On October 20, 2020, the Federal Deposit Insurance Corporation (FDIC) announced an interim final rule that provides banks with temporary relief from the audit and reporting requirements under Part 363 of the FDIC Rules and Regulations.

Below, we cover the key changes and primary effects for banks.

Background

Requirements and Measurement

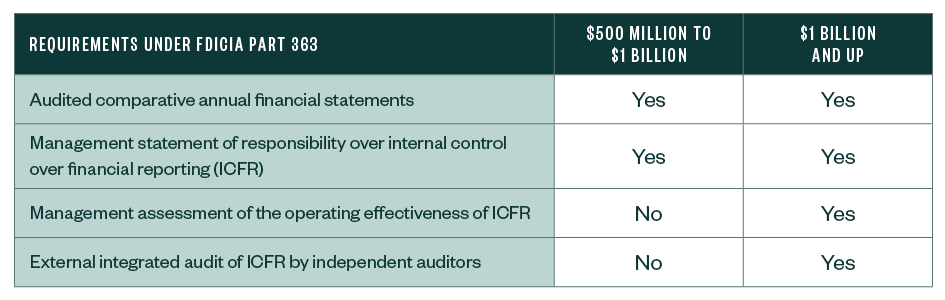

The requirements of Part 363 are based on the asset size of the bank, with the key requirements summarized in the following table.

The FDICIA Part 363 requirements are often considered the most significant after a bank crosses over $1 billion in assets. The requirement of an internal control over financial reporting (ICFR) integrated audit by independent auditors can create a significant level of preparatory work for the bank and increase external audit fees.

Although the measurement date for Part 363 requirements is the first day of the fiscal year, it’s measured by the consolidated total assets on the last day of the preceding year. For example, a bank that’s evaluating requirements for the year ended December 31, 2021, would use the December 31, 2020, consolidated asset balance to determine Part 363 requirements.

Asset Growth in 2020

During 2020, many banks saw unexpected growth in their balance sheets due to COVID-19-related stimulus programs, which may only be temporary and not a representation of the core balance sheet size. Relief initiatives such as the Paycheck Protection Program (PPP) caused many banks to grow over the $1 billion threshold during 2020. As PPP loans are forgiven, the balance sheets may fall back below $1 billion.

If a bank’s consolidated assets are above $1 billion at December 31, 2020, and fall below $1 billion during 2021 as PPP loans are resolved, the bank would still be subject to all of the Part 363 requirements for the year ended December 31, 2021.

Key Changes

To help alleviate the impact of this unanticipated growth, the FDIC’s Interim Final Rule provides temporary relief by allowing banks to use the December 31, 2019, consolidated asset balance when determining their fiscal year 2021 requirements under Part 363.

Effectively, whatever requirements were in place for fiscal year 2020 continue to be in place for fiscal year 2021. At a minimum, this provides banks extra time to prepare for the increase in compliance requirement, or, in some cases, may enable them to adhere to a lower level of compliance requirements because of their asset size.

Exception

The notable exception in the interim final rule is that the FDIC reserved the right to require banks to comply with one or more of the Part 363 requirements if the asset growth was a result of a merger or acquisition.

For example, if a $800-million bank acquired a $400-million bank during 2020, which resulted in an asset size of $1.2 billion, the FDIC could require compliance with the Part 363 requirement. The bank would then need to obtain an ICFR audit for fiscal year 2021.

We’re Here to Help

For more information about Part 363 requirements, including ICFR compliance for your institution, explore our FDICIA Reporting Guide and compliance solutions or contact your Moss Adams professional.