The events of 2020-2021 brought about a revolution for life sciences companies. From developing solutions related to COVID-19 to addressing a range of unmet diseases, the innovation spree is greater than ever. This has in turn catapulted activity in the IPO market, with a record number of life sciences companies going public.

For companies drafting their first registration statement to those making continuous public filings every year, maintaining sound adherence to SEC standards is key. Understanding the nature of past SEC scrutiny encourages proactive preparedness, preventing companies from running into similar comments and helping them save both time and money.

In our guide, Under the Microscope: An Analysis of SEC Comment Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, we look at SEC comments directed toward Forms S-1, 10-K, 10-Q, and 20-F filed by life sciences companies during a review period from May 1, 2020, to April 30, 2021. Comments were analyzed by frequency as a way to identify the most prominent topics under SEC scrutiny.

Below, we cover key findings in the 2020–2021 SEC report, comparisons to findings from prior years, and the implications for middle-market and pre-IPO life sciences companies.

Initial Findings

Similar to previous years, research and development (R&D) made up the largest area of SEC focus in 2020–2021, with a strong emphasis on clinical trials and developmental products and pipelines. Focus on entity-related disclosures grew, with many companies asked to clearly disclose the impact of COVID-19 on their operations.

Comment Categories

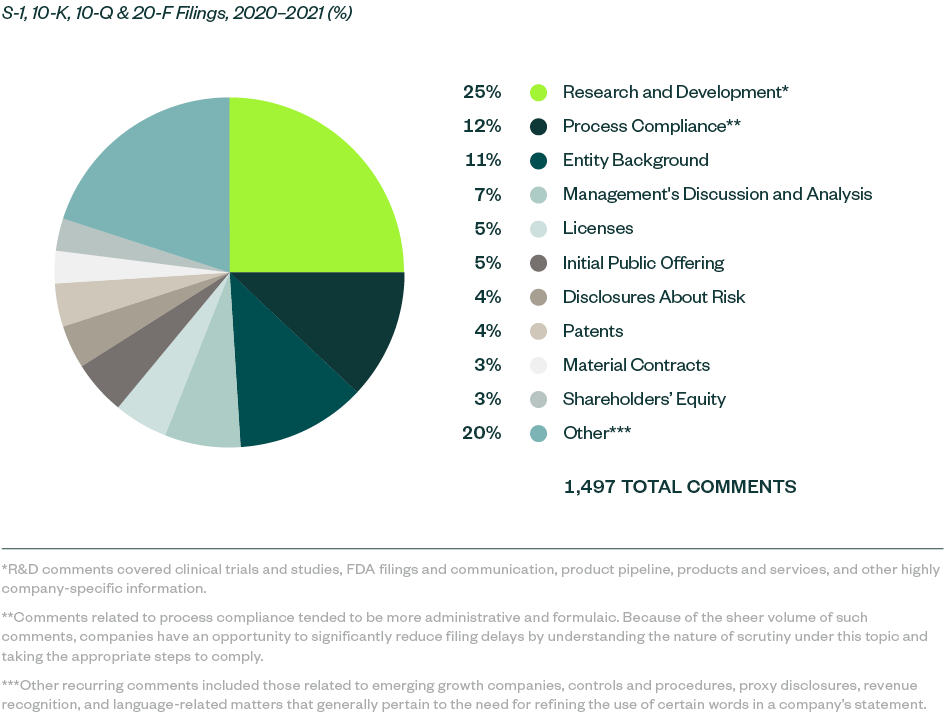

SEC comments toward Forms S-1, 10-K, 10-Q, and 20-F filings for 2020–2021 stood at 1,497 whereas SEC comments for 2019–2020 filings totaled 799.

Comments were largely spread across key categories, in which those related to R&D were starkly prominent at a 25% share. The SEC continued to focus on ensuring complete disclosure when it came to companies’ clinical trials and studies, alongside requiring clarity and objectivity in developmental products and pipelines.

Process compliance was the next major category at a share of 12.2%, with most comments— as in the 2019–2020 study—requiring companies to make requisite disclosures throughout their prospectuses, including filing all material information.

This was followed by comments requiring disclosures of the following:

- Entity background

- Management’s discussion and analysis (MD&A)

- Licensing agreements

- Details on the actual offering and use of proceeds

Information around current and anticipated risks related to the business, underlying patents, material contracts, and shareholders’ equity collectively constituted another significant portion of SEC scrutiny, followed by various comments targeting company-specific controls and regulatory features.

The following infographic depicts a breakdown of the 1,497 comments analyzed, according to category and frequency.

