The IRS released Rev. Proc. 92-29 in 1992. It allowed developers to allocate the costs incurred for common area improvements during the current tax year plus the estimated future costs for common area improvements over the next 10 succeeding tax years across all benefiting properties in the development—subject to certain limitations—when determining the gain or loss incurred on properties sold in the current year.

Without using the alternative cost method under Rev. Proc. 92-29, a developer would instead only allocate costs incurred in the current tax year over all benefiting properties when determining gain or loss on current year properties sold.

By using Rev. Proc. 92-29, the developer was often able to increase the basis of properties sold in earlier years, reducing their tax liability on the front end of the development and deferring taxes into later years. A key limitation in this strategy was the total amount of common area improvements deducted could not exceed the total amount incurred to date, known as the alternative cost limitation.

Example of Rev. Proc. 92-29

A developer will sell 10 properties over three years and expect to incur $500,000 of common area improvement costs. In year one, the developer sells four properties and incurs $300,000 of common area improvement costs.

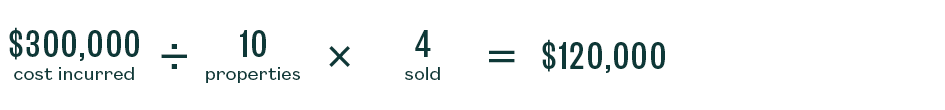

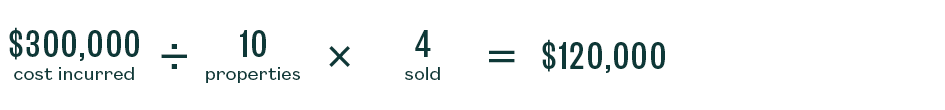

Without 92-29, the developer would deduct $120,000 of common area improvement costs in year one:

With 92-29, the developer would deduct $200,000 of common area improvement costs in year one. The $200,000 deducted doesn’t exceed the $300,000 incurred, so there’s no current year alternative cost limitation.

If, in subsequent years, the estimated cost figure changes, meaning actual costs differ from estimated costs, revised estimates, or the common area improvement scope changes, the calculation is revised and any difference that should have occurred in a prior year is adjusted prospectively to both properties in progress and properties previously sold as opposed to filing an amended return or administrative adjustment request.

To use the alternative cost method, the developer must have been contractually obligated by law to provide the common area improvements. Furthermore, the developer was required to:

- Obtain consent from the IRS for each separate project

- Agree to extend the statute of limitations for all returns reporting the gain or loss on properties sold

- Furnish detailed information annually to the IRS on the project’s status

Rev. Proc. 2023-9 Effective Date

Effective January 1, 2023, Rev. Proc. 2023-9 makes Rev. Proc. 92-29 obsolete and makes key changes to the application and implementation of the alternative cost method. These changes are generally tax beneficial to real estate developers as they can facilitate a tax deferral strategy with reduced administrative burdens. The key changes are as follows.

Alternative Cost Method Application

Rev. Proc. 2023-9 changes the alternative cost method to a method of accounting applicable to the taxpayer’s entire business, encompassing all qualified projects instead of a project-by-project basis. The alternative cost method is available to taxpayers using the accrual or completed contract methods of accounting.

Common Area Improvement Cost Allocation Methods

Rev. Proc. 2023-9 provides several methods for allocating common area improvement costs over the benefitting properties, such as equal allocation, relative costs, relative size, or relative fair market value.

IRS Consent No Longer Required

The requirements to request IRS consent for each project, annual reporting obligations, and statute of limitation extensions, are no longer applicable under Rev. Proc. 2023-9.

Retain Documentation and Calculations for Three Years

Rev. Proc. 2023-9 includes a new requirement for taxpayers using the alternative cost method to retain all relevant documentation and calculations for three years after filing the tax return that reports the completion of the qualifying project.

Alternative Cost Method Taxpayer Guidance

Rev. Proc. 2023-9 provides guidance for taxpayers to change their method of accounting to utilize the alternative cost method. This guidance includes transition instructions for taxpayers with projects in progress as of January 1, 2023, who are using the alternative cost method under Rev. Proc. 92-29.

We’re Here to Help

For help evaluating the potential tax and cash flow benefits of using the alternative cost method under Rev. Proc. 2023-9 or help evaluating strategies to transition existing projects from using the alternative cost method under Rev. Proc. 92-29, please contact your Moss Adams professional.