A version of this article was previously published in the December 2021 issue of California CPA Magazine.

Between the COVID-19 pandemic, numerous natural disasters, and a frameshift in work environments, 2021 continues to present significant challenges to Californians’ ability to work and thrive—as well as dramatically increasing workloads for tax professionals.

The insight below presents a summary of relevant updates and changes impacting tax professionals for the 2021 tax season.

Following, you’ll find more details on income tax perspectives, income tax credits, disaster loss deductions, and sales tax. Here’s a breakdown of each topic within four categories:

Income Tax Perspectives:

- State and Local Tax Deduction Workaround

- Main Street Small Business Tax Credit II

- Tax Treatment of Paycheck Protection Program (PPP) Loans

- Net Operating Loss (NOL) Suspension

- Business Tax Credit Limitation

Income Tax Credits:

- Earned Income Tax Credit

Disaster Loss Deductions:

- Extended Deadlines

- Other 2020 and 2021 Disasters

- Interest Rates

- Doing Business and Economic-Nexus Thresholds

Sales Tax:

- Main Street Small Business Hiring Credit

Income Tax Perspective

State & Local Tax Deduction Workaround: Elective Pass-Through Entity Tax

California enacted Assembly Bill (AB) 150 on July 16, 2021, joining numerous other states in enacting laws to allow individual owners of pass-through entities (PTEs) to shift the state tax burden of PTE income from individuals to the entities’ level.

Other states have similar laws in place since 2018. The PTE elective tax opportunity is in response to the IRS-issued Notice 2020-75 in November 2020, signaling that the agency would allow an entity-level deduction for PTEs paying state tax on their individual owners’ behalf in this manner.

AB 150 added Section 17052.10 to the California Revenue and Taxation Code with the following specific provisions and limitations:

- The election is made at the entity level and available for tax years beginning January 1, 2021 through January 1, 2026.

- The tax is paid at 9.3% of the collective pro rata shares of owners’ income subject to California tax.

The following types of PTEs aren’t eligible for this provision:

- Disregarded entities

- PTEs with owners that are partnerships

- PTEs that are part of a combined reporting group for corporation tax purposes

- PTEs that are publicly traded companies

From a California perspective, the general benefit of this provision can be calculated as follows:

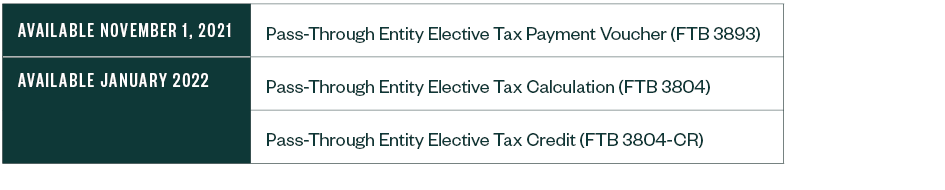

The Franchise Tax Board (FTB) has indicated it will create and release the following forms by the release dates shown below.

Keep an eye on the FTB site for more information and updates.

Main Street Small Business Tax Credit II

AB 150 also contained provisions authorizing a second, revised version of 2020’s Main Street Small Business Tax Credit.

This credit provides $1,000 for each net increase in qualified employees and may be used to offset either sales and use taxes or income taxes.

Applications for tentative credit amounts may be made to the California Department of Tax and Fee Administration (CDTFA) November 1, 2021, through November 30, 2021.

Credits are allocated on a first-come, first-serve basis, with a total of $116 million allocated by the state for the credit. No employer may receive an allocation of more than $150,000, and allocations are reduced by any 2020 credit received under the first version of this credit.

To qualify for the credit, a business must:

- Have experienced a 20% reduction in gross receipts as compared to prior period data— the period of comparison varies for calendar year filers, fiscal year filers, and new businesses opened during 2019

- Have had 500 or fewer employees whose wages are subject to California withholding as of December 31, 2020

- Not be required or authorized to be included in a combined report

FTB will again use Form 3866 for claiming the credit against income tax liability.

Tax Treatment of PPP Loans

On September 9, 2020, California enacted AB 1577 (CARES Act Conformity) to allow the exclusion of forgiven PPP loans from income for tax years beginning on or after January 1, 2020. On April 29, 2021, the state then enacted AB 80, which expanded the income exclusion to include second draw PPP loans as well as Economic Injury Disaster Loan (EIDL) grants.

To qualify under AB 80 for expense deductions, adjustments in basis, and corresponding lack of reducing tax attributes, California required that the taxpayer not be publicly traded and had to meet a 25% gross receipts reduction test.

Taxpayers that qualified under AB 80 were eligible to report the changes on either an amended return or an original return that had yet to be filed. Additionally, even if a taxpayer didn’t qualify under AB 80, they may still qualify to deduct some expenses related to the second PPP draw in accordance with IRS Revenue Ruling 2020-27.

