As audit committees continue to address disruption from the COVID-19 pandemic, some regulatory bodies—including the American Institute of CPAs (AICPA)—have issued guidance to assist audit committees in performing their oversight, risk management, and governance functions.

As audit committees continue to address disruption from the COVID-19 pandemic, some regulatory bodies—including the American Institute of CPAs (AICPA)—have issued guidance to assist audit committees in performing their oversight, risk management, and governance functions.

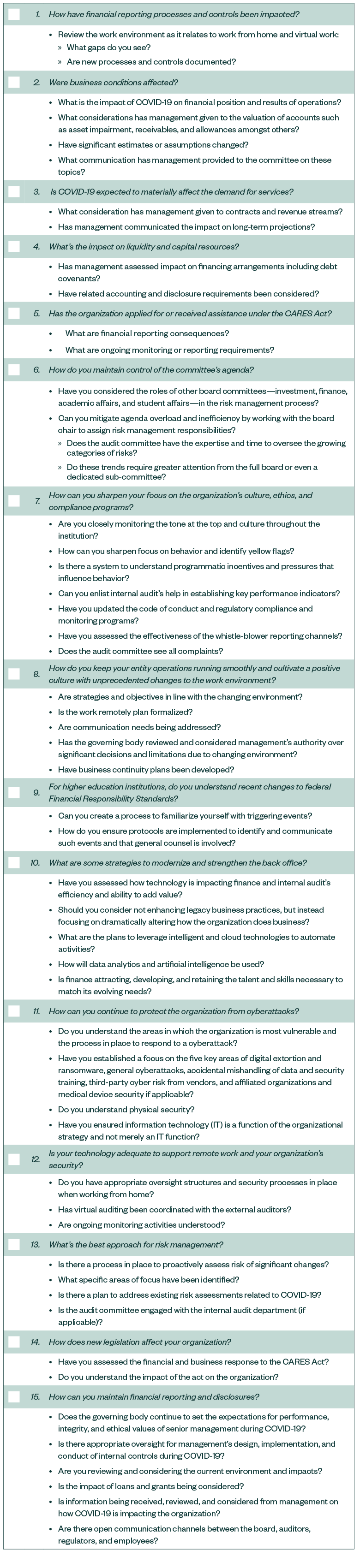

To help not-for-profit organizations and higher education institutions navigate these unprecedented times, we’ve summarized some key considerations for audit committees to examine when executing financial reporting responsibilities and working to ensure audit and financial reporting quality.

Essential questions cover how the pandemic has impacted the following topics:

- Financial reporting processes and controls

- Business conditions

- Demand for services, programs, or goods

- Liquidity resources

- CARES Act funding and stimulus

- Technological changes and cybersecurity

In addition to the questions your audit committees should ask, we’ve also included a list of follow-up inquiries to help your organization determine if it’s meeting its benchmarks.

15 Questions and Follow-Up Inquiries to Consider

If you’d like to view a PDF version of the checklist above, please click here.

We’re Here to Help

If you have any questions about the challenges your audit committees are facing as a result of COVID-19, please contact your Moss Adams professional.