The SEC published amendments to its rules requiring registrants to disclose information reflecting the relationship between executive compensation actually paid by a registrant and the registrant’s financial performance.

The amendments are provided for in Release No. 34-95607, Pay Versus Performance.

Registrants are required to comply with these disclosure requirements for fiscal years ending on or after December 16, 2022.

Background

Section 953(a) of the Dodd-Frank Act added Section 14(i) to the Securities Exchange Act of 1934, which mandates the SEC to adopt rules requiring a registrant to disclose the relationship between executive compensation actually paid and the financial performance of that registrant.

The amended rule adds Item 402(v) of Regulation S-K to comply with this mandate.

Pay Versus Performance Table Requirement

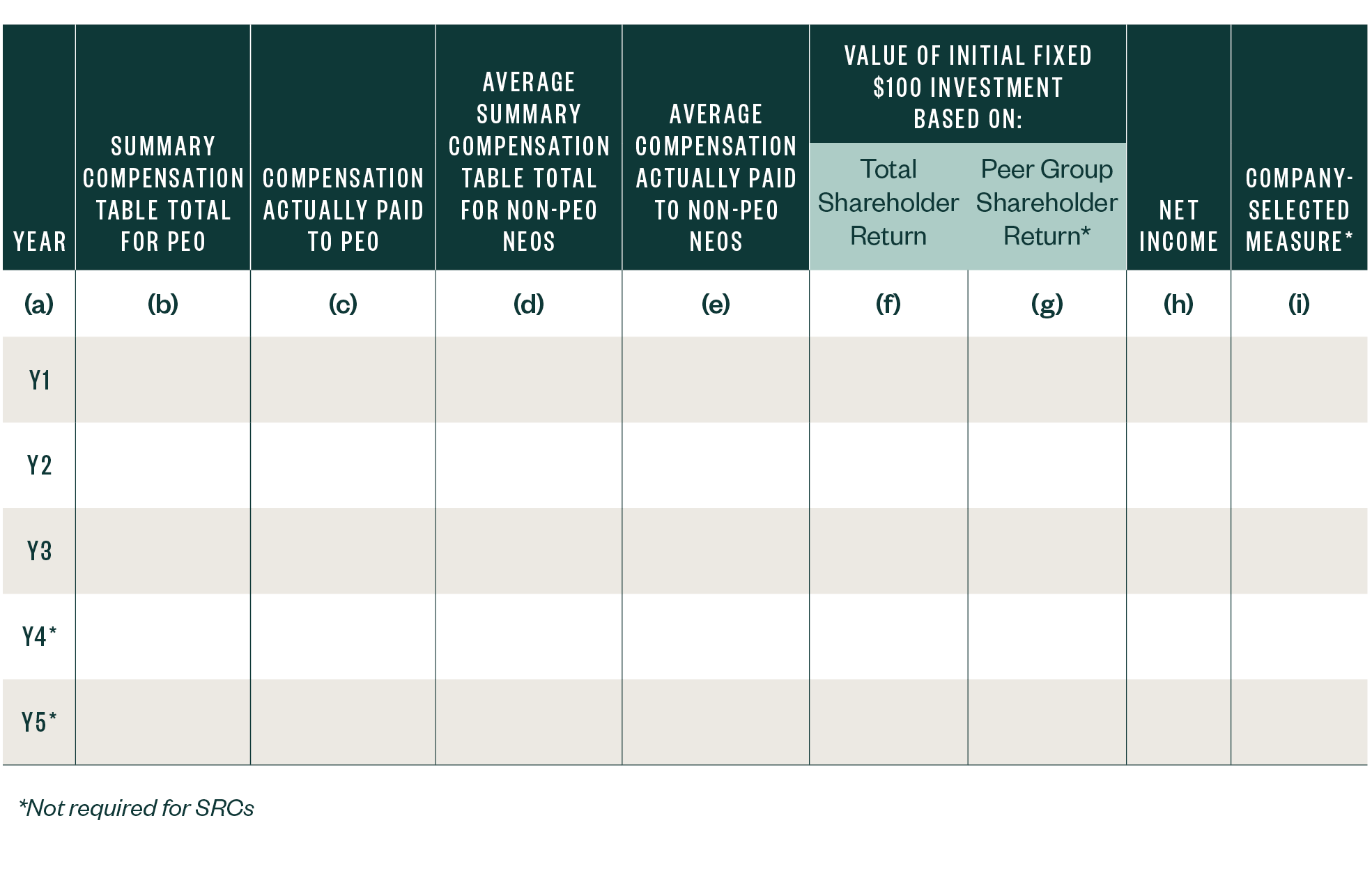

In any proxy statement or information statement where executive compensation disclosure is required, registrants must provide the following pay versus performance table.

This table is to disclose financial performance measures and specified executive compensation for the principal executive officer (PEO) and other named executive officers (NEOs) for the five most recently completed fiscal years.

As shown in the above table, registrants are required to report the following specified executive compensation:

- Summary Compensation Table (SCT) total for PEO, calculated in accordance with Item 402(c)(2)(x) of Regulation S-K or Item 402(n)(2)(x) for smaller reporting companies (SRCs)

- Compensation actually paid to PEO

- Average SCT total for NEOs, excluding the PEO

- Average compensation actually paid to NEOs, excluding the PEO

Footnote disclosure will be required of the amounts deducted from, and added to, the Summary Compensation Table total compensation amounts to arrive at the amounts actually paid.

In addition, registrants are required to report the following measures of financial performance in the table:

- Total shareholder return (TSR) for the registrant, calculated on the same cumulative basis as required by Item 201(e) of Regulation S-K

- Peer group TSR, as determined in accordance with Regulation S-K Item 201(e), of a peer group chosen by the registrant

- Registrant’s net income in accordance with GAAP

- Financial performance measure chosen by the registrant and determined to be the most important financial performance measure used by the registrant to link compensation actually paid to the registrant’s NEOs to performance for the most recently completed fiscal year

Additional Disclosure Requirements

Using the information provided in the table, registrants will need to describe the relationship between compensation actually paid to its PEO and on average to its other NEOs and the measures of financial performance over the five most recently completed fiscal years.

Registrants should also include a clear description of the relationship between the registrant’s TSR and the TSR of its selected peer group—also over the five most recently completed fiscal years.

Registrants are required to also provide a list of three to seven financial performance measures that it determines are its most important performance measures for linking executive compensation actually paid to company performance for the most recently completed fiscal year.

Registrants will be required to use Inline XBRL to tag their pay versus performance disclosure. SRCs will have to provide the Inline XBRL data, starting with the third filing that provides the newly required disclosure.

Scope

The amended rules apply to all reporting companies, excluding foreign private issuers, registered investment companies and emerging growth companies.

Effective Dates

The final rule is effective October 11, 2022.

Registrants are required to comply with these disclosure requirements in any proxy statement and information statements that must include Item 402 executive compensation disclosure for fiscal years ending on or after December 16, 2022.

The amendments allow for a period of transition with registrants providing three years of information in the first proxy or information statement, then adding another year of disclosure in each of the two subsequent annual filings. SRCs will be required to provide two years of information in the first proxy or information statement and add another year of disclosure in the next annual filing.

We’re Here to Help

For more information on how the rule may affect your business or more on Assurance Services, contact your Moss Adams professional.