As a primary component of Medicare Disproportionate Share Hospital (DSH) reimbursement, a hospital’s Supplemental Security Income (SSI) percentage plays a significant role in determining the reimbursement impact.

Hospitals should research annually whether their facility could benefit from an SSI percentage recalculation, also known as an SSI recalculation, realignment, or redetermination. If this hasn’t been historically or consistently reviewed, it’s recommended that hospitals perform a look back through their SSI data.

What is the SSI Fraction?

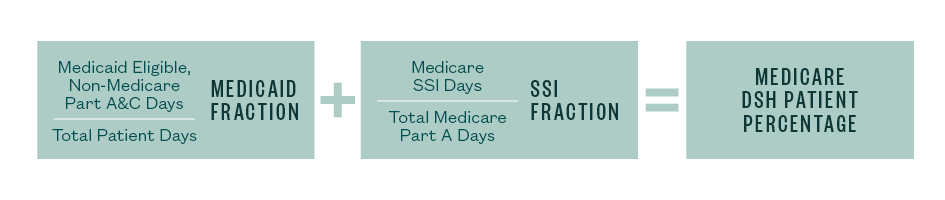

Also referred to as the Medicare fraction of the Medicare DSH calculation, the SSI fraction represents the percent of patient days for beneficiaries who are eligible for both Medicare Part A and Part C and SSI.

By default, SSI fractions are based on the federal fiscal year (FFY) end—October 1 to September 30—and are generally published annually by the Centers for Medicare & Medicaid Services (CMS).

This concept makes sense for providers whose cost reporting period mirrors the federal fiscal year, but what about providers with cost reporting periods that differ from the September 30 FFY end?

Current CMS regulations allow a hospital to request its Medicare fraction or SSI ratio be recalculated or realigned based on the hospital’s cost reporting period when it’s different from the federal fiscal year.

In practice, if a hospital’s fiscal year-end is December 31, 2017, the September 30, 2017, SSI ratio would be used in the Medicare Disproportionate Share calculation. According to the CMS regulations mentioned above, the SSI ratio could be recalculated to mirror the hospital’s fiscal year beginning on January 1, 2017, and ending December 31, 2017, by using a combination of two federal fiscal years of the Medicare Provider Analysis and Review (MedPAR) file.

Both the September 30, 2017, and the September 30, 2018, SSI ratio data would need to be analyzed to determine the hospital fiscal year SSI ratio.

Determining Benefit

It’s a common misconception that stakeholders can attempt to estimate if they benefit from an SSI ratio redetermination by identifying provider fiscal years where their SSI percentage increased year over year. However, patient-level detail must be obtained and analyzed to accurately calculate and prepare a request for an SSI percentage redetermination from federal fiscal year to hospital fiscal year.

Once requested, hospitals must use the recalculated SSI percentage for the requested fiscal year. If a redetermination isn’t analyzed properly, it could actually harm the hospital by decreasing reimbursement.

Data Required

CMS mines SSI patient detail data from MedPAR—a maintained record set that contains inpatient prospective payment system (IPPS) billing records for all Medicare beneficiaries who received inpatient hospital services. It’s this patient detail that should be analyzed to properly determine the effects of a redetermination.

Let’s establish another quick example. Hospital A’s fiscal year-end is June 30, 2018. Traditionally, the September 30, 2017, SSI percentage would be used in the Medicare DSH calculation. However, since CMS regulations allow for an SSI redetermination, a recalculated SSI percentage would use a combination of data from the September 30, 2017, and September 30, 2018, routine use files that cover the months included in the hospital’s cost reporting year.

Data Analysis

While the concept of requesting an SSI percentage redetermination seems fairly simple, hospitals should be aware the process contains many steps including data reconciliation. Verification of the published SSI percentage is always a recommended first step which can be accomplished by reconciling the routine-use, patient-level data.

When reviewing the routine-use data, providers should also be aware of the potential impact of Medicare Advantage days; the Allina Health Services v. Sebelius decision of the Supreme Court of the United States could have implications on what data should ultimately be included in your SSI percentage.

These are just a couple of data scrubbing procedures that must be completed prior to requesting an SSI redetermination. After all data scrubbing measures are performed, if your recalculated SSI percentage is found to be higher than the CMS-published SSI percentage for your hospital and fiscal year, then you could benefit from a recalculation and should prepare a redetermination request.

We’re Here to Help

If you have any questions about facilitating SSI percentage redetermination data analyses or requests, please contact your Moss Adams professional.