Effective working capital management is critical for a recreational vehicle (RV) dealer, although it often gets deprioritized during times of low inventory and high turnover.

As demand slows, inventory increases and interest rates rise, and competent working capital management becomes crucial to keeping your business in operation—namely, when it comes to cash and floor plan financing for RV dealers.

What Is Working Capital?

Working capital refers to current assets minus current liabilities. It represents the excess of mostly liquid capital available to meet obligations.

Inventory and its associated financing are often the largest components of not only working capital, but total assets and liabilities for RV dealers.

Financial Statements

The three possible primary financial statements are interrelated and should be reviewed that way, alongside any additional statements and notes.

- Balance sheet. Provides an overview of assets, liabilities, and equity as of a point in time.

- Income statement. Focuses on revenue, expenses, and other inflows and outflows over a period.

- Cash flow statement. Provides an understanding of cash inflows or outflows over a period.

These statements can provide a wealth of information about operations, although data interpretation can be broad. These statements are also important in relation to working capital for the following reasons described below.

- Working capital occurs at the point in time when it’s derived from balance sheet information.

- The income statement provides an understanding of operating income and expenses over a period, which can help in assessing the required level of working capital needed for meeting obligations.

- The cash flow statement provides an understanding of how cash is derived and expended through operations, investing, and financing activities, so that sustainability of meeting obligations can be assessed.

Cash Flow Versus Revenue

In a broad sense, revenue is the inflow derived by an entity’s ongoing major operations, while cash flow is concerned with the inflow and outflow of the operation’s most liquid asset over a given period.

Neither of these variables alone provide the information needed to assess an RV dealer’s ability to meet their obligations. Further information from financial statements and management should be considered.

Cash Management

The most liquid asset of any business is cash on hand. Proper cash management is vital in paying obligations as they become due, which in turn impacts a business’s risk profile and ability to obtain and maintain bank and other lender financing.

An RV dealer’s operations won’t remain a going concern without the ability to meet obligations as they become due.

Liquidity and Ratio Analysis

Comparing available ratios from sources, such as the National RV Dealers Association (RVDA) or RV 20 groups, can be useful in identifying areas for improvement and areas of strength. Any ratio will be highly dependent on the information used. In other words, unreliable data results in unreliable ratios.

The first step in effective working capital management is having proper accounting practices and processes in place.

Some important ratios for understanding working capital and cash management include the following:

- Current and quick ratio. The higher the variable, the better the ability to meet short-term obligations, but too high of a variable may indicate inefficient use of assets.

- Working capital. Working capital and its components as a percentage of total assets indicate an operation’s concentration in liquid assets.

- Working capital turnover. In general, a higher variable—as compared to industry norms—indicates that the operations are effective at converting working capital into sales. However, too high a variable could indicate that there’s a lack of working capital in place and a potential near-term inability to meet obligations.

- Growth rate of inventories versus sales. Higher inventory growth rates versus sales may indicate declining demand, which may result in discounting of inventory in the future.

- Turnover ratios. This includes accounts receivable, inventory, and accounts payable. In general, the higher these variables are, the more effective an operation is at using its assets.

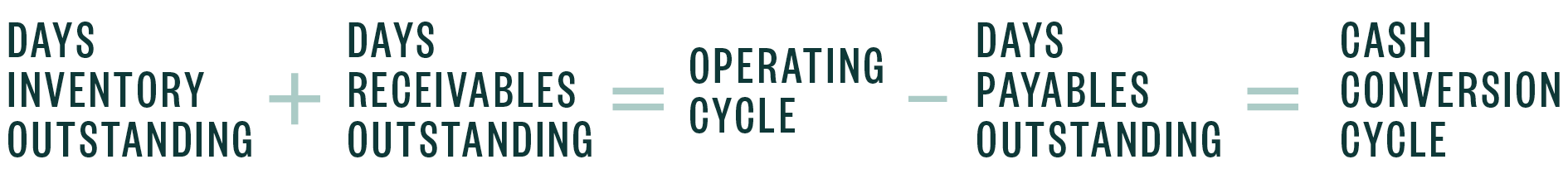

- Operating and cash conversion cycles. The operating cycle is the average number of days it takes to convert inventory to cash, while the cash conversion cycle is the average number of days cash is tied up in the operating cycle.

Cash Conversion Cycle

Understanding the cash conversion cycle is critical in working capital management and assessing an operation’s liquidity. Typically, if the cash conversion cycle is shorter, there’s less need for working capital.

An increasing cash conversion cycle may be an indication of slowing demand for inventory, and if the trend continues, it could lead to an increased risk of not meeting future obligations.

Ways to shorten the cash conversion cycle include:

- Better collection of accounts receivables

- Enhanced inventory management

- Longer supplier payment terms

For RV dealers, the days inventory outstanding will be the largest component of the cash conversion cycle, as trade account payables and receivables are often small in comparison to inventory.

Floor Plan Financing

For RV dealers, one of the largest current assets in dollar terms will be inventory, which consists of new vehicles, used vehicles, parts, and accessories. Similarly, one of the largest current liabilities in dollar terms is usually floor plan financing. The connection between these two and their management is crucial for an RV dealer.

What Is Floor Plan Financing?

Floor plan financing is a short-term loan collateralized by the inventory held at a dealership and is directly associated with specific vehicles on the showroom floor or lot of the dealership. The loan can be with the financing arm of the original manufacturer, a traditional banking institution, or a specialty lender.

Once the inventory is sold to the end customer, the loan is repaid. The longer that the inventory remains on the showroom floor or dealer lot, the higher the cost associated with any floor plan financing. For this reason, inventory turnover is important in keeping costs associated with floor plan financing to a reasonable level.

Floor plan financing allows a dealership to have greater flexibility over cash needs. Due to the flexibility that floor plan financing offers, most dealerships will finance almost all new inventory as it’s generally expected that new vehicles will turnover quickly. We find that the level of financing associated with used inventory can vary greatly between dealerships.

Floor plan financing for used inventory can be beneficial for dealerships that have strong inventory controls and turnover in the used department.

Interest Rates

Given the level of floor plan financing that most RV dealers have, small changes in interest rates can have a large impact on profitability. The cost of floor plan financing should be closely monitored.

For over a decade, interest rates have been historically low, however, 2022 has seen increases in interest rates and uncertainty as to the near-term interest rate environment. For RV dealers, interest rate increases impact the specific rate paid on floor plan financing and customers’ ability to finance their purchases.

These factors could then result in lower demand and lower inventory turnover, which increases the number of days that inventory remain on hand, and then in turn, floor plan financing costs.

Self-Funding Versus Lender Funding

Dealerships that use low or no floor plan financing fund their inventory. This means that higher levels of cash will be needed to purchase inventory. They’ll need to handle the back-end processing that many floor plan lenders often handle, such as payment to the original manufacturer or auction companies and title transfers.

Potential benefits of self-funding include there being no associated interest expense and the dealership not needing to submit to audits from the lender.

Inventory Turnover

Inventory turnover should be a concern for any dealership whether they self-fund or lender fund. Stale inventory can have negative effects through increased insurance costs, storage costs, and deep discounting to eventually move the inventory.

While the effects of the pandemic led to industry-wide inventory shortages, these won’t last forever. As inventory and demand return to normalized levels RV dealers should be careful not to overextend their inventory beyond what they can reasonably sell.

Debt Covenants

Terms and requirements, or debt covenants, from floor plan lenders can vary greatly. A dealership should perform some level of due diligence when selecting a floor plan lender.

Common bank and debt covenants include:

- Minimum working capital and cash requirements

- Maintenance of specific financial ratios including debt-to-equity, debt-to-total capital ratio, interest coverage ratio, quick ratio, current ratio, and so forth

- Subjection to inventory audits which may be performed on an unscheduled basis

- Limitations on further debt

- Restrictions on payment of dividends or distributions

- Limitations on disposal of specific assets

- Personal guarantees

The goal of debt covenants is to maintain the debtors’ credit rating and make sure the loan remains adequately covered. Because floor plan financing is related to specific inventory the lender may demand immediate payment on stale inventory. This also means that the dealer should be ready to verify their inventory to the lender.

Personal Guarantees

Personal guarantees from RV dealership owners can result in lower interest rates and larger amounts of short-term or long-term financing. While these may not be directly linked to floor plan financing, they may be required for any additional debt financing of the business. Personal guarantees may involve personal collateral such as a personal residence.

We’re Here to Help

For guidance on assessing the strength of your working capital processes and controls, contact your Moss Adams professional. You can also visit our Automotive & Dealer Services Practice page for additional resources.