On July 6, 2020, the Seattle City Council voted 7-2 to pass Council Bill 119810, which imposes a Seattle payroll expense excise tax on large employers.

An overview of the ordinance follows.

To whom does the tax apply?

The tax is imposed quarterly on persons, which includes not-for-profit organizations or other entities, with highly-paid employees, specifically:

- Persons with a Seattle annual payroll expense of at least $7 million

- Employees or independent contractors who earn $150,000 or more per year

Exclusions are provided for the following:

- Grocery businesses

- Insurance businesses

- Certain motor vehicle fuel businesses

- Liquor businesses

- Independent contractors whose compensation is included in the payroll expense of another business that’s subject to this tax

Businesses engaging temporary or contracted employees are responsible for reporting and paying the tax for such individuals, regardless of if the employees are from an employment agency.

What’s included in payroll expense?

For purposes of the tax, compensation includes:

- Salary

- Wages

- Bonuses

- Commissions

- Equity compensation

- Severance payments

- Previously accrued compensation

Pass-through Entities

For owners of a pass-through entity, compensation includes guaranteed payments for services rendered, or work performed, and net distributions.

Compensation, however, doesn’t include payments to a pass-through entity owner that aren’t earned for services rendered, including—for example—return of capital, investment income, or other income from passive activities.

Employee Compensation

When determining the extent to which the tax applies to any given company, it’s necessary to evaluate what’s included in payroll expense.

Payroll expense includes employee compensation, including payments made to independent contractors, if the employee or independent contractor:

- Is primarily assigned to a business location within Seattle

- Isn’t primarily assigned to any place of business for the tax period and performs 50% or more of their services for the tax period in Seattle

- Isn’t primarily assigned to any place of business for the tax period, the employee doesn’t perform 50% or more of their services in any city, and the employee resides in Seattle

The ordinance includes a provision allowing apportionment of payroll expense for payroll related to work done and services provided within and outside Seattle.

This must fairly represent the compensation paid by the taxpayer to its employees that’s attributable to work performed or services rendered in Seattle.

How is the tax rate determined?

This quarterly payroll expense tax is imposed on the Seattle payroll expense of the person multiplied by the applicable tax rate.

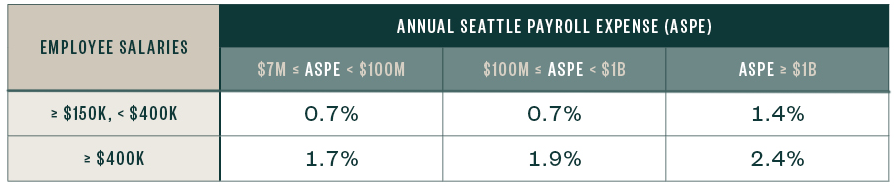

The applicable tax rate is on a sliding scale from 0.7% to 2.4%, depending on the person’s annual Seattle payroll expense and the level of compensation of the company’s employees.

Many persons will apply two different rates in calculating the amount of tax due, distinguished by payroll expense related to employees making:

- Between $150,000 per year and $399,999 per year

- More than or equal to $400,000 per year

Health Care Deductions

Not-for-profit health care entities are allowed a deduction from the measure of the tax equal to the payroll expense of employees with annual compensation of $150,000 to $399,999.99 for the period from January 1, 2020 through December 31, 2023.

Example

Consider the following example for how the tax’s rates are determined.

A person incurs $10 million in annual Seattle payroll expense, of which:

- $2.5 million is related to employee salaries under $150,000

- $5 million is related to employee salaries under $400,000 but at least $150,000

- $2.5 million is related to employee salaries greater than or equal to $400,000

The $2.5 million of annual Seattle payroll expense isn’t subject to this tax, while the $5 million and other $2.5 million are subject to 0.7% and 1.7% payroll tax, respectively. This person would owe $77,500 in tax.

When does the tax go into effect?

The ordinance was sent to Mayor Jenny Durkan for approval; however, she expressed concerns and opted to let the ordinance pass without her signature. Without a mayoral veto, no further action is necessary from the Seattle City Council; the ordinance will take effect August 16, 2020.

The tax will become effective January 1, 2021 and sunset December 31, 2040. However, the ordinance states that the council will reevaluate the tax if the county or state creates a revenue source that overlaps with the goals of the ordinance before December 31, 2040.

Tax Compliance

In the first year of compliance, the tax for 2021 will be paid in one annual installment due January 31, 2022.

In subsequent years, the tax will be paid in quarterly installments, with the tax being due by the end of the month following the end of each calendar quarter. For example, Q1 is due April 30.

We’re Here to Help

For more information about how your business could be affected by the new tax, contact your Moss Adams professional.