Add in modern distractions, competitive pressures, increasing work tempo, remote-work—and you have a recipe for important operational cues to be missed, or worse, a loss of trust in an individual or a process. Over time, this can lead to significant issues.

Benefits of Dashboards

Regardless, spreadsheets are here to stay, and there will always be a need for the one-off processing they enable. However, many of their functions can be replaced and improved by dashboards.

Visualize Trends and Insights

Dashboards allow you to visualize trends over time and track any spikes or dips, which can be more meaningful than simply looking at raw numbers.

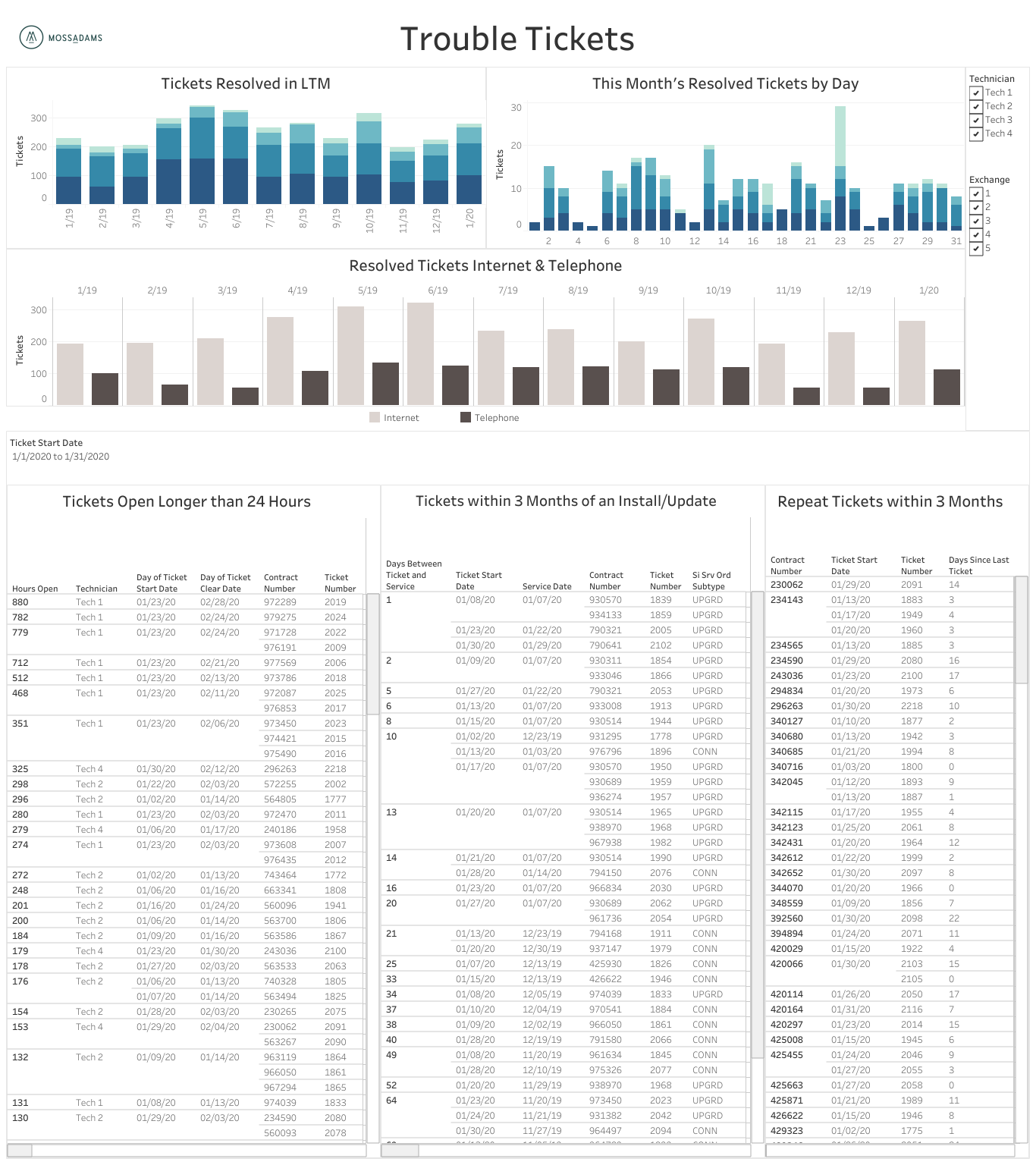

Additionally, depending on the source of the dataset, you can easily drill down to the most specific level of detail, whether it be the account balance, journal entry with header information or line item detail, or even customer-level insights.

When utilizing data visualization software and dashboards, all your financial data is conveniently connected and stored in one place for easier accessibility. For example, you may currently produce multiple sets of financial statements for your various companies and subsidiaries separately. With dashboards, you can access and visualize this data at once and instantly change selections or assumptions. This can improve efficiency for your team.

