The No Surprises Act went into effect January 1, 2022, and prohibits balance billing of surprise bills for specific out-of-network services. A surprise bill is one that comes unexpectedly when the patient has insurance coverage. For instance, if someone is hospitalized but they are seen by an out-of-network physician, it can result in a separate bill that is not covered by insurance as part of their in-network benefit.

Air ambulance services are included in the No Surprises Act, but the ban doesn’t extend to ground ambulance services.

A new analysis from the Peterson-KFF Health System Tracker discovered about 50% of emergency ground ambulance rides and 39% of non-emergency rides resulted in an out-of-network charge for people with private health insurance.

The median surprise bill for ground ambulance was $450 as cited by April 2020 Health Affairs.

What Does the No Surprises Act Cover?

The following patient care services currently fall under the guidelines of the No Surprises Act:

- Emergency visit at an out-of-network provider

- Select, non-emergency care from out-of-network providers at in-network facilities

- Air ambulance services from out-of-network providers

Because ambulance services are often out-of-network, there is a good chance that ambulance billing will be included under the No Surprises Act at some point, especially in light of the advisory committee the federal government created to assess options to improve disclosure of charges and fees for ground ambulance services. It’s prudent to understand the potential impact.

What States Provide Surprise Ground Ambulance Billing Protections?

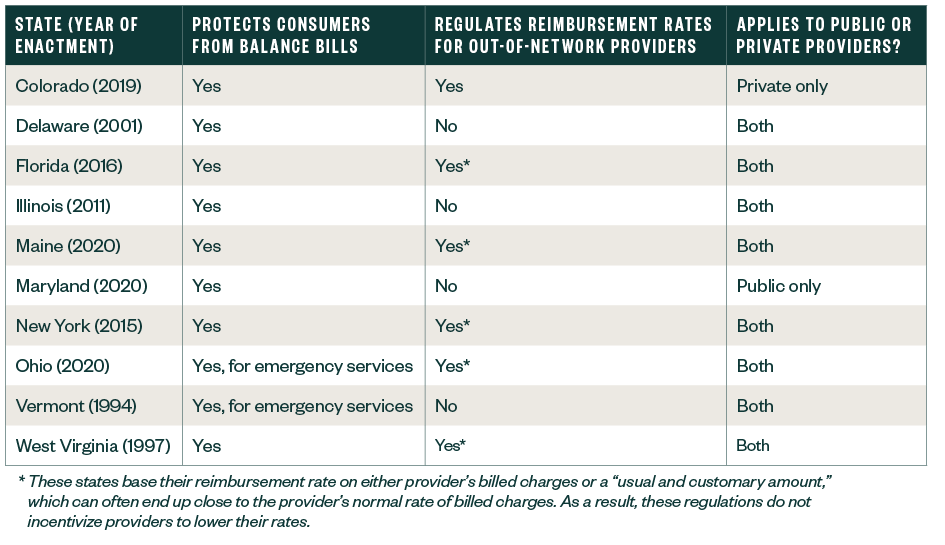

10 states currently provide some protection against ground ambulance balance bills:

- Colorado

- Delaware

- Florida

- Illinois

- Maine

- Maryland

- New York

- Ohio

- Vermont

- West Virginia

Protection differs from state to state contingent on the type of ambulance ownership structure.

EMS Oversight & Agency Ownership

According to 2020 National Emergency Medical Services Assessment conducted by the National Association of State EMS Officials, providers of emergency medical services (EMS) vary in the types of services provided and also in the many ownership structures.

EMS offices also differ in the layers of regulatory oversight from state to state.

In some states, the state agency licenses the ambulance providers, but not ambulance vehicles, while others might regulate both.

The EMS providers operated by municipal and county governments could be out of network with private insurance companies. This increases the risk of a patient receiving a surprise bill.

The 2020 Public-Release Research Dataset found that 62% of emergency ground ambulance rides were provided by fire departments or other government-owned organizations in 2020, which were typically out-of-network for private insurers.

The complexities surrounding how ground ambulances are operated and regulated has historically made it challenging for states and federal agencies to effectively address surprise billing protections for ground ambulances.

No Surprises Act Required Data Reporting and Collection

The No Surprises Act required a federal advisory committee to study the issue and recommend options to protect patients from surprise bills.

The Ground Ambulance and Patient Billing (GAPB) Advisory Committee formed to advise the Departments of Labor, Health and Human Services, and Treasury on options to improve the following:

- Disclosing charges and fees for ground ambulance services

- Informing consumers of insurance options for ground ambulance services

- Protecting consumers from balance billing

The process of gathering surprise billing data began before the enactment of the No Surprises Act. When Section 50203(b) of the Bipartisan Budget Act of 2018 was amended, section 1834(l) of the Social Security Act detailed requirements for ground ambulance service and supplier providers to submit costs and other information. The Centers for Medicare and Medicaid Services (CMS) developed the Medicare Ground Ambulance Data Collection System (GADCS) to meet this requirement and has selected ground ambulance providers and suppliers to participate in the GADCS 2020–2024.

Organizations selected in Years 1 and 2 have started collecting information in 2022 and will report information starting in 2023. Selected organizations in Year 3 will collect and report information at the same time as organizations that have yet to be selected in Year 4, with data collection starting in 2023 and data reporting in 2024. Coinciding with the implementation of the No Surprises Act, the Secretary of Health and Human Services would apply a 10% reduction to payments made for the applicable period to a ground ambulance provider or supplier that’s required to submit information under the data collection system but doesn’t sufficiently submit such information.

Signs once again point to ground ambulance reimbursement coming under the coverage of the No Surprises Act.

No Surprises Act Operational Considerations and Recommendations

There are a few operational factors to consider when preparing for ground ambulance and other EMS billing to meet the requirements of the No Surprises Act.

Balance Billing Practices and Revenue Sources

If revenue for an EMS provider is heavily dependent on balance billing from out-of-network patients, that provider should assess the amount of revenue that is at risk and consider the impact on accounts receivable and bad debt.

Determine the volume of patients and revenue associated with out-of-network services to begin your planning and facilitate important decision making. This should be done sooner rather than later, as the impact could be material.

Medicare Reimbursement and Market Trends

Understanding how the EMS provider’s in- and out-of-network commercial payor reimbursement compares to Medicare and benchmarking against market trends could help establish expectations. It’s likely that median in-network rates will be the benchmark if ground ambulance services become impacted by the No Surprises Act.

In-Network Contracting

EMS providers that are out-of-network for select insurance plans might want to consider approaching higher volume payers to participate in their network.

Modeling financial scenarios to propose the in-network reimbursement rates is a good next step. EMS providers might need to adjust their reimbursement expectations and use their modeling outcomes to determine an acceptable range of rates to proactively approach payors for negotiations.

Clear communication of the value proposition EMS providers bring to members will be important. We expect more downward pressure on the reimbursement rates but becoming in-network can avoid potentially lengthy disputes between health insurers and providers.

Asset and Resource Utilization, Limitations, or Constraints

Fixed costs are sunk costs. But, when revenue declines and there’s a lack of new income sources, all expenses should be re-evaluated.

Providers could consider reviewing their ambulance capacity and utilization, route efficiencies, productivity, and identifying opportunities to appropriately size spans of control. This ultimately increases the effectiveness, efficiency, speed, and productivity of the entire organization. Also, review the capital assets and budgeting for ambulance bases and the fleet of ambulances.

Implementing Good Faith Estimates (GFE)

The No Surprises Act requires providers and facilities scheduling services three days or more in advance for an uninsured or self-paying person to provide a GFE or when an uninsured or self-paying person requests it.

CMS further clarified that no specific specialties, facility types, or sites of service are exempt from this requirement. While most ambulance transports are emergent in nature, providing either basic or advanced life support, some provide nonemergency medical transportation scheduled in advance. These providers would be faced with workflow shifts to comply with the GFE timeline and format requirement.

The American Healthcare Association estimated that it takes 10 to 15 minutes to produce each GFE for most healthcare encounters. Planning for this additional time requirement would reduce employee frustration and burnout while ensuring compliance.

Providers will also need to consider how GFEs are tracked and how to identify internal controls to ensure data quality.

Patient-Provider Dispute Resolution

Uninsured or self-paying patients who get a bill from a provider at least $400 more than the expected charges on the GFE can use the patient-provider dispute resolution (PPDR) process. The patient or an authorized representative may initiate the PPDR and an independent third-party dispute resolution entity will determine the amount the patient must pay. Providers should be prepared for third-party entities playing a role in this process.

If a patient disputes a charge, the provider will be asked to provide:

- The GFE

- The bill they sent to the patient

- Any supporting documents that explain the bill

During the PPDR process, the provider and patient can negotiate but all billing actions would be paused until this process is resolved. Providers need to have strong revenue cycle management controls to keep patient bills from going to collections or accruing late fees while the PPDR process is in motion.

We’re Here to Help

To learn more about how the No Surprises Act may impact your organization, contact your Moss Adams professional.

You can also find more insights at our Health Care Practice.