Overview of SEC Comment Categories

Significant Shifts

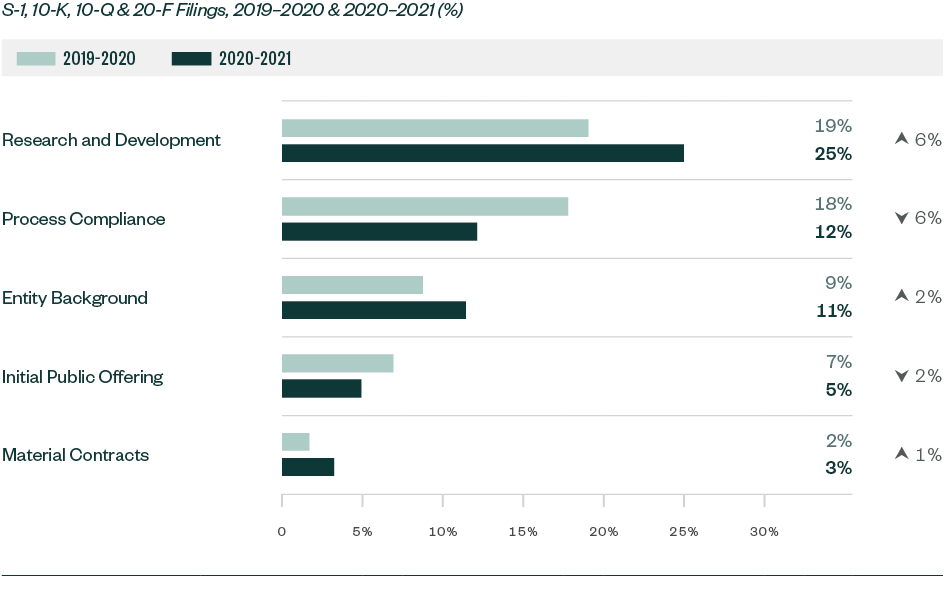

A number of topics saw a slight-to-significant shift in focus when compared to 2019–2020, with the positive or negative variance measured as a ratio to the total number of comments. This included categories, such as:

- R&D

- Process compliance

- Entity background

- Initial public offering (IPO)

- Material contracts

Significant Shifts in SEC Focus for Overall Filings—By Ratio of Comments

Comments related to R&D significantly increased by 5.9% while those related to entity background and material contracts rose by 2.7% and 1.5%, respectively. On the other hand, comments directed toward process compliance substantially decreased by 5.6% while those on the actual offering went down by 2.1%.

The mean variance of overall comments went up from 0.9% in 2019–2020 to 1.8% this year, highlighting greater movement in comment composition.

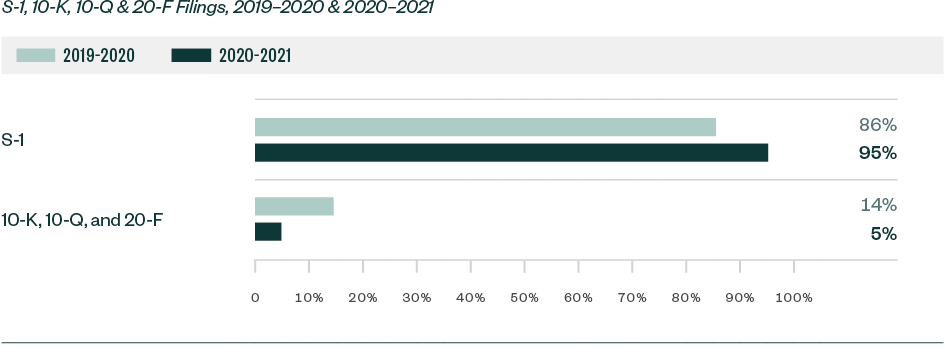

Filing Type

S-1 filings continued to lead in relation to SEC scrutiny. Of the total 1,497 comments analyzed in the study, roughly 95%—or 1,424 comments—were directed at Form S-1. This represented a substantial increase from a share of 86% in 2019–2020.

The remaining 5% of comments were directed toward Forms 10-K, 10-Q, and 20-F filings.

Ratio of Comments—By Filing Type

The nature of comment categorization continued to vary among pre- and post-IPO companies. Comments related to R&D, process compliance, entity background, and the actual offering remained dominant for S-1 registrants. Those related to licensing agreements also came into greater focus this year. Information comprehensiveness took center stage, with the SEC requiring registrants to give a complete contextual setting of their operations and programs.

Contrastingly, comments for Forms 10-K, 10-Q, and 20-F filings were more focused on operational disclosures in the MD&A section as well as procedural compliance related to updated disclosures and requisite certifications.