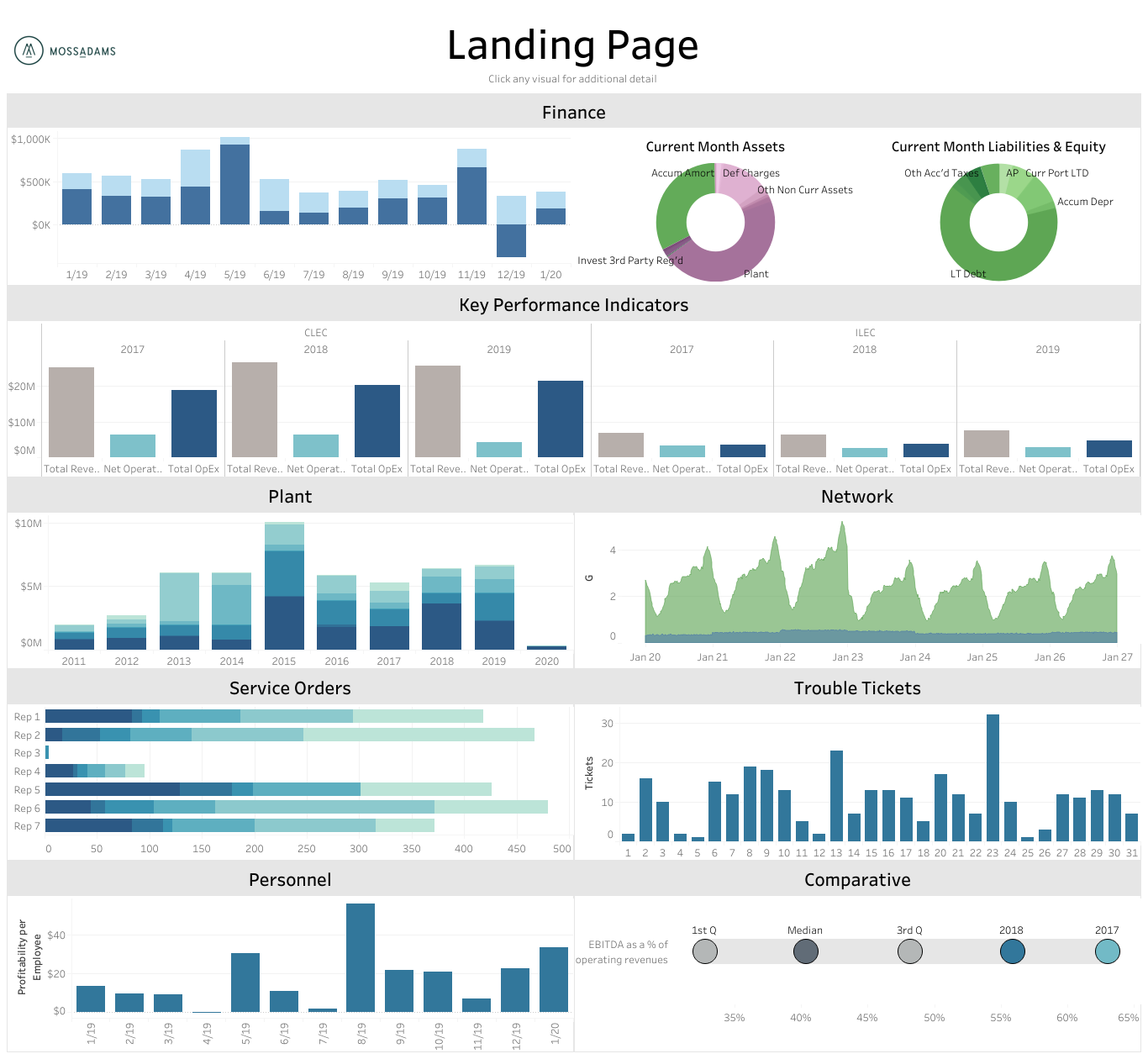

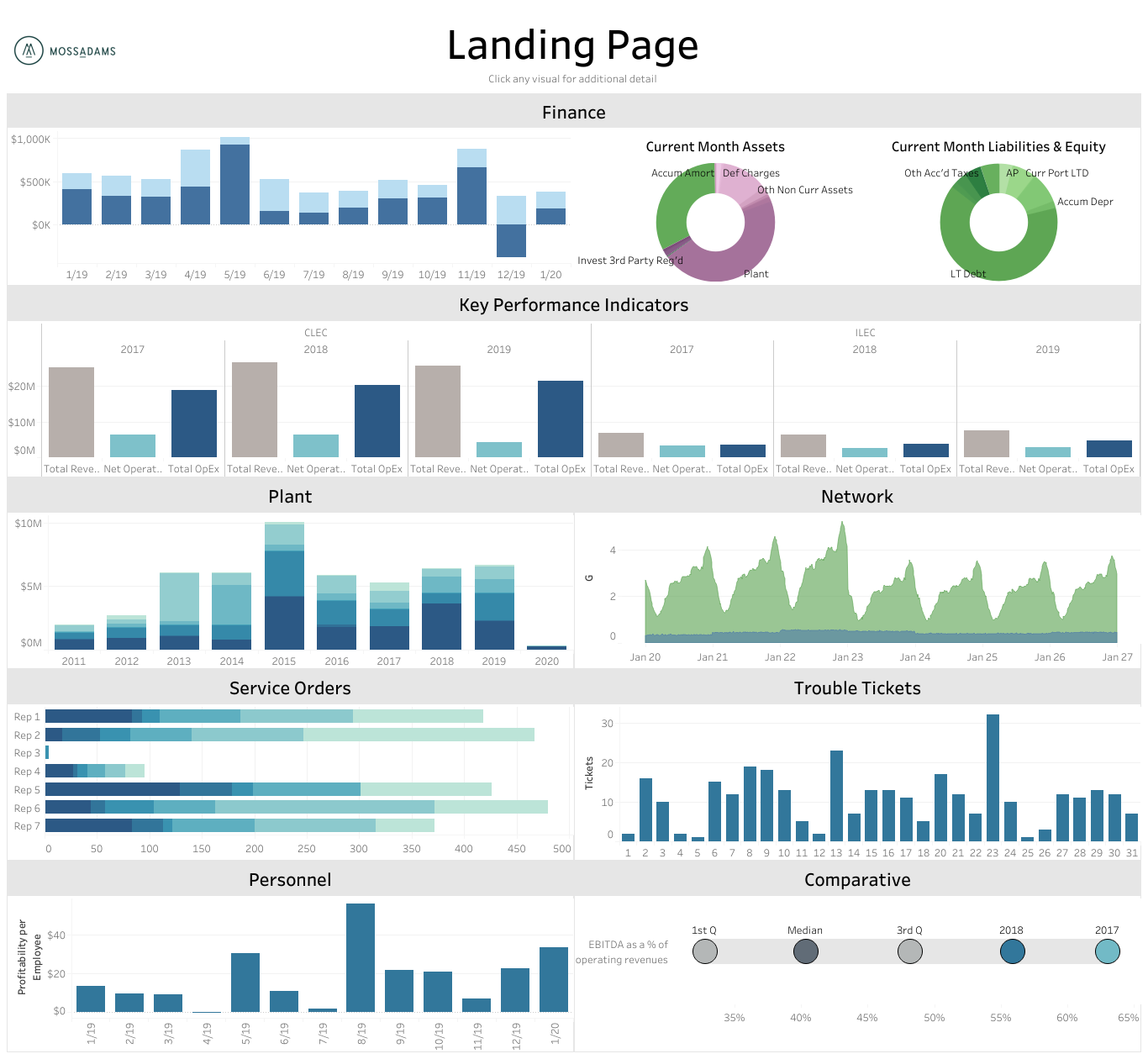

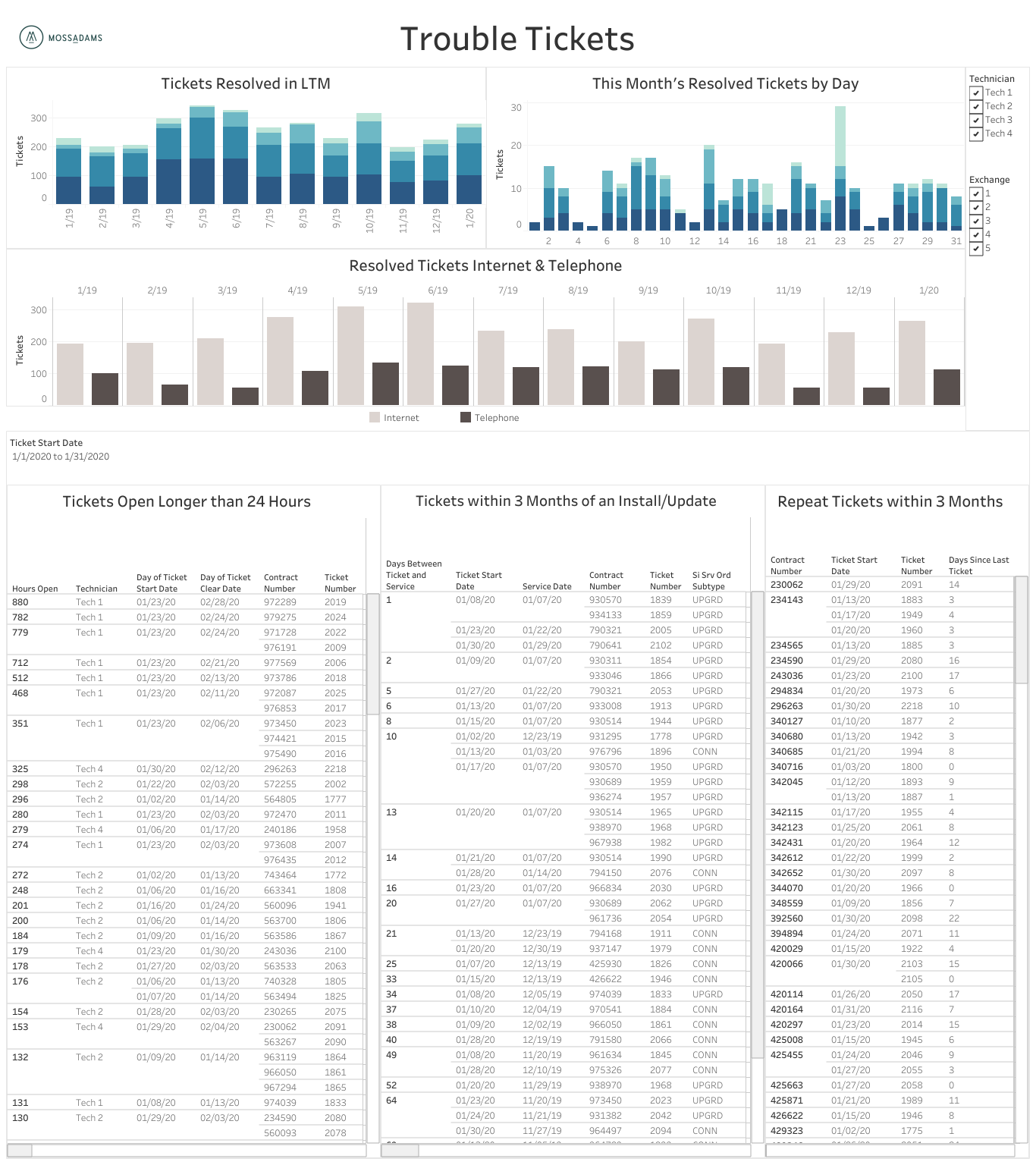

The following are examples of how dashboards can provide summary data across many functions and drill-down capabilities.

A landing page can reveal cross-functional insights as well as provide a clear path to accessing these datasets.

