Paycheck Protection Program (PPP) loan forgiveness and its tax and financial reporting implications are steeped in uncertainty. The key challenges are the timing of income recognition and deductibility of expenses, among other tax and reporting questions.

Complexity with Timing

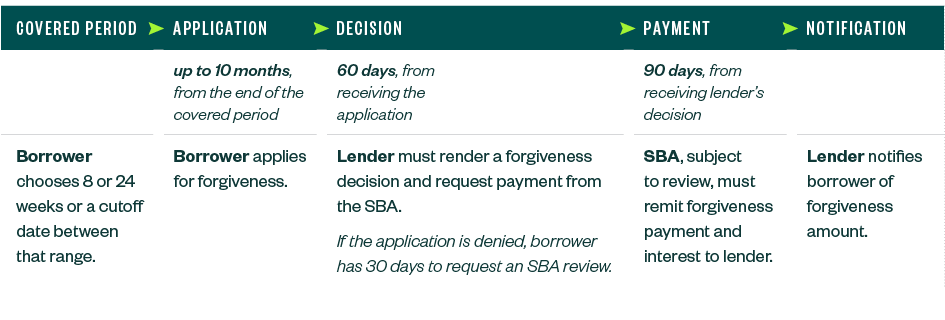

It’s likely you won’t know if your loan is forgiven and by how much until 2021, which will have implications on your tax planning and financial reporting. Here’s what we know about the timeline to apply for forgiveness.

Forgiveness Application Timeline

Companies can choose a covered period of eight or 24 weeks or a cutoff date between that range. Each has its own financial implications to consider.

From the end of their chosen covered period, borrowers have 10 months to apply for forgiveness. Once the application is received by the lender, the lender has 60 days to render a forgiveness decision and request payment from the Small Business Association (SBA).

From that point, the SBA has 90 days to remit payment of the forgiveness amount and interest through the payment date back to the lender. It’s then the lender’s responsibility to notify the applicant of the forgiveness amount received from the SBA. If the forgiveness application is denied by the lender, the borrower has 30 days to notify the lender that they request a review by the SBA, which the SBA isn’t required to accept.

Timeline at a Glance

Finally, the SBA has said it will automatically review PPP loans over $2 million. If a loan is forgiven, the SBA has a five-year statute of limitations to reassess its forgiveness.

2020 versus 2021

With this timeline, it could be well into 2021 until a borrower knows how much of their loan is forgiven. The question is whether the forgiveness of the loan increases taxable income in 2020 when the proceeds are received and expenses are incurred or in 2021, when the borrower receives confirmation their loan is forgiven. There’s also a question of whether the ultimate tax treatment of these income and expense items will match your generally accepted accounting principles (GAAP) financial statements or not.

Following are considerations related to the complexities of tax planning and financial reporting for your PPP loan forgiveness.

Tax

For federal purposes, PPP loan forgiveness may be excluded from gross income by an eligible recipient by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

However, the IRS issued Notice 2020-32 in April 2020 stated that expenses associated with the tax-free income are nondeductible. This guidance was consistent with historic IRS guidance regarding nontaxable income and related expenses but has the net effect of essentially reversing the tax-free benefit of the exclusion on the loan forgiveness.

While the IRS guidance doesn’t appear to align with Congress’s expressed intention, there hasn’t yet been a law to rectify it despite discussion in Congress about fixing it.

Taxability of Expenses

Based on current guidance, we know that expenses associated with forgiveness are nondeductible. What isn’t clear is if they’re nondeductible for 2020 tax returns or not until 2021 when forgiveness is determined.

This leaves timing the most significant question mark.

Forgiveness in 2021

As detailed above, most borrowers aren’t likely to see their final forgiveness notification until 2021. If you file your 2020 return before forgiveness is determined, should you deduct the expenses related to the use of the PPP funds? Or do you disallow the deduction, assuming the loan ultimately will be forgiven? If you deduct the expenses, what happens when the loan is forgiven?

At this point, these questions are still unanswered. Taxpayers should consider filing extensions for their 2020 tax returns to hold off on filing until forgiveness is determined or potentially Congress acts to address this issue.

It’s also important to note that you may have to file a tax return before you know the ultimate forgiveness amount depending on the timeline of your application and other factors including your fiscal year-end. In this case, there’s limited guidance available on the tax return reporting requirements.

Forgiveness in 2020

If you’re able to apply and receive forgiveness in 2020, the answer on timing is simple. You have nontaxable income and nondeductible expenses in the same period for federal purposes based on current guidance. If you fall into this category, don’t stop here. Keep reading for more details on planning around nondeductible expenses.