Market Capitalization Range

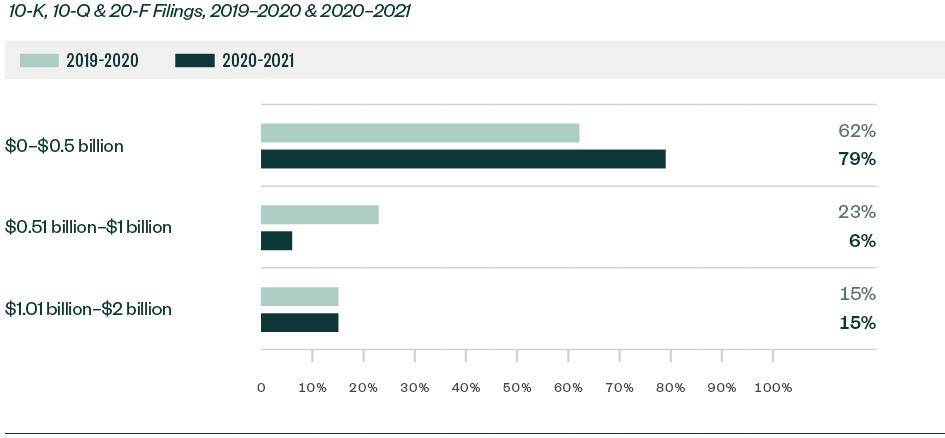

Ratio of Comments—By Market Capitalization Range

Over 79% of all Forms 10-K, 10-Q, and 20-F comments were centered on companies with a market capitalization of less than $500 million. Of the remaining comments, 6% were directed toward those with market capitalization between $500 million and $1 billion while 15% pertained to those greater than $1 billion but less than $2 billion.

Smaller companies continued to attract the greatest scrutiny.

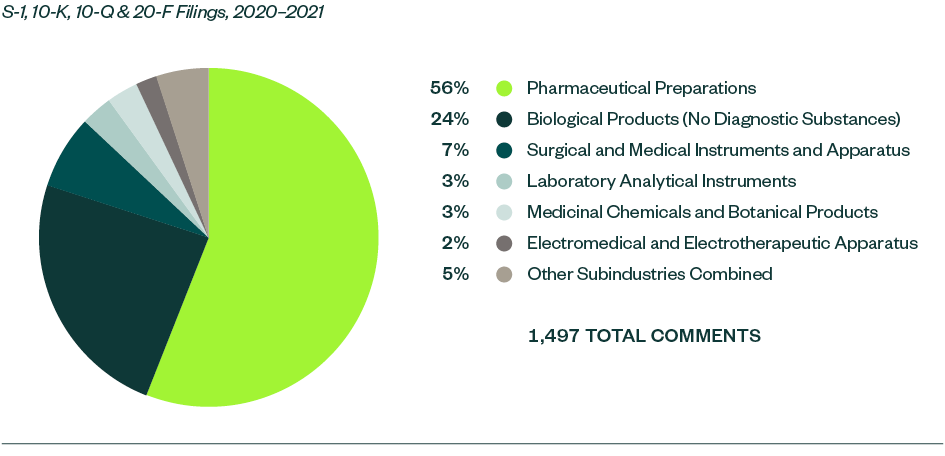

Results by Subindustry

SEC Comments—By Subindustry

Of all the subindustries analyzed in this study, pharmaceutical preparations continued to receive much of the SEC’s focus. This subindustry made up 55.8% of total comments this year, which was a very slight decrease from a 56.7% share in 2019–2020.

Biological products stood as the next most significant subindustry with an aggregate comment share of 23.7%, followed by surgical and medical instruments and apparatus at 7.3%. Similar to the previous study, there was yet again an interesting shift of dynamics within these two categories. While the ratio of comments for biological products went up considerably by 7.8% from 2019–2020, that of surgical and medical instruments and apparatus went down by 9.6%.

A mix of various other subindustries followed, though with relatively smaller shares of less than 5% each. Within this, laboratory analytical instruments—which didn’t attract any relevant comments in 2019–2020—garnered 51 comments this year.

Additional Content

The SEC considers both the macro-environment and business-specific value chains when directing the nature of review. While topics, such as process compliance, were generically commonplace for the entire life sciences sector, others varied among subindustries.

For example, in 2020–2021, scrutiny in R&D remained more significant for pharmaceutical preparations and biological products while entity-related disclosures were more in focus for laboratory analytical instruments.

This doesn’t mean, however, that the nature of comments within a subindustry remains static. Certain topics may attract greater scrutiny one year and less the year after. It depends on market dynamics at the time of the SEC’s analysis, which may bring certain issues to the forefront, and the efforts companies undertake to properly address those areas in their statements.

We’re Here to Help

For more information on SEC comments, read our full guide, which covers these topics in greater detail, or contact your Moss Adams professional.