insured days proxy utilizing 2013 Medicaid days and the most recent SSI days to calculate Factor 3 for one more year.

CMS is also proposing to use the most recent available single-year audited S-10 data for Factor 3 in all subsequent years.

Additional Factor 3 Proposals

CMS is proposing a merger multiplier for an acquired hospital in lieu of annualizing data.

In the case of a newly merged hospital’s final uncompensated care payment, CMS proposes that it should be determined at cost report settlement where the numerator of Factor 3 will be from the surviving hospital only for the current fiscal year. If the merged hospital’s data is for less than a 12-month period, the reported data will be annualized to 12 months.

CMS is proposing a modification to the long-cost-reports policy, where a hospital’s cost reporting period starts in one fiscal period and spans the entirety of the following fiscal year.

CMS is also proposing certain cost-to-charge ratio and uncompensated care data trims.

Interim Uncompensated Care Payments

CMS is proposing a voluntary process through which a hospital may submit a request for a lower per-discharge interim payment amount if the hospital thinks it may be overpaid due to a spike in FY 2021 discharges.

Medicare Bad Debt

CMS has proposed changes and updates to the Medicare bad debt rules and regulations.

According to the rule, these will be effective before, on, and after the effective date of the IPPS Rule of October 1, 2020, unless otherwise noted.

Longstanding Policies Clarifications and Codifications

This proposed rule is revising 42 CFR 413.89 to codify some longstanding policies. Because these were longstanding policies, the updated regulation has a retroactive impact on providers.

Allowable Medicare Bad Debts and Contractual Allowances

CMS clarified that premiums and Medicare copayments as well as Medicare bad debt amounts written off to charity care or contractual allowance accounts aren’t included in allowable bad debts under Medicare.

For cost reporting periods beginning on or after October 1, 2020, CMS proposes that Medicare bad debts be charged to an expense account for uncollectible accounts—bad debt or implicit price concession—instead of to a contractual allowance account.

Definition Changes

CMS is codifying the definition of nonindigent beneficiaries. They are also proposing to amend the definition of an indigent nondual eligible beneficiary.

Collection Efforts

CMS is also clarifying and codifying what reasonable time means for the issuance of a bill as well as how partial payments affect collection effort periods for nonindigent beneficiaries.

The proposed rule clarifies and codifies that providers must conduct similar collection efforts for collecting Medicare deductible and coinsurance as those they use when collecting similar amounts from non-Medicare patients, including the use of a collection agency.

CMS is also proposing to amend what constitutes a reasonable collection effort for dual eligible beneficiaries.

Topic 606 and Accounting for Medicare Bad Debt

CMS is proposing to recognize Accounting Standards Update (ASU) Topic 606 terminology, specifically addressing bad debts also known as implicit price concessions.

Other Notable Updates

CMS is proposing changes to many hospital programs, including:

- Hospital-Acquired Condition (HAC) Reduction Program

- Hospital Readmissions Reduction Program (HRRP)

- Hospital Inpatient Quality Reporting (IQR) Program

- Hospital Value-Based Purchasing (VBP) Program

- PPS-Exempt Cancer Hospital Quality Reporting (PCHQR) Program

- Medicare and Medicaid Promoting Interoperability Programs

In August 2018, CMS Office of Hearings (OH) and the Provider Reimbursement Review Board (PRRB) released the OH Case and Document Management System (OH CDMS). According to the proposed rule, the PRRB may require electronic filing using OH CDMS for all new appeal submissions for new and pending appeals. If adopted, there will be an update to the PRRB instructions and 60-days’ notice will be given. The earliest this change could be mandated is November 30, 2020.

Due to COVID-19, CMS is waiving the 60-day delay of the final rule effective date. Instead, there will be a 30-day delay of the final rule effective date. Historically there is a 60-day delay from the final rule publication date and effective date.

Economic Impact

The overall economic impact of this proposed rule is an estimated $2.07 billion in increased payments from the US Federal Government during FY 2021.

Public Comments

Hospitals have 60 days from the date the rule was put on public display to submit their comments on the full FY 2021 IPPS Proposed Rule, including notifying CMS of any inaccuracies in the data files used as part of the rule. Public comments can be submitted no later than 5:00 p.m. Eastern Standard Time on July 10, 2020. Reference CMS-1735-P in your comment submission.

Before submitting comments, consult with the rule’s submission instructions so you adhere to the proper method.

We’re Here to Help

For more information about the proposed rule and possible implications for you and your organization, contact your Moss Adams professional.