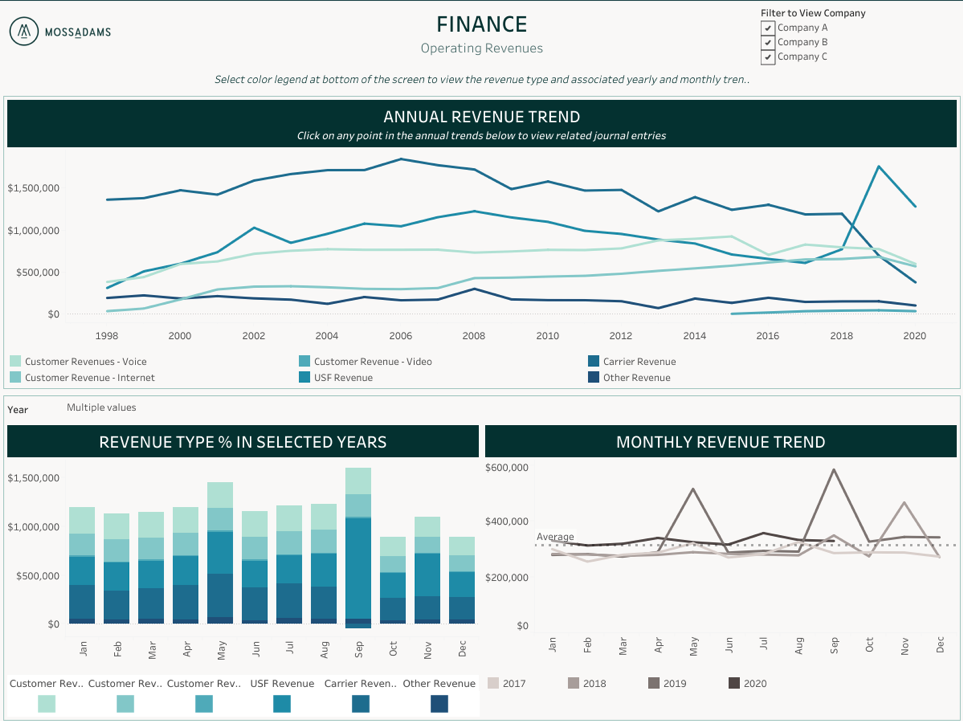

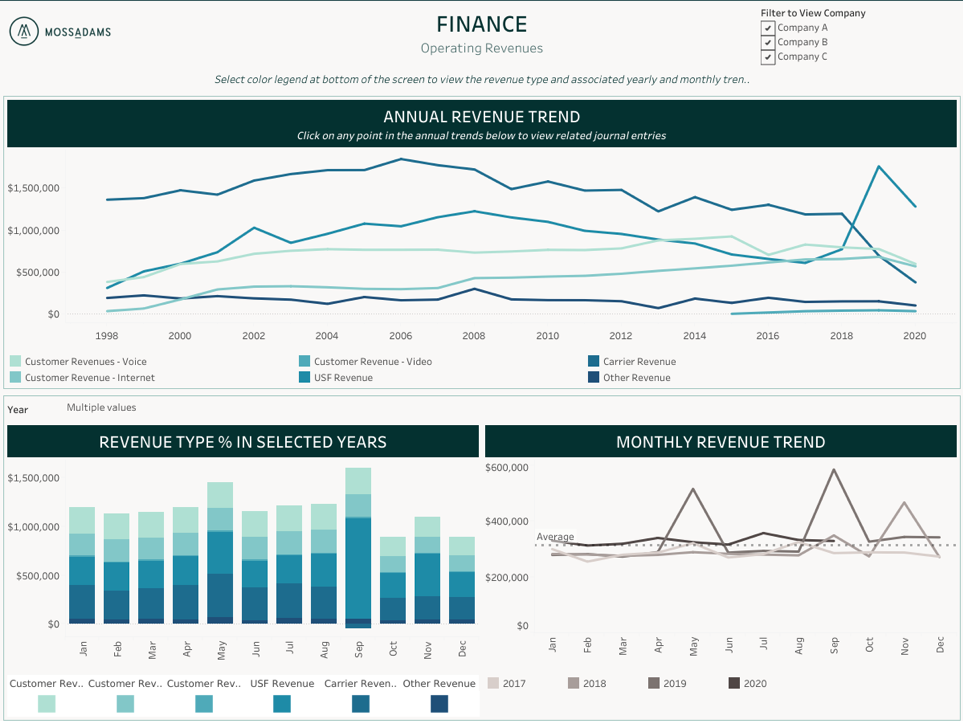

Here’s an example of a financial dashboard tracking select revenue metrics that also permits multiple divisions or companies to be viewed together or individually.

Dashboards let you track and view trends to meaningfully report on data, while easily accessing its source.

Tap Unused Data

It’s likely that your organization has a large amount of unused data. Some of it may be old, unusable, or irrelevant to the present need, however, other data may help you arrive at deeper insights.

With spreadsheets, it’s too time-consuming to sift through data that isn’t current, but a dashboard can provide instant access. This means data that can offer valuable insight isn’t left out of your reports.

Adaptability

With a data project, once you have a dashboard that surfaces clear and reliable data, you’ll have more options for deeper and more creative data analysis and reporting. Because dashboards can grant you immediate access to current data, you can then quickly report on your business’s current state. This can free up time to use your experience and judgment to solve other problems and ask more complex questions.

Another benefit of assembling a set of dashboards for any part of your company is that the data sources can provide you additional insight—often to questions that have yet to arise. The creation of a data source to accurately report on revenues, expenses, and customer count, for example, can be leveraged to build new dashboards. This can lead to better business intelligence about plant expenses; selling, general, and administrative (SG&A) costs; key performance indicators (KPIs), and more.

Some of these new areas of analysis will probably result in new dashboards, which can provide the opportunity to derive even more value out of your current system.

Other areas of inquiry may be simple one-off thoughts, an analysis that you might’ve previously figured out with a spreadsheet—or perhaps didn’t attempt because it would’ve taken too long without a dashboard. These ad-hoc type of analytics are also useful because it can give you access to multiple sources of proven data instantly. As a result, you get an answer to your quick question with context. The ease of this process will lend itself to you getting more answers to your questions.

Automation

These two types of automation can ultimately lead to time savings and a reduction in human error. This includes any potential errors relating to manual data entry, calculations, or compilations in your reporting process.

Connection to Data

Once you’ve created a data source or connected to an existing one, the next connection will continue to be automatic from that file. This means, the foundation will be in place before you get started.

If going into multiple data sources is a difficult and time-consuming process, this can save you countless hours of obtaining and aligning the data.

Refresh the Connected Data

Any changes in the data will automatically update and appear in the dashboard as it refreshes. This means automated dashboards or reports won’t require a lengthy process to manually retrieve the latest data from the system.

For example, connections to your general ledger account data can be set to automatically refresh the data as the data changes, on a schedule, or when the dashboard file is opened.