Taxes often take center stage during an election year, and the coming presidential election is no different.

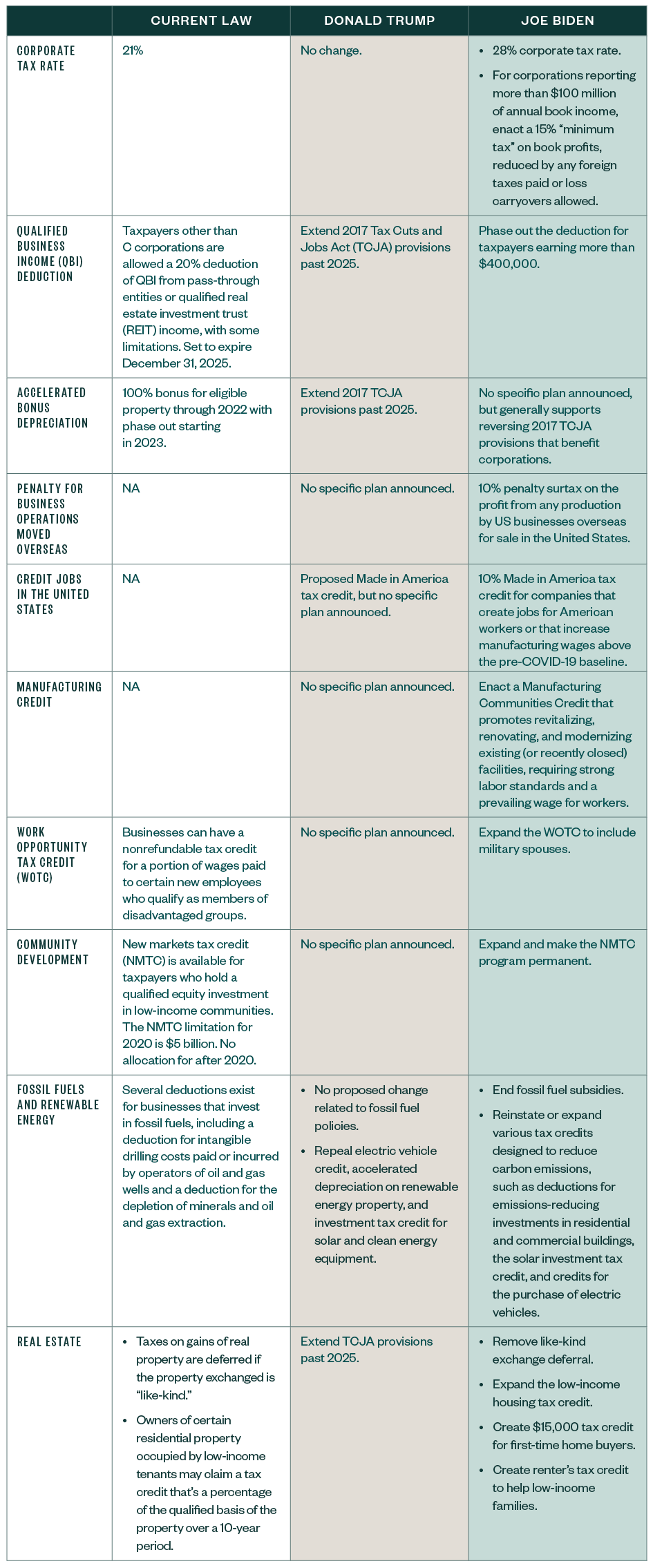

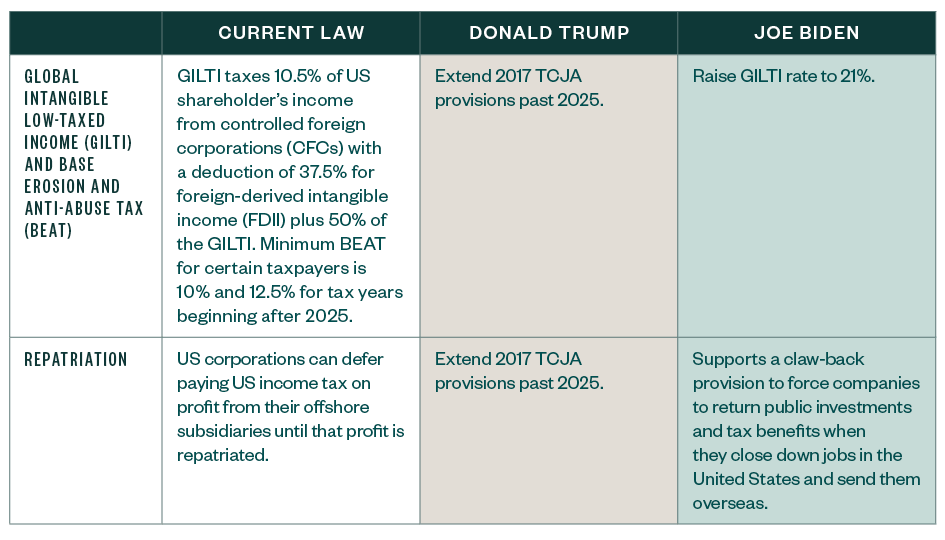

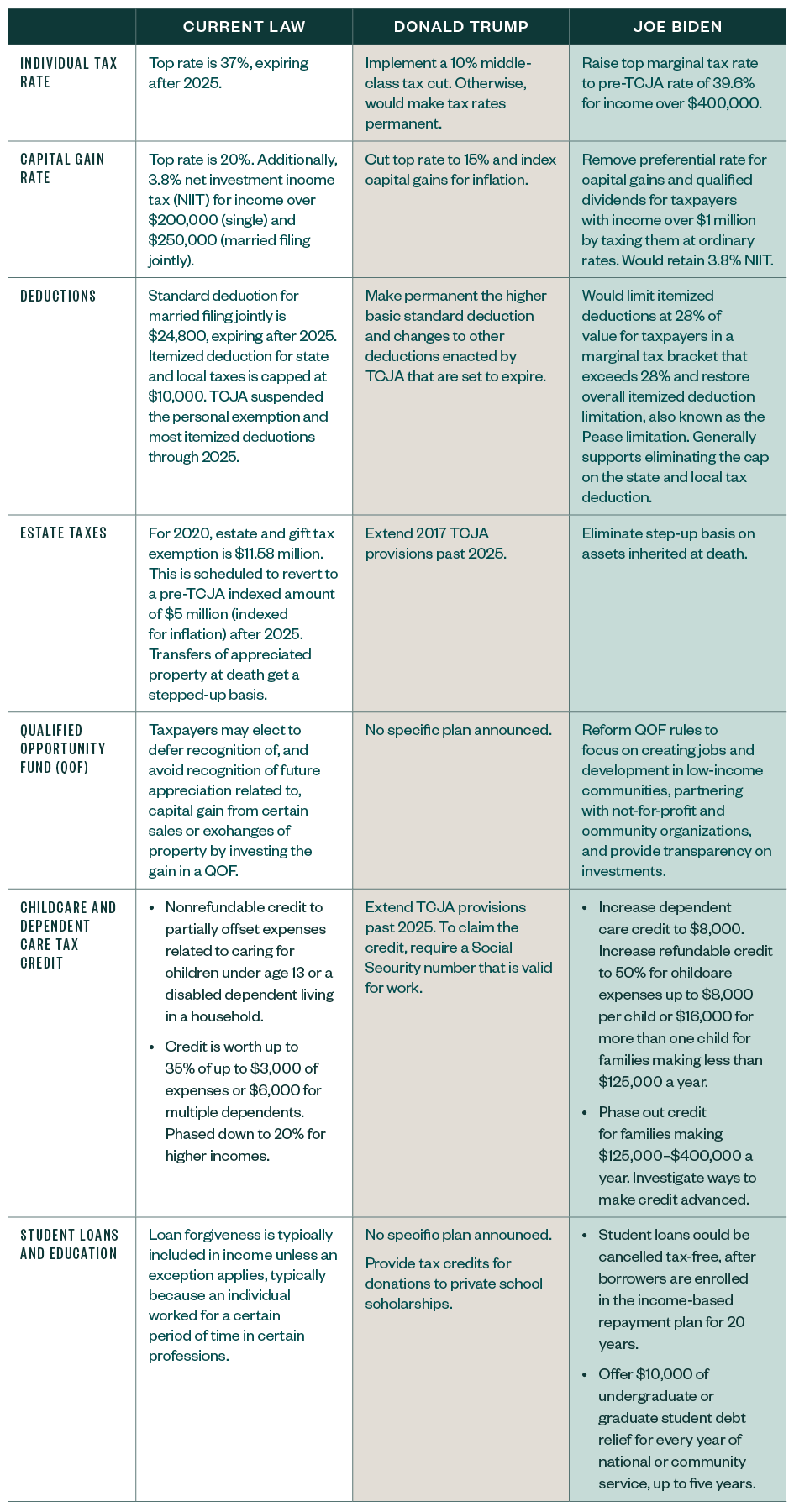

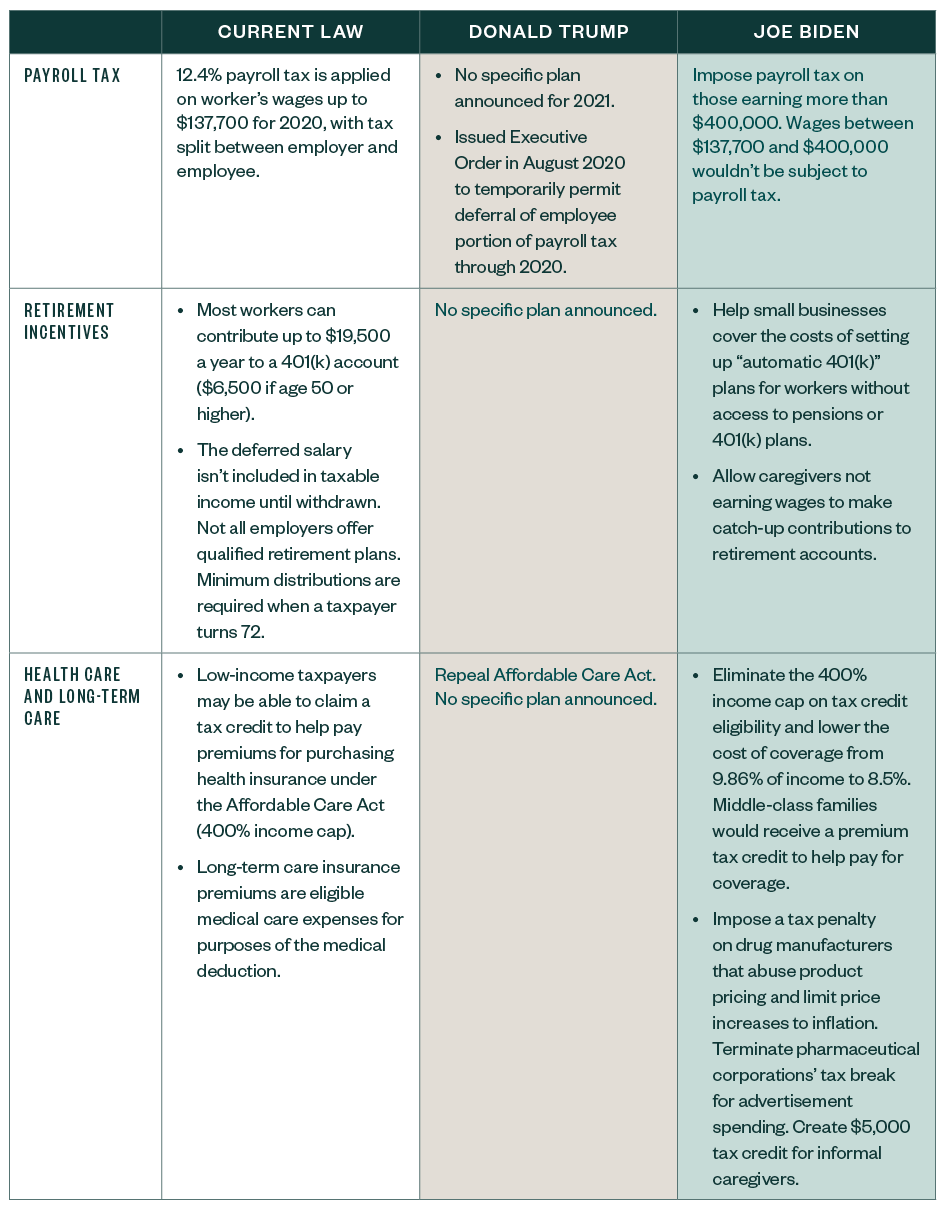

Following is a side-by-side comparison that shows you current tax law as well as proposed changes from President Donald Trump and Democratic nominee Joe Biden. We cover proposals for businesses, including those that operate internationally, individuals, and other tax provisions.

Businesses

International

Individuals

Other Tax Provisions

We’re Here to Help

For questions or insight on how some of these proposals might affect your business or individual finances, contact your Moss Adams professional.