Estimated Tax Payments

All of this uncertainty impacts tax planning, particularly estimated tax and extension payments for 2020.

Due to business disruption related to the pandemic, many taxpayers have chosen to forgo protective estimated tax payments based on 110% of prior year for estimates based on current-year projected taxable income. If you do decide on protective payments, assess it from a cash-flow perspective to make sure it’s the right approach for you.

With two quarterly estimated tax payments remaining this tax year, you’ll need to consider how or if you incorporate this into your payments. However, no matter what you decide for estimates, a decision will ultimately need to be made at extension time.

Election Impact

An election year often creates uncertainty with tax planning.

If loan forgiveness produces taxable income through a reduction in deductible expenses, you’ll need to assess the year it’s taxable in and the respective tax rates, if different. Legislation that may provide the basis for determining answers to these questions may be delayed during an election period or during a change in administration. Filing an extension for 2020 may give you the opportunity to see the full impact of any planning.

Nondeductible Expense Allocation and Planning

After it’s determined that the expenses associated with loan forgiveness are nondeductible, the next question is how to allocate those nondeductible expense to the different categories of qualified expenses used to apply for forgiveness.

At first glance, this may not seem to matter; however, there may be opportunity in that allocation.

Take interest expense, for example. For many companies, tax reform in 2017 made the deductibility of interest expense an area requiring planning. If your interest expense became limited under those law changes, an allocation of the nondeductible expenses to interest expense may be beneficial compared to an allocation to other nonpayroll costs such as rent and utilities.

Again, there may be future guidance from the IRS on this issue. Until then, it’s important to take the time to assess your options.

Financial Reporting

Although the legal form of the loan is debt, it’s possible in certain circumstances to account for your PPP loan as a government grant. There’s no guidance in existing US GAAP that specifically considers how to account for forgivable loans obtained from, or guaranteed by, a governmental entity.

Business entities will generally account for a PPP loan as either:

- Debt. The loan proceeds are recorded as debt on the balance sheet. Any amount forgiven would be recognized in the income statement only when loan forgiveness is granted and approved by the SBA.

- In-substance grant. If the loan is expected to be forgiven and specific conditions are met, the loan proceeds may be recorded as a deferred income liability on the balance sheet. Income would be recognized as you spend the money on eligible expenses.

There are significant hurdles, however, to be eligible to account for a PPP loan as an in-substance grant. There must be reasonable assurance that your loan will be forgiven and that you meet all requirements on the loan application, including proving the necessity for that loan. Consult with your accounting advisors and auditors before selecting this accounting treatment.

Depending on the accounting policy elected, your GAAP financial statements may or may not match your tax returns. You’ll be required to disclose the accounting policy for the loan and the related impact to the financial statements, regardless of the accounting treatment applied. See our Alert for more details on the financial accounting.

Bank Covenants

How lenders view PPP loans may have a significant impact on financial covenants.

Accounting for a PPP loan as debt could impact your ability to meet certain covenants because the full amount of the PPP loan would be recognized as debt on the balance sheet and you won’t recognize the benefit of loan forgiveness income until the lender formally forgives the loan and the debt is extinguished.

On the other hand, if you meet the criteria to account for the loan as an in-substance grant, you may be able to recognize the income (or off-set to expense) from PPP loan forgiveness sooner, as the related expenses are incurred. Additionally, the portion of the proceeds that are spent on eligible expenses wouldn’t be presented as debt. This treatment may have a favorable impact on certain covenants.

It’s advisable to have a conversation with your bank about how you’re accounting for your PPP loan to better understand the ramifications of either approach. In most cases, companies received their PPP loan from their current lender.

Other Considerations

There are two additional considerations to keep in mind—record keeping and staying up-to-date with the latest information related to your forgiveness:

- Record keeping. It will be very important to keep records helping to prove to the SBA the necessity of your loan because the SBA has a five-year statute of limitations to reassess its forgiveness. The SBA has already said it will automatically review PPP loans over $2 million.

- Up-to-date information. There’s a significant calculation that goes into applying for forgiveness. It’s important to keep up on the latest rules and regulation on the program to be sure you’re making decisions based on accurate data. The SBA is still releasing updates to its FAQ.

We’re Here to Help

For more information on your tax and financial reporting implications or if you have general PPP questions, please contact your Moss Adams professional. You can also explore our video on PPP loan forgiveness and Disruption Services, which includes information about PPP and the Main Street Lending Program.