Qualifying taxpayers are eligible at the California level for income exclusions and deductions analogous to the federal provisions found in the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act.

Due to California’s late conformity to certain CARES Act provisions, it may be appropriate to consider amending returns for eligible years to report additional deductions, basis adjustments, and restore tax attributes.

Net Operating Loss Suspension

AB 85 is another impactful bill from 2020 as it suspends the utilization of NOLs—for both corporate and individual taxpayers with taxable income of more than $1 million—for tax years beginning January 1, 2020, and ending on or before December 31, 2022. AB 85 took immediate effect once signed into law on June 29, 2020.

The state’s general 20-year NOL carryforward may be extended by taxpayers impacted by the NOL suspension for up to three years if the losses can’t be utilized as a result of the NOL suspension.

Under existing law, California removed the ability to carry losses generated beginning with the 2019 tax year back to the prior two years, which was otherwise permitted for losses generated in tax years 2013 through 2018.

Business Tax Credit Limitation

In addition to the NOL suspension provisions, AB 85 also placed a limit on the use of business tax credits for tax years 2020 through 2022. Specifically, the use of business tax credits will be subject to a $5 million annual limitation for those years.

The limitation applies on a combined group basis; this means a reporting group is collectively subject to the limitation rather than each of its members.

Income Tax Credit

Earned Income Tax Credit

In 2018, the California Earned Income Tax Credit extended to help low-income taxpayers. In 2019, AB 91 raised the maximum eligible amount of earned income to $30,000. The bill also added a refundable young child tax credit of up to $1,000 per qualified taxpayer, per taxable year.

The FTB’s web page details credit amounts, income limits, qualifications, and additional information.

Disaster Loss Deductions

California taxpayers may deduct losses in any presidential- or governor-declared disaster area.

In this regard, the state generally follows federal law regarding the treatment of losses incurred as a result of a casualty or disaster though relevant nonconforming provisions still apply. Find additional information here.

Extended Deadlines

The FTB automatically follows the IRS’s extended deadlines to file or pay taxes until the date indicated for the specific disaster.

Taxpayers should write the disaster name in dark ink at the top of their tax return to alert the FTB of the disaster to which the return is related.

Additional Designated Areas

The IRS disaster relief web page lists additional designated areas eligible for a postponement period.

If a taxpayer qualifies for the postponement period, any interest, late-filing, or late-payment penalties that would otherwise apply will be cancelled. The FTB also will follow these stipulations.

Other 2020 and 2021 Disasters

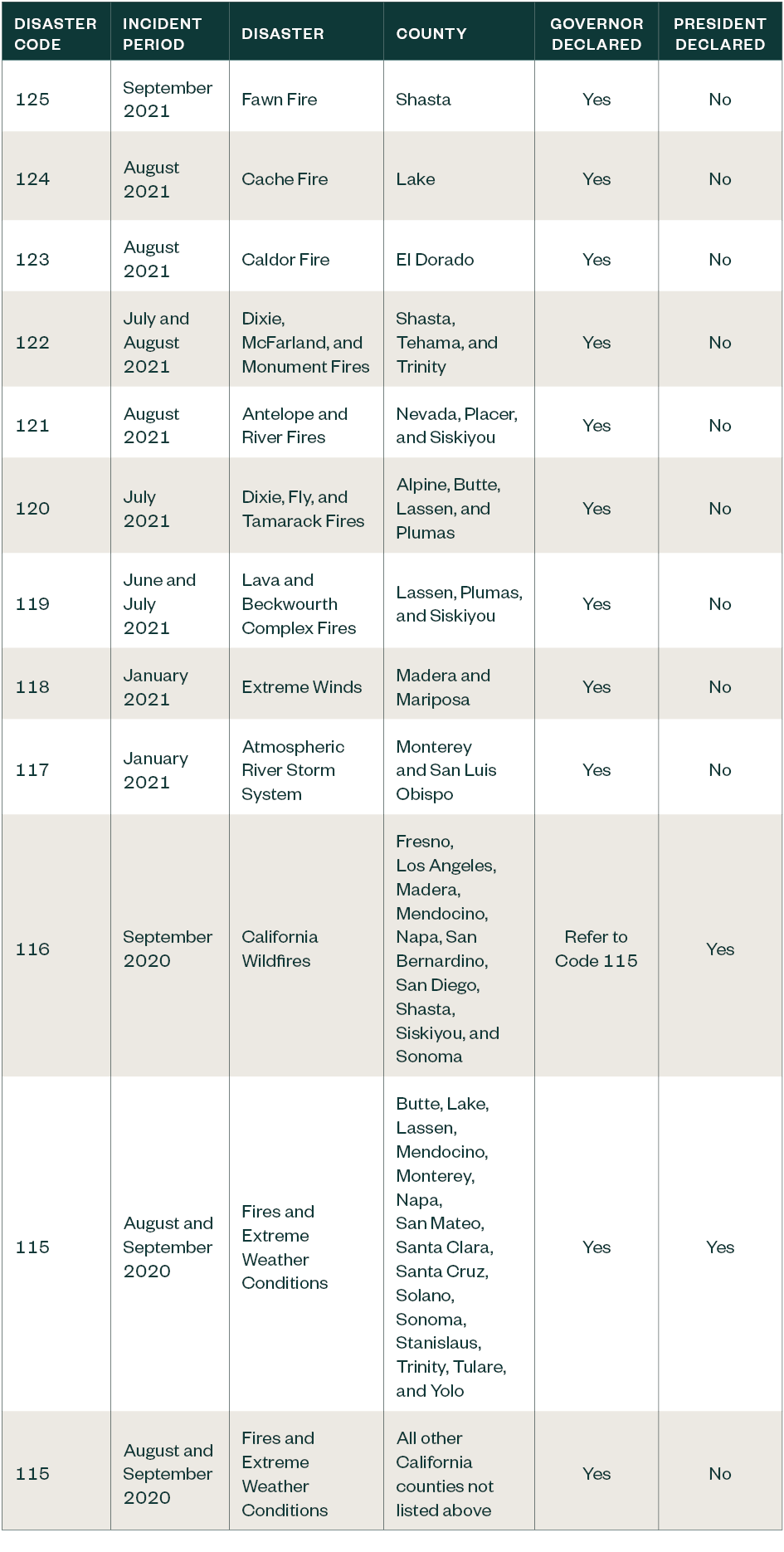

Taxpayers may deduct a disaster loss for any loss sustained in a California city or county where the governor declares a state of emergency.

The list of California Qualified Disasters is below as published on the FTB website on October 12, 2021.

For more information regarding California disaster losses, see the FTB website and Publication 1034, Disaster Loss How to Claim a State Deduction.

Interest Rates

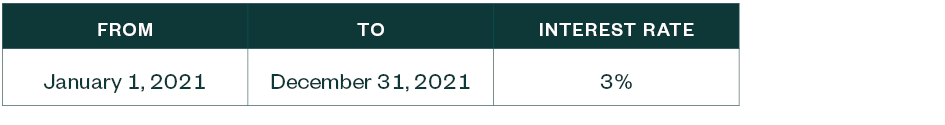

Effective January 1, 2021, the FTB pays 0% interest on corporate overpayments. This rate is effective through December 31, 2021.

The interest rate for personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties follows.

For interest rates after December 31, 2021, the FTB will provide more information on their website as it becomes available.

Doing Business and Economic-Nexus Thresholds

For California income tax purposes, doing business is defined as, “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.”

For the taxable year beginning on or after January 1, 2020, a taxpayer is seen as doing business in California for a taxable year if any of the following conditions are satisfied:

- The taxpayer is organized or commercially domiciled in California.

- The taxpayer’s California sales exceed the lesser of $610,395 or 25% of total sales.

- The taxpayer’s real property and tangible personal property in California exceed the lesser of $61,040 or 25% of total real property and tangible personal property.

- The taxpayer’s compensation amount paid in California exceeds the lesser of $61,040 or 25% of total compensation paid.

The doing-business thresholds for taxpayers are indexed for inflation and revised annually.

Sales Tax

Main Street Small Business Hiring Credit

Businesses that apply and are approved for the Small Business Hiring Tax Credit can make an irrevocable election to apply the credit amount to offset California sales and use tax amounts.

If making the sales and use tax offset election, the credit must be claimed on returns filed with the California Department of Tax and Fee Administration (CDTFA).

The first return on which the credit can be claimed will depend on your California sales and use tax filing frequency, outlined below:

- Monthly filers—the credit applies to amounts due and payable on returns commencing March 1, 2022.

- Quarterly filers—the credit applies to amounts due and payable on returns commencing January 1, 2022.

- Annual and fiscal year filers—the first return on which the credit may be applied are returns due on or before April 30, 2022.

If the credit amount isn’t used on the first return, it will roll forward and can be applied to future returns. The approved credit amount must be used on returns filed on or before April 30, 2027.

Any unapplied credit amounts are considered forfeited and aren’t refundable.

We’re Here to Help

Federal tax changes and related conformity requirements will continue to impact California taxpayers in addition to the changing landscape of business and everyday life.

As the state continues to expand, evolve, and respond to these challenges, please contact your Moss Adams professional with any questions.