Transitioning your business is a major life event that requires careful planning. There are financial, emotional, and asset protection issues that all must be considered in tandem. While the COVID-19 pandemic has created a time of great uncertainty, it also presents an ideal environment for reviewing your business’s transition plans.

Here, we address commonly asked questions to help you seize planning opportunities and successfully transition your business.

Why would I consider transitioning my business during a time of disruption?

Some key factors that have made this an attractive time to review transition planning include:

- Historically low interest rates provide an opportunity for buyers to more easily finance their purchase of a business. They can also increase the flexibility of cash flow for transitions that will be funded from future business cash flows.

- Lower business valuations due to economic interruptions can present an opportunity for future generations of family ownership to acquire a business at a lower valuation and reduce the tax burden for the seller.

- A relatively low income tax environment means that the portions of a business transition event that are taxable may result in a lower tax bill than during periods of higher tax rates.

- The large federal estate tax exemption allows for flexibility in structuring family transition events to potentially include gifting as part of the plan.

All these factors are temporary and while currently favorable, they’re likely to shift in the coming years.

What are different options for transitioning my business?

Successful, closely held businesses have several options for transition paths, including:

- Family transition. One of the most common transition plans for family businesses is to transfer ownership to the next generation over time. The current tax and financial environments are particularly friendly to this transition option.

- Ownership transition to an employee. It can benefit an organization to identify a key employee or group of employees who could step into ownership roles in the coming years.

- Purchase by strategic buyer. An offer from a competitor might be a good option during uncertain times if you have similar offerings, values, and company cultures.

- Purchase by a private equity firm. During times of disruption, there’s often increasing interest from private equity firms who are seeking well-run, profitable companies for their portfolios.

If you haven’t investigated these options thoroughly, learn more about how to transition while meeting your professional and personal goals.

How could I capitalize on low interest rates?

As of the date of publication, the yield on the 10-year US Treasury was around 1.7%. The Federal Open Market Committee (FOMC) has openly stated they have no intention of increasing the Federal Reserve Funds Rate (fed funds rate) in the next year or two.

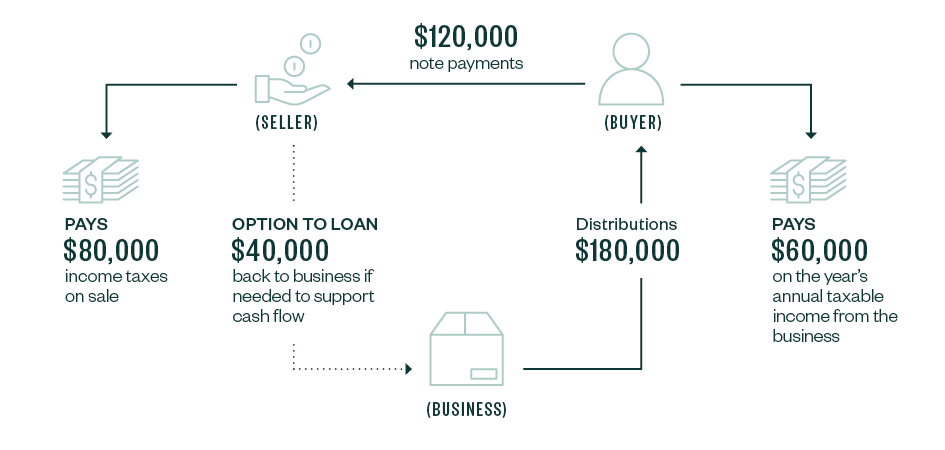

This interest rate environment provides an opportunity to structure a transition to the next generation so it’s successful for the buyer, seller, and company. Often these transactions are internally financed and utilize a circular cash flow model as shown below.

The success of this plan relies on several factors:

- The company’s ability to generate cash flow to continue distributions of profits to the buyer

- The buyer’s ability to take those payments and meet annual debt payments and income tax liabilities

- The seller’s ability to receive enough in annual payments to support their income needs

Current low interest rates can help the buyer and seller structure manageable note payments, or, alternatively, help the buyer secure outside financing at a low cost of borrowing.

How could income and estate tax rules assist transitions?

The federal estate tax exemption for deaths occurring in 2021 is $11.7 million per person. This exemption is scheduled to drop back to approximately $6 million per person—depending on inflation in the interim—at the end of 2025 and possibly sooner if Congress pursues tax legislative changes before then.

This exemption amount can also be used to make gifts during a person’s lifetime, which can provide an opportunity to structure a business transition to include purchases and gifts to the next generation.

Structuring a transition in this way can provide flexibility for the next generation to take over ownership in a business and reduce the income tax burden of the transition.

Example

A farming operation belonging to owner A is worth approximately $10 million, and she would like to transition this business over the next 10 years to her son, B. A sale of the business with note payments over 10 years and bearing interest at a rate of 4% would require annual payments of $101,245 per year. Alternatively, if A chooses to gift 20% of the business to B and sell the remaining 80% over 10 years, the payments drop to $80,996 per year.

Additionally, the transfer of 20% of the business via gift wouldn’t be subject to income taxes, as is typically the case with a sale. Owner A should review her overall planning to make sure these reduced payments still allow her to achieve her personal goals. If doable, this arrangement can provide flexibility for B as well as the business and make the ownership transition successful from a cash-flow standpoint.

To learn more about transitioning a family farm, read our article.

How do I know if I’m prepared for a business transition?

After reviewing the general transition considerations that impact all companies, undergoing a transition preparedness evaluation, and preparing for due diligence, there are several considerations and issues to account for as you prepare for a transition. While every situation is unique, common issues owners should consider include the following:

- Review your financial plan to determine how much and in what structure you need to monetize the business to meet your personal, financial, multi-generations, and philanthropic goals.

- Review your buy-sell or shareholder agreements to confirm that potential transitions are permitted and that issues such as control, funding of future transitions, or valuations will still be appropriate during and after the transition.

- Review any loan guarantees to make sure you’ll be released from those in conjunction with your transition of ownership or control of the business.

- Review your management team to ensure that relationships with buyers and suppliers as well as institutional knowledge will be preserved.

- Consider the need for life insurance to secure the payments you’ll receive during a sale and to provide certainty for the business and the new owner in the unfortunate event that something happens after the transition.

- Review your other estate planning documents to make sure they’re updated for the new mix of assets in your personal balance sheet after the transition. Replacing a business interest with liquid assets or a note receivable may prompt other changes in your estate planning that should be reviewed.

We're Here to Help

To learn more about business transition planning, buy-sell arrangements, life insurance, and how they can work in your estate and succession plan, contact your Moss Adams professional.