During this period of economic disruption caused by the COVID-19 pandemic, it’s natural to want to protect your assets. However, pursuing gifting opportunities during this time—while business valuations are lower for many companies—could benefit your estate and heirs.

During this period of economic disruption caused by the COVID-19 pandemic, it’s natural to want to protect your assets. However, pursuing gifting opportunities during this time—while business valuations are lower for many companies—could benefit your estate and heirs.

Though it’s difficult to predict an exact recovery timeline, increasing the ownership percentage of a private business you gift to your successors could pay off should the economy strengthen and valuations increase again. While financial markets hit lows in March, signs of improvement are beginning to emerge, so there could be limited time for business owners to make an appropriate gift in response to the current conditions.

Below is an overview of how declining company values could benefit your estate during the pandemic and factors to consider when determining your company’s value.

Why is now the time to gift?

While the fair market values of real estate, asset-holding companies, and operating companies have likely fallen during this disruptive time, business owners can gift a larger percentage of their companies at low values to increase the impact of estate planning.

Currently, the individual lifetime gift tax exemption—the highest amount your estate can gift during your lifetime without paying a gift tax—is $11.58 million. Should tax laws change in the future, there’s no guarantee the lifetime exemption will remain at this relatively high level.

Gifting while values are depressed can help reduce the impact on your lifetime exemption and allows you to move a greater percentage of assets out of your estate. This could also reduce your future estate taxes. In addition, your heirs could benefit from the appreciation in value of the assets that you gift once the economy normalizes.

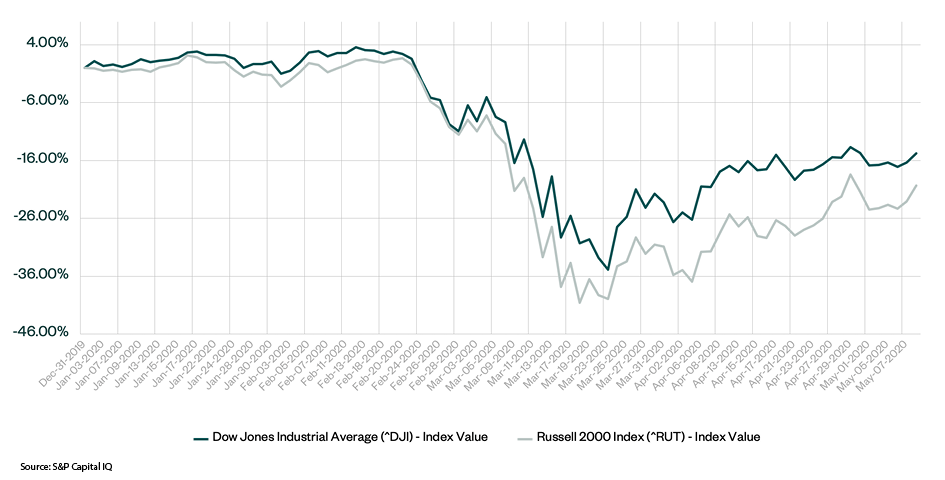

Since the end of 2019 through May 8, 2020, the Dow Jones Industrial Average and the Russell 2000 indices are down 14.7% and 20.3%, respectively, primarily as a result of the pandemic.

While additional time has passed since publication of this article, the below chart demonstrates markets are improving over time. This shows the sense of urgency that should accompany your decision-making process.

How has the value of my business been impacted?

Determining the ownership percentage of your company you’d like to gift will depend on the company’s current value. Every business has been impacted by the pandemic differently, so it will be important to address the specifics of your company.

Different valuation methods are often used to assess current value depending on the type of company. An overview of valuation methods for different companies follows, as well as how they might be impacted during this time.

Asset-Holding Companies

Asset-holding companies often hold investments in real estate or marketable securities, so their values are based on their net asset values, or the market value of assets less liabilities.

The values of assets held by these entities tend to decline in challenging economic environments, resulting in lower value of the company as a whole.

Operating Companies

Operating companies engage in a business other than holding assets for sale or rent. Two common methods of valuing an operating company are the market approach and the income approach.

Market Approach

The market approach uses valuation multiples derived from market transactions to arrive at a company’s value.

The valuation multiples from many public companies and merger and acquisition transactions have declined in the current market, causing closely-held company values to fall.

Income Approach

Under the income approach, estimated future cash flows are discounted to a present value.

Due to the economic downturn, the amount of future cash flows has declined for many companies. In addition, there’s additional risk associated with such cash flows.

Closely-Held Companies

The discount for lack of marketability is applied in a valuation context because no market exists for minority interests in closely-held companies. This means a minority interest in a closely-held company is illiquid and can’t easily be sold and converted to cash.

During periods of high volatility, investors typically prefer to hold liquid investments in lieu of illiquid investments. This means the discount applicable to illiquid investments typically increases.

Therefore, larger discounts for lack of marketability could now be applicable to minority interests in closely-held companies. These discounts cause minority interest values to be lower than they would in a less volatile market environment and increase the estate benefits associated with gifting.

Do I need to consider the specifics of my industry?

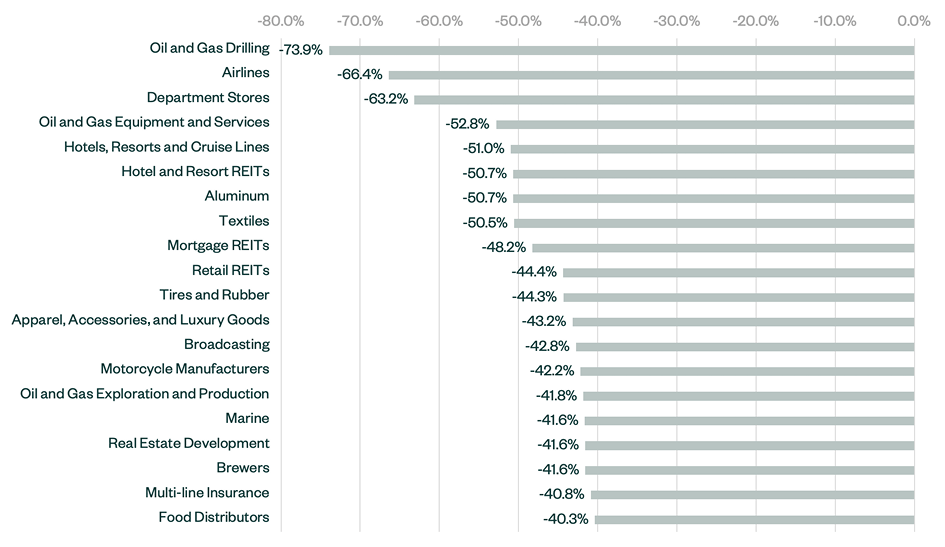

While some industries are currently benefiting from the present market volatility, most have seen their value drop significantly in terms of market capitalization, which is defined as price per share times the number of shares outstanding.

The value of your private company is directly tied to the values of comparable publicly-traded companies. Of the 157 industry classifications provided by S&P Capital IQ, 112 have experienced a market capitalization decrease of 10% or more.

Below, is a sample of how the overall market capitalization in select industries has changed since the end of 2019 to provide a sense of how your industry might be performing.

Example

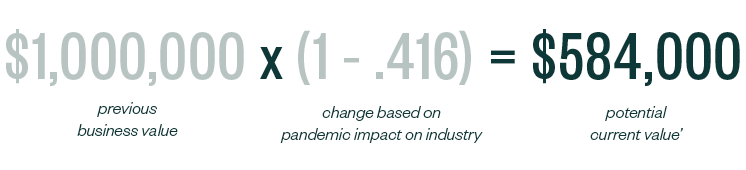

Consider a business owner in the brewing industry interested in gifting a 10% ownership interest in the company to a successor.

As of December 31, 2019, the 10% interest was worth $1 million after appropriate discounts for lack of control and marketability. As of May 8, 2020, that same 10% interest could be worth 41.6% less, or $584,000, due to the impact the pandemic has had on that particular industry.

You can assess the potential impact on your business through the below formula, referencing the brewing industry as the example.

Are there any tax-savings opportunities?

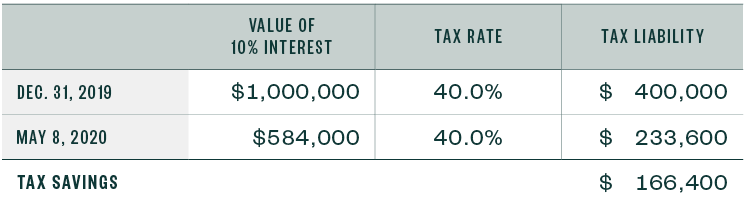

As noted in the brewing industry example above, making the gift of the 10% ownership interest as of the present date could result in federal transfer tax savings of $166,400, or 41.6%, if you have already exceeded your individual lifetime gift tax exemption.

Following is the breakdown.

In a situation where the full lifetime gift tax exemption remains, the business owner only used up $584,000 of their exemption, instead of $1,000,000 had the transfer been made at the end of 2019 when values for the brewing industry were significantly higher.

We’re Here to Help

To learn more about the advantages of estate-planning opportunities during this time, contact your Moss Adams professional.