The most essential part of any wealth management plan is preservation. Having the right processes in place can add resiliency to your wealth management practices and help you protect your assets.

In some cases, your wealth was created over many years. To successfully pass it on to future generations, it’s important to continually check that your processes and documents are re-examined, especially after any type of transition. Doing this regularly can build greater confidence that your wealth will be protected and help any transitions go more smoothly.

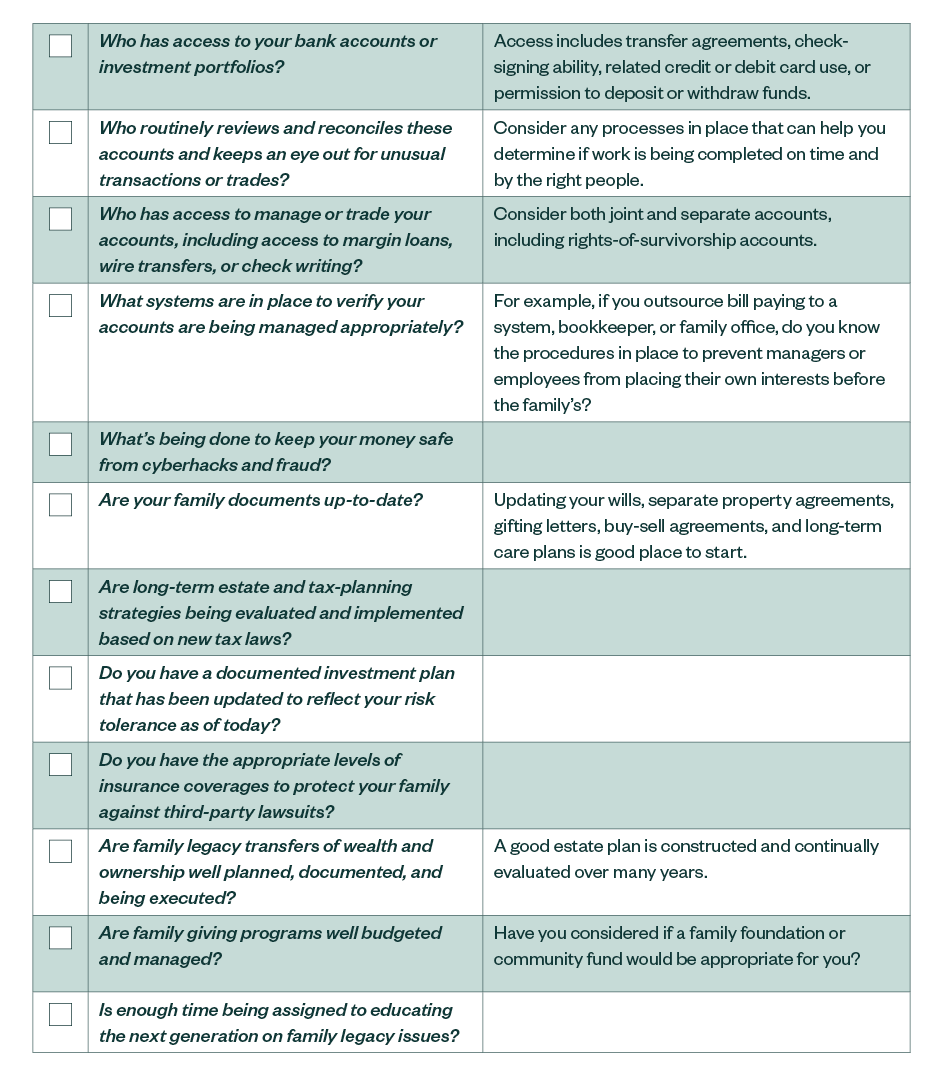

The below 12-question checklist will help you examine your routine so your assets aren’t compromised unnecessarily by complacency. Overall, it’s important to keep in mind three key principles as you’re going through the questions:

- Evaluate who has access to your accounts

- Continuously assess your practices

- Build a reliable plan

Evaluate Account Access

The remote work trend has exacerbated three conditions that increase the likelihood of someone taking advantage of your assets: pressure, opportunity, and rationalization.

It can be easy to fall into unhelpful habits or routines because they’re familiar. It’s never too late to discover possible areas of vulnerability and establish updated practices to keep your assets safe.

Staying up-to-date with the latest cybersecurity tools will help make sure you also have best practices in place to prevent cyberattacks.

Assess Current Practices

It’s important to have in place an engaged, responsive, and strategic advisor or team of advisors. Uninformed or hasty decisions could have detrimental consequences.

Your team should continually do the following to protect your finances:

- Evaluate and respond to changing tax codes

- Stay current on estate planning trends and risks

- Make the best use of various investment channels overall

It’s important to stay current on proposed changes in tax law that could impact your current wealth management practices. Learn more in this article where we outline possible changes on the horizon.

Build a Reliable Plan

If you find yourself thinking primarily about wealth creation and are closely monitoring your asset performance, you’re in good company. Don’t forget, it’s also important to continually review your plans and activities around any potential transition.

Much like a garden needs constant care to thrive, your asset transition plans should be complete and comprehensive, but, above all, they need to be current.

Also, consider educating the next generation on goal setting and action plans. This article can provide a useful framework to educate the younger generation about money matters, including spending, saving, borrowing, taxes, and investing.

Checklist of 12 Wealth-Planning Questions

We’re Here to Help

It’s never too late to build a strong foundation of healthy practices so your wealth is there for future generations. Explore our free tools and articles to learn more about building long-term financial security.

If you’d like to discuss your options and available strategies to preserve your wealth for the next generation, reach out to your Moss Adams professional.