A recent IRS Chief Counsel Advisory (CCA) memorandum, also known as CCA 202243008, addressed how to treat interest on a self-dealing loan that arose during years in which the statute of limitations to collect the excise tax has closed, also referred to as closed years.

Based on the memorandum, any interest that accrued on the self-dealing loan during closed years would still be used to compute the amount of the self-dealing loan during taxable years that are still open, also referred to as open years.

A closed year occurs when the statute of limitations has expired. It’s generally three years from the date the original return was filed.

The CCA memorandum was released in October 2022, and has been included in the January 2023 revision of the Exempt Organizations Technical Guide: TG 58, Excise Taxes on Self-Dealing under IRC 4941. Technical Guides (TGs) offer techniques, methods, and technical information to help IRS agents on cases involving exempt organizations.

The CCA may not be used or cited as precedent.

What Is Self-Dealing?

Internal Revenue Code (IRC) Section 4941 imposes an excise tax on certain direct and indirect financial transactions between a private foundation and its disqualified persons, also known as self-dealing.

A disqualified person could be one of the following:

- A substantial contributor

- A foundation manager, which is an officer, director, or trustee of the foundation, or a person who has the powers and responsibilities similar to those of an officer, director, or trustee

- An owner of more than 20% of a corporation, partnership, or trust that’s a substantial contributor to the foundation

- A family member of any individual described above

- A corporation, partnership, or trust or estate in which any individuals described above own more than 35%

A substantial contributor is any person who contributes more than $5,000 to a private foundation, if that amount exceeds more than 2% of the total contributions the foundation has received from its inception through the close of the taxable year. Once a person or entity becomes a substantial contributor, they generally continue to be substantial contributors in perpetuity, except under certain conditions.

One type of self-dealing transaction is a loan or other extension of credit from a private foundation to a disqualified person. A disqualified person is allowed to lend money to a private foundation, as long as there’s no interest or other charges, and the proceeds of the loan are used exclusively for charitable purposes. However, a loan from a private foundation to a disqualified person is an act of self-dealing, with no exceptions.

If an act of self-dealing occurs, it must be corrected, and the disqualified person is subject to a 10% excise tax on the amount of self-dealing. If the self-dealing transaction is not corrected, the disqualified person would be subject to a 200% excise tax.

Also, any foundation managers who participated in the act of self-dealing are subject to a 5% excise tax on the amount of self-dealing, up to a maximum of $20,000, and a 50% excise tax if not corrected, also up to a maximum of $20,000.

The excise tax on foundation managers isn’t imposed if the manager’s participation wasn’t willful and was due to reasonable cause.

Facts from the Memorandum

The memorandum dealt with the following facts:

- A private foundation makes a loan to a disqualified person, which is an act of self-dealing

- Unpaid interest is added to the loan balance each year

- The disqualified person doesn’t make any principal or interest payments on the loan

- By the time the loan is addressed during an IRS examination, the period of limitations has expired for the initial act of self-dealing, which occurred on the date the loan was made, and for several years thereafter

Memorandum Background

The law imposes the excise tax on the act of self-dealing for each year in the taxable period. The term taxable period is defined as the period beginning on the date the act of self-dealing occurs and ending on the earliest of the following:

- The date of mailing of a notice of deficiency with respect to the excise tax

- The date on which the excise tax is assessed

- The date on which the act of self-dealing is corrected

A loan is considered an act of self-dealing on the date it occurs, known as the initial act of self-dealing. It’s considered a new act of self-dealing on the first day of each taxable year within the taxable period, known as a deemed act. For each deemed act, there’s a separate taxable period beginning on the date the deemed act occurred and a separate amount involved.

Regarding the statute of limitations, the law generally provides that any tax imposed must be assessed within three years after filing the return. For purposes of the self-dealing excise tax, the return is the one filed for the year in which the self-dealing occurred.

The effect of the law is that the IRS may not assess tax for acts of self-dealing that occurred in closed years. But the loan balance, including unpaid interest, isn’t an amount of tax, and the law doesn’t prevent accrued interest and principal payments incurred or made in closed years from affecting the loan balance used to determine the excise tax in open years.

The memorandum concludes by saying, “consequently, interest that accrues on a loan during closed years is included in the loan balance to compute the amount involved for a deemed act of self-dealing that occurs in an open year.”

Self-Dealing Loan Example

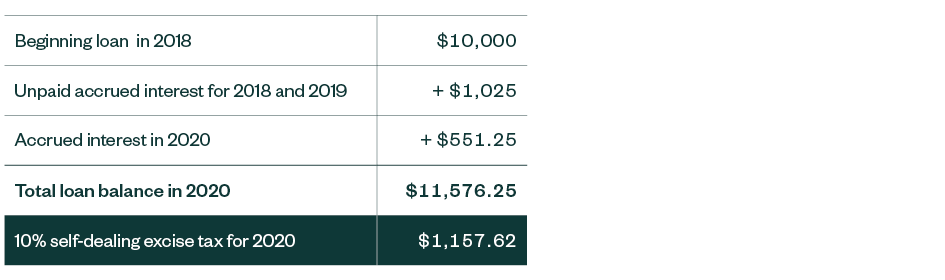

A private foundation makes a $10,000 loan to a disqualified person in tax year 2018. The loan and accrued interest remain unpaid through tax year 2020. Tax years 2018 and 2019 are closed years. The unpaid interest for those years is added to the balance of the loan and accrued interest for 2020, an open year.

For 2018, the accrued interest on the $10,000 loan is calculated to be $500. For 2019, accrued interest on the $10,000 loan and $500 in unpaid interest is calculated to be $525.

The unpaid accrued interest for the closed years of $500 and $525 is added to the loan balance for 2020, equaling $11,025. Accrued interest in 2020 is $551.25, leaving the total loan and interest balance for 2020 of $11,576.25.

The self-dealing excise tax for 2020 would be 10% of $11,576.25, or $1,157.62.

We’re Here to Help

For more information about the new memorandum or treating interest on self-dealing loans, contact your Moss Adams professional. Learn more at our Not-for-Profit Practice.