The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2020-11, Financial Services—Insurance (Topic 944): Effective Date and Early Application, on November 5, 2020.

In light of business disruptions due to the COVID-19 pandemic, the ASU is intended to help insurance companies effectively implement new guidance by providing a one-year deferral of the effective date for ASU 2018-12, Financial Services—Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI). ASU 2020-11 also eases the transition requirements for entities that early adopt the LDTI standard.

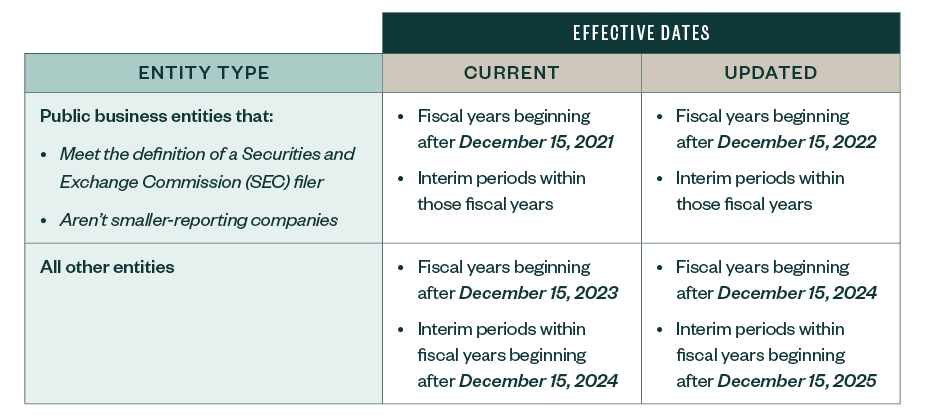

Updated Effective Dates

To provide additional time for implementing the LDTI standard, ASU 2020-11 defers the effective date of ASU 2018-12 by one year for all entities.

.png?width=945&height=420&ext=.png)

An entity is required to use its most recent determination of whether it’s eligible to be a smaller-reporting company, in accordance with SEC regulations, as of November 15, 2019. This was the issuance date of ASU 2019-09, Financial Services—Insurance (Topic 944): Effective Date. For example, for calendar year-end companies, the determination date would generally be as of June 28, 2019—the last business day of the second quarter.

Early application is still allowed.

Transition Relief

To facilitate early adoption of the LDTI standard, ASU 2020-11 amends the early-application requirements. It allows entities to apply the standard as of the beginning of the most recent prior period, if they choose to early adopt.

If an entity elects early application of the LDTI standard, it may choose a transition date of either the beginning of the prior period presented or the beginning of the earliest period presented. Conversely, if an entity doesn’t elect early application of the LDTI standard, the transition date remains the beginning of the earliest period presented.

We’re Here to Help

For more information on how these changes could affect your business, contact your Moss Adams professional.