Not-for-profit organizations have seen a rapid rise in federal funding, primarily due to the COVID-19 pandemic and hyperinflation. With this influx of funding, scaling grant management and compliance monitoring is key.

Ongoing compliance monitoring, including that of subrecipients, has become increasingly important to cognizant agencies and a focal point of annual single audits.

The Coronavirus Aid, Relief, and Economic Security (CARES), American Rescue Plan Act (ARPA), and other COVID-19 relief funds have become major programs in single audits and the focus of funding agency compliance reviews, which aim to help assess an organization’s ability to manage and monitor funding.

For organizations of all sizes, identifying grant compliance requirements and monitoring how your organization adheres to them are both important in managing government funded awards.

What Is Grant Compliance and Why Is it Important?

Federal, state, and local government grants all come with compliance requirements to regulate how taxpayer funds are being spent. These requirements include the spending and use of funds, programmatic and financial expenditure reporting, and the frequency of recipient and subrecipient audits.

Regardless of the government agency awarding funds, funders want to ensure that recipients are good stewards of funding received and that funding is spent on purposes that align with the intended mission and purpose of the grant.

Ensuring that your employees understand any applicable requirements, along with deploying ongoing internal monitoring, helps to ensure continued eligibility for future funding while mitigating noncompliance risk and avoiding penalties, including federal agency audits and even debarment.

Grant Compliance Requirements

Your specific compliance requirements will be outlined in your prime funding agreement or contract with the awarding agency.

These requirements typically include what the funds can and can’t be used for, when they can be used (period of service and performance), what programmatic and financial reporting is required, and other restrictions or stipulations of use. Refer to the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 CFR 200 for more information.

How to Prioritize Grant Compliance for Your Organization

Whether you’re a large or small organization, you can make compliance and related monitoring a priority. It doesn’t always have to be burdensome, complex, or overtax limited resources.

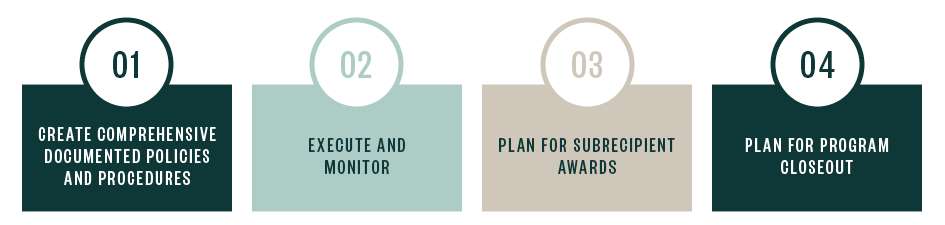

Following are four steps your organization can take.

Create Comprehensive Documented Policies and Procedures

Develop Policies

Ideally, either an internal team who’s familiar with funding, or an external consultant who specializes in grant management and compliance, would develop policies.

Allocate Funds

Start by determining how you’ll receive and allocate funds, monitor direct and indirect expenditures, regrant funds to subrecipients if applicable, and conduct ongoing monitoring on your organization and subrecipients.

Share With Employees

Document requirements in each key area, then build out the corresponding details of how employees should adhere to them.

Define roles and responsibilities, and make policies detailed enough to be a valuable employee resource.

Execute and Monitor

Once you’ve developed processes, determine how to execute them throughout the life of a grant program.

Report

Determine what reporting the funding agency requires. Due dates need to be tracked, required reviews and approvals need to be timely, and the documentation of reported information needs to be maintained.

Many organizations report in a decentralized manner. Consider whether a centralized tracking and accountability model would help the required reporting to be submitted properly.

Track

Develop a tracking mechanism for following progress. Tracking individual grant award budgets is important, and accounting for related revenues and expenses by funding source is required.

Additionally, monitoring budgets to actual progress and burn rates can help your organization appropriately spend the funds throughout the term of the award (program period or period of performance). This can be done through a variety of sources, such as a spreadsheet and your accounting system.

Document

Track and retain all support for expenditures incurred in the execution of the program by grant award. Make sure that supporting documentation clearly illustrates how funds were spent, including any allocations to a specific grant. This could include:

- Purchase orders, including documentation of approval

- Receiving documentation

- Vendor invoices and receipts

- Timesheets and pay stubs

- Subrecipient agreements

- Subcontracts

Monitor

Monitor how funds are spent on a consistent basis, along with any supporting documentation.

An ongoing compliance monitoring function helps organizations to internally monitor that they meet applicable compliance requirements and identify potential non-compliance prior to an external audit or funder review.

Plan for Subrecipient Awards

If your organization is regranting funds to subrecipients, you’ll need to plan for how you will monitor subrecipients during the life of the grant. Understanding compliance requirements related to subrecipient monitoring is essential if your organization is regranting funds, as your organization will be responsible for the any subrecipient’s performance and spending.

This will include the following minimums:

- Requests for applications

- Scoring and awarding criteria

- Pre-award risk assessment—a federal funding requirement

- Minimum insurance requirements verification

- Subrecipient agreement and contract templates

- Programmatic and financial reporting

- Subrecipient desk reviews and audits

Plan for Program Closeout

This is typically comprised of all final programmatic and financial reporting, including the roll-up of any subrecipient reporting and monitoring, that is presented to the funding agency in a reporting package at the end of your prime agreement or contract term.

This process should also ensure that your organization has a process for retaining all program documentation based on the requirements of your funder.

We’re Here to Help

For more information on grant compliance, visit our Not-for-Profit Practice page for additional resources or contact your Moss Adams professional.