On February 23, 2021, Governor Gavin Newsom signed a legislative package to provide further immediate assistance through the COVID-19 Relief Grant to help Californian families and businesses.

Part of this package includes a four-fold increase—from $500 million to $2.1 billion—in grant funding to small businesses and not-for-profit cultural institutions.

These funds and tax relief measures build on previous, ongoing efforts to support small businesses during the pandemic.

Previous relief included legislation signed November 30, 2020, which provided immediate assistance for small businesses, including not-for-profits, impacted by the COVID-19 pandemic.

Additional Rounds of COVID-19 Relief Grant Funding

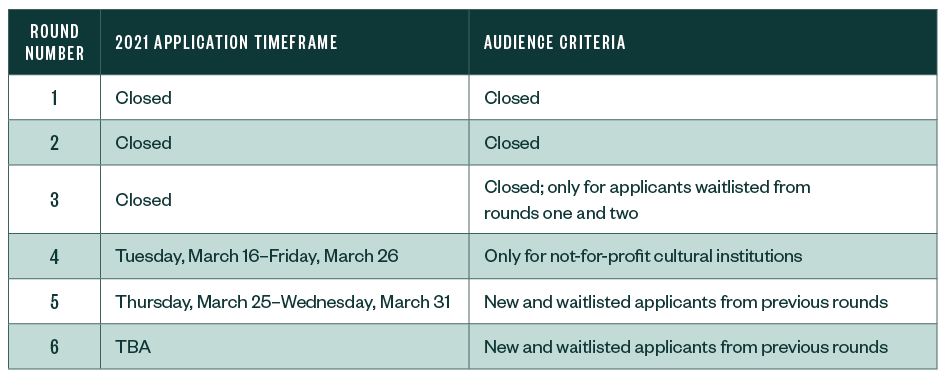

With this increased funding, there are now additional rounds of funding to which small businesses can apply. Following are details for rounds one through six.

Timeframes and Criteria for Application Rounds

How to Apply for COVID-19 Relief Grant

Underserved micro- and small businesses—both for-profit and not-for-profit—may apply for grants up to $25,000 to be distributed by early 2021.

Eligibility

To apply, cultural institutions must be a registered 501(c)(3) not-for-profit entity that matches one of the 13 listed North American Industry Classification System (NAICS) Codes that can be found in the not-for-profit cultural institution application guide on the CalOSBA website.

All businesses—for-profit and not-for-profit alike—must have a physical address in California. Not-for-profit businesses must be registered 501(c)(3), 501(c)(6), 501(c)(19).

Apply Online

Eligible applicants will need to apply online through a Lendistry partner. You can select partners based on those available in your county or by language. Any partner you apply through is acceptable.

You must first complete the online application. Once complete, you’ll receive a confirmation email with log-in information to upload the necessary documents.

Required Documents

Stage One

- Application Certification

- Grant application, completed through the online portal

- Government-issued photo identification, such as a driver’s license or passport

- Business financial information

- Most recent tax returned filed—2019 or 2018

- Evidence of minimum gross annual revenue between $1,000 and $2.5 million

Stage Two

- Copy of official filing with the California Secretary of State, if applicable, or local municipality, such as:

- Articles of Incorporation

- Certificate of Organization

- Fictitious Name of Registration or Government-Issued Business License

- Not-for-profits must provide a copy of their most recent IRS tax exemption letter

- Verification of bank account

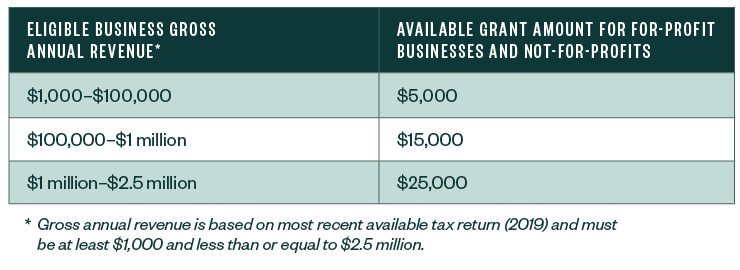

Application Amount Is Based on 2019 Gross Revenue

In rounds five and six, there will be $729 million available in grant funding in each round for for-profit and not-for-profit organizations.

The amount that businesses can apply for is contingent on the applicant’s gross annual revenue as filed on their most recent tax return (2019). Those that have gross revenue between $1,000 and $2.5 million are eligible; this excludes arts and cultural organizations that have a different set of eligibility criteria, as described in the next section.

Application Criteria and Amounts

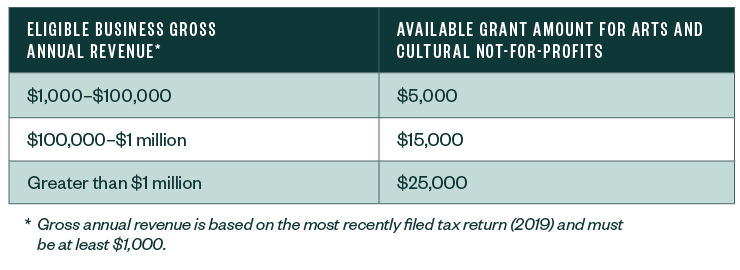

Different Application Process for Cultural Organizations

Previously, there was no designated amount allocated nor a separate application process specifically for not-for-profit cultural institutions. Under the expanded package, $47.5 million of the $2.1 billion is earmarked for these institutions.

Not-for-profit cultural organizations now have a separate application through which they can apply for grants between $5,000 and $25,000. Application dates are from March 16 to March 26.

Application Criteria and Amounts

Additional Tax Relief Measures

Businesses filing less than $1 million in sales tax will receive an automatic 90-day income tax extension.

Penalty- and interest-free payment arrangements will be available to businesses with up to $5 million in taxable sales.

Additionally, larger businesses severely impacted by COVID-19 will have more opportunities to enter interest-free payment arrangements.

We’re Here to Help

To learn how these relief opportunities could help your business or organization, as well as how to address compliance with applicable restrictions or requirements, contact your Moss Adams professional.

Additional Resources

- California Small Business COVID-19 Relief Grant Program

- FAQs

- Application guide for all businesses

- Application guide for not-for-profit businesses

- Application guide for not-for-profit arts and cultural institutions

Special thanks to Consulting Senior Pat Oungpasuk for her contributions